Legal Deed in Lieu of Foreclosure Document for the State of Ohio

In Ohio, homeowners facing the prospect of foreclosure have a potential alternative that can simplify the process and mitigate some of the financial burdens associated with losing a home. The Deed in Lieu of Foreclosure form serves as a legal instrument that allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often stressful foreclosure proceedings. This agreement can benefit both parties; the homeowner can escape the negative impacts of foreclosure on their credit score, while the lender can recover their investment more efficiently. The form typically outlines essential details such as the property description, the parties involved, and any existing liens or encumbrances. It also addresses the homeowner's rights and responsibilities during the transfer process. By understanding the implications and requirements of the Deed in Lieu of Foreclosure, individuals can make informed decisions that align with their financial situations and future goals.

Consider Other Common Deed in Lieu of Foreclosure Templates for Specific States

Sale in Lieu of Foreclosure - Borrowers may find this option less stressful compared to a lengthy foreclosure process.

A Florida Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction and outlines essential details such as the buyer, seller, and description of the item being sold. For those needing a Bill of Sale template, resources like Florida Forms can be invaluable in providing the necessary documentation, ensuring a smooth and transparent exchange.

Pennsylvania Deed in Lieu of Foreclosure - Completing the deed in lieu can also lead to a more favorable outcome for the lender in terms of asset recovery.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document that allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Ohio Revised Code Section 5301.10 and related statutes. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may be eligible for this option. |

| Advantages | It can help homeowners avoid the lengthy foreclosure process and minimize damage to their credit score. |

| Process | The borrower must negotiate with the lender and complete the necessary paperwork to execute the deed. |

| Impact on Credit | A deed in lieu may have a less severe impact on credit compared to a foreclosure, but it still may affect credit scores. |

| Tax Implications | Homeowners should consult a tax professional, as there may be tax consequences associated with the transfer of property. |

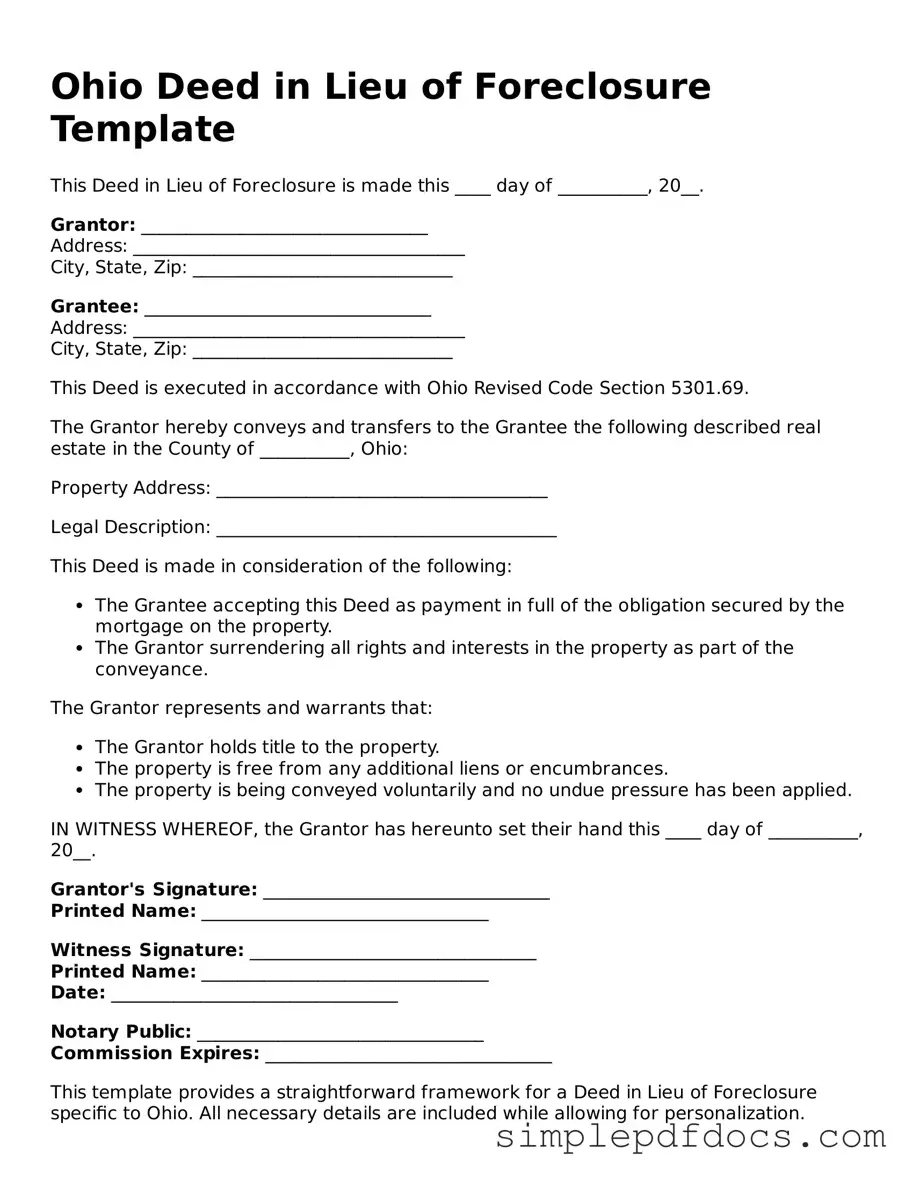

How to Write Ohio Deed in Lieu of Foreclosure

After completing the Ohio Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate parties. Typically, this includes the lender and local county recorder's office. Ensure all required signatures are present and consider consulting with a legal professional for guidance through the process.

- Obtain the Ohio Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or local courthouse.

- Begin by filling in the grantor's name. This is the person or entity transferring the property.

- Next, provide the grantee's name. This is usually the lender or financial institution receiving the property.

- Fill in the property description. This should include the address and any other identifying details of the property.

- Include the date of the transfer. Make sure this is the date you are signing the document.

- Sign