Legal Durable Power of Attorney Document for the State of Ohio

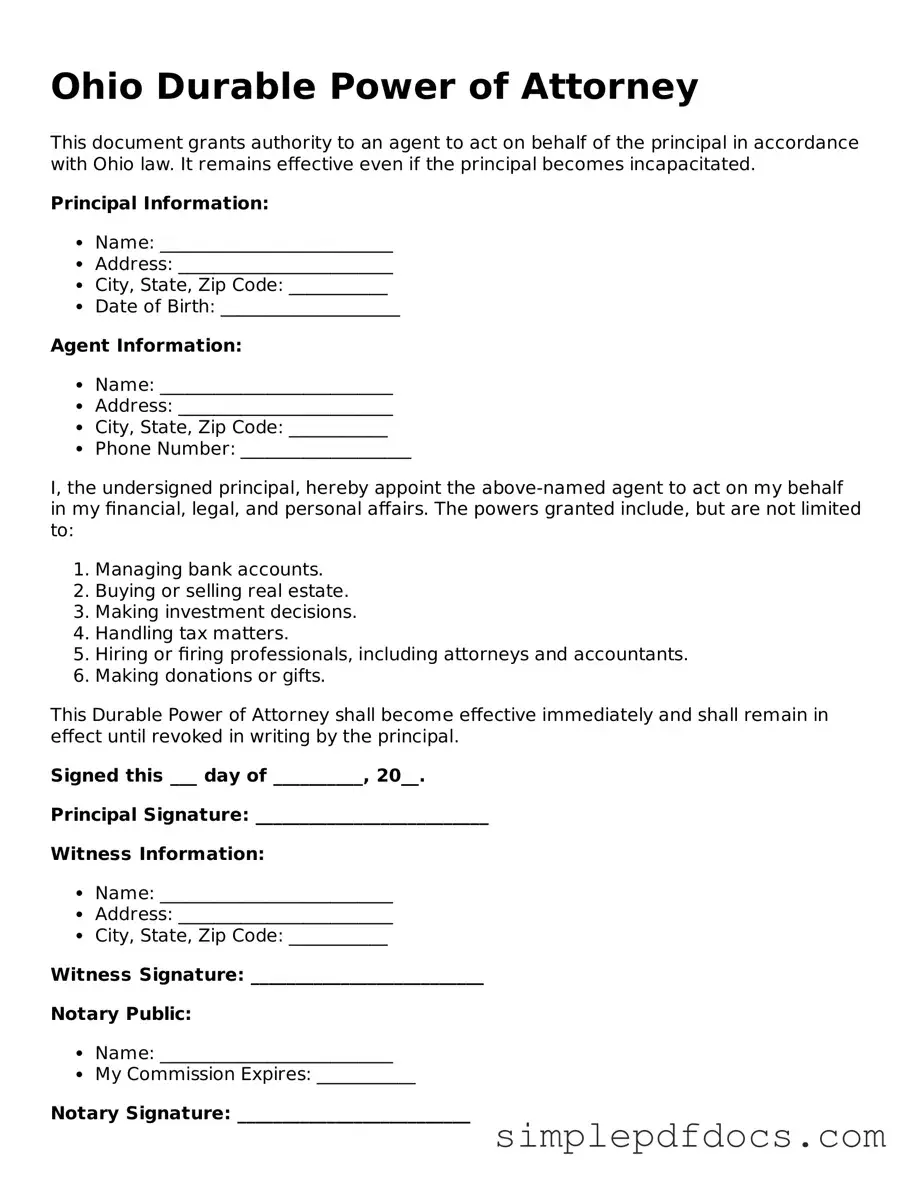

The Ohio Durable Power of Attorney form is a vital legal document that allows individuals to appoint someone they trust to manage their financial and legal affairs in the event they become incapacitated. This form grants the designated agent, often referred to as the attorney-in-fact, the authority to make decisions regarding property, finances, and other important matters. It remains effective even if the principal becomes unable to make decisions due to illness or injury. Key aspects of the form include the ability to specify the powers granted, such as handling bank transactions, selling property, or managing investments. Additionally, the principal can set limitations on the agent’s authority, ensuring that their wishes are respected. Understanding the nuances of this document is essential for anyone considering its use, as it provides peace of mind and safeguards one’s interests during challenging times.

Consider Other Common Durable Power of Attorney Templates for Specific States

What Is Statutory Power of Attorney - It can simplify legal and financial processes for your appointed agent during your incapacitation.

