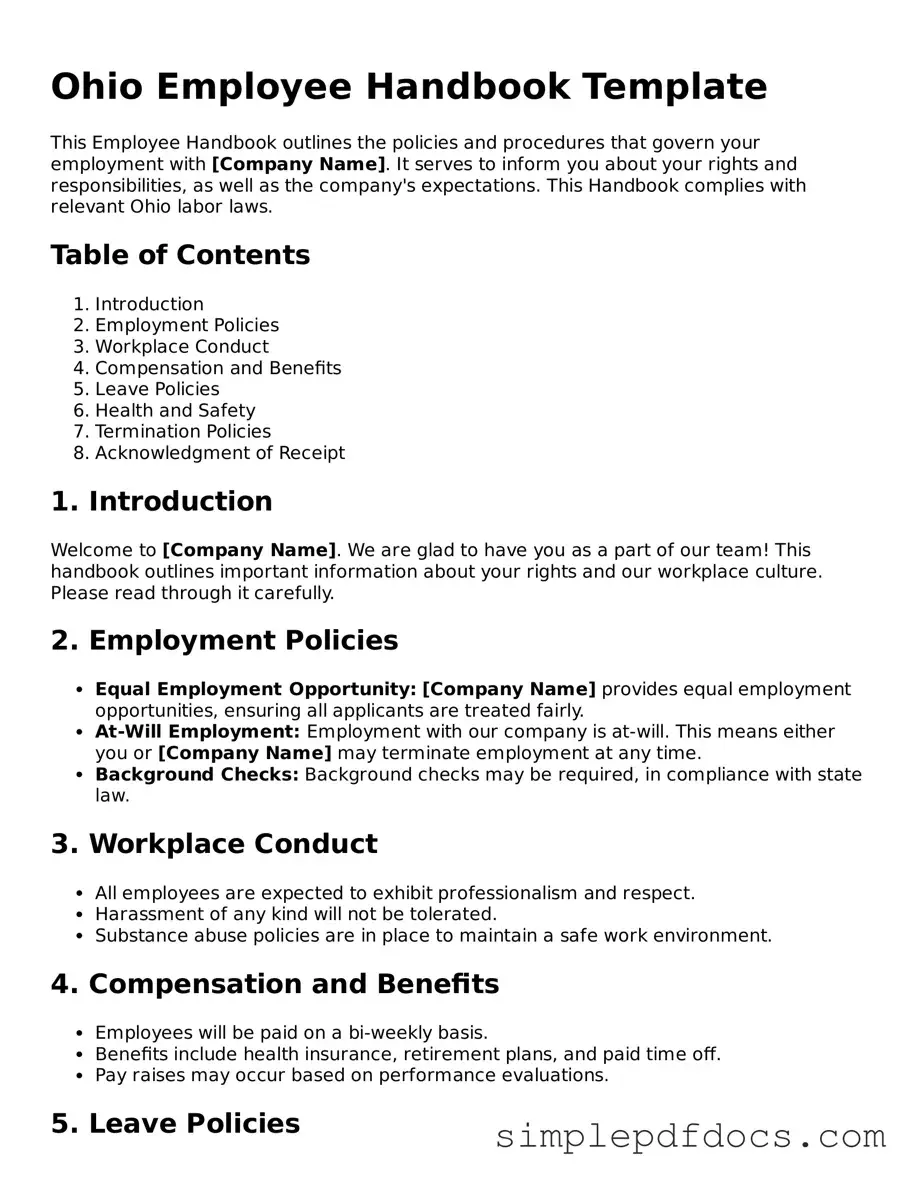

Legal Employee Handbook Document for the State of Ohio

The Ohio Employee Handbook form serves as a crucial tool for employers in establishing clear workplace policies and expectations. This form outlines essential information such as employee rights, company policies, and procedures that govern workplace behavior. It typically includes sections on anti-discrimination policies, workplace safety, attendance requirements, and disciplinary procedures. By providing a comprehensive overview of the company's rules and regulations, the handbook helps to ensure that employees understand their responsibilities and the consequences of non-compliance. Additionally, it often addresses benefits, including health insurance, leave policies, and other employee resources. A well-crafted employee handbook not only protects the employer from potential legal disputes but also fosters a positive work environment by promoting transparency and accountability among staff members.