Power of Attorney Form Texas Pdf - A Durable Power of Attorney is a responsible step toward financial planning.

For those interested in facilitating the sale or purchase of a tractor, understanding the significance of a well-prepared document is vital. This is where a comprehensive guide to the Tractor Bill of Sale comes into play, ensuring all aspects of the transaction are covered and legally binding.

Durable Power of Attorney Form Pa - This form provides peace of mind knowing someone trusted is in charge of your finances.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Ohio Durable Power of Attorney allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The Ohio Durable Power of Attorney is governed by Ohio Revised Code Section 1337.22 to 1337.64. |

| Durability | This form remains effective even if the principal becomes mentally incompetent, distinguishing it from a regular power of attorney. |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the principal's wishes as outlined in the document. |

| Signing Requirements | The document must be signed by the principal in the presence of a notary public or two witnesses to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are still competent to do so. |

| Limitations | Some decisions, such as those regarding the principal's healthcare, may require a separate healthcare power of attorney. |

| Record Keeping | It is advisable for the principal to keep a copy of the Durable Power of Attorney in a safe place and provide copies to the agent and relevant institutions. |

How to Write Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form requires careful attention to detail. This document allows you to designate someone to make decisions on your behalf in the event that you are unable to do so. Follow these steps to ensure the form is completed correctly.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or at legal supply stores.

- Read the entire form carefully to understand the sections that need to be completed.

- Fill in your name and address at the top of the form. This identifies you as the principal.

- Enter the name and address of the person you are appointing as your agent. This individual will act on your behalf.

- Specify the powers you wish to grant to your agent. You can choose general powers or specific powers related to financial matters, healthcare, or other areas.

- Include any limitations on the authority of your agent, if applicable. Clearly state any restrictions you want to impose.

- Sign and date the form in the designated area. Your signature must be witnessed or notarized to be valid.

- Have your signature witnessed by at least one person or notarized by a notary public, depending on the requirements.

- Provide copies of the completed form to your agent and any relevant parties, such as family members or financial institutions.

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it’s important to follow certain guidelines to ensure the document is valid and meets your needs. Here are some key do's and don'ts to keep in mind:

- Do clearly identify the person you are appointing as your agent. Make sure to include their full name and contact information.

- Do specify the powers you are granting to your agent. Be as detailed as possible to avoid confusion later.

- Do sign the form in the presence of a notary public. This step is crucial for the document to be legally recognized.

- Do keep a copy of the completed form for your records. This will help you remember the details of the powers granted.

- Don't leave any sections blank. Incomplete forms may lead to complications or disputes in the future.

- Don't choose an agent who may have conflicting interests. It's best to select someone you trust completely.

- Don't rush through the process. Take your time to understand what you are signing and the implications of the powers you are granting.

- Don't forget to review and update the document as needed. Life circumstances can change, and so might your preferences.

Documents used along the form

When creating a Durable Power of Attorney (DPOA) in Ohio, several other documents can complement it. These documents help ensure that your wishes are respected and provide clarity on various aspects of your financial and medical decisions. Below is a list of common forms and documents that are often used alongside the DPOA.

- Health Care Power of Attorney: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. It focuses specifically on health care matters.

- Living Will: A living will outlines your preferences regarding medical treatment and end-of-life care. It can guide your health care agent in making decisions that align with your wishes.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document grants someone authority to handle your financial affairs. However, it may not remain effective if you become incapacitated unless it is a durable version.

- Advance Directive: This is a broader term that includes both a living will and a health care power of attorney. It provides comprehensive instructions about your health care preferences.

- Will: A will outlines how your assets will be distributed after your death. While it does not take effect until you pass away, it works in conjunction with a DPOA to manage your affairs while you are alive.

- Florida Vehicle POA Form 82053: This form is essential for authorizing someone to handle vehicle-related transactions on your behalf. It is especially beneficial for those who are unable to manage these tasks themselves, ensuring everything is executed efficiently and legally. For more details, you can refer to Florida Forms.

- Trust Documents: If you have set up a trust, these documents detail how your assets will be managed and distributed. They can provide additional layers of control over your financial matters.

- Beneficiary Designations: These forms specify who will receive your assets upon your death. They are often used for accounts like life insurance and retirement plans, and they work alongside your will.

Having these documents in place can provide peace of mind. They ensure that your financial and medical decisions align with your preferences, even when you cannot communicate them yourself. It is advisable to consult with a legal professional to ensure all documents are properly executed and tailored to your specific needs.