Consider Other Common Employee Handbook Templates for Specific States

Developing an Employee Handbook - This handbook serves to align employee behavior with company values.

New York State Employee Handbook - Information on exit procedures and exit interviews is provided.

When entering into business agreements or partnerships, it is crucial to have a clear understanding of the terms surrounding confidentiality. This is where a Florida Non-disclosure Agreement (NDA) comes into play, serving as a vital tool to safeguard sensitive information. For those looking for a template or more details on the NDA process, resources can be found at floridaforms.net/blank-non-disclosure-agreement-form/.

Nc State Employee Handbook 2023 - This form collects essential employee information.

How to Hire an Employee in Texas - Discover how performance evaluations are conducted at our company.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Employee Handbook serves as a guide for employees regarding company policies, procedures, and expectations. |

| Legal Requirement | While not legally required, providing an employee handbook is considered a best practice under Ohio employment law. |

| Governing Laws | Ohio Revised Code, particularly sections related to employment and labor standards, guides the content of employee handbooks. |

| Content Recommendations | It is advisable for the handbook to include topics such as workplace conduct, anti-discrimination policies, and employee benefits. |

How to Write Ohio Employee Handbook

Completing the Ohio Employee Handbook form requires careful attention to detail. After filling out the form, ensure that all information is accurate and that you have signed where necessary. This process helps maintain clear communication between employers and employees.

- Obtain the Ohio Employee Handbook form from your employer or the designated HR department.

- Read through the entire form to familiarize yourself with the required information.

- Begin filling out your personal information, including your full name, address, and contact details.

- Provide your job title and department as requested on the form.

- Fill in the date of your employment start date.

- Review any policies or guidelines included in the handbook that may require acknowledgment.

- Sign and date the form at the bottom to confirm your understanding and agreement.

- Submit the completed form to your HR department or designated representative.

Dos and Don'ts

When filling out the Ohio Employee Handbook form, it is crucial to follow certain guidelines. Here are nine essential do's and don'ts to keep in mind:

- Do read the entire handbook before starting the form.

- Do provide accurate personal information.

- Do ask questions if you are unsure about any section.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't use abbreviations unless specified.

- Don't forget to review the form for errors before submission.

Documents used along the form

When developing an Ohio Employee Handbook, it is beneficial to consider various other forms and documents that can complement the handbook. These documents help clarify policies, ensure compliance with state and federal laws, and provide employees with essential information about their rights and responsibilities. Below is a list of commonly used forms and documents that often accompany the Employee Handbook.

- Employment Application: This form collects information from potential employees, including their work history, education, and references. It serves as a foundational document for the hiring process.

- Offer Letter: An offer letter outlines the terms of employment, including job title, salary, benefits, and start date. It formalizes the employment relationship and sets clear expectations.

- Non-Disclosure Agreement (NDA): This document protects sensitive company information by requiring employees to keep certain information confidential. It is particularly important for businesses that handle proprietary data.

- W-4 Form: The W-4 form is used by employees to indicate their tax withholding preferences. Employers need this information to properly withhold federal income tax from employees' paychecks.

- Non-disclosure Agreement: To ensure confidentiality in your business dealings, consider utilizing our comprehensive Non-disclosure Agreement resources to protect sensitive information.

- Employee Acknowledgment Form: This form confirms that employees have received, read, and understood the Employee Handbook. It serves as a record that employees are aware of company policies.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their paychecks directly into their bank accounts. It streamlines the payment process and can enhance employee satisfaction.

- Time Off Request Form: Employees use this form to request time off for vacations, personal days, or other reasons. It helps manage staffing needs and ensures that time off is documented and approved.

Incorporating these documents alongside the Employee Handbook can create a comprehensive framework for managing employee relations. Each form plays a specific role in ensuring that both the employer and employees are clear about expectations, rights, and responsibilities. Proper documentation fosters a positive work environment and supports compliance with legal requirements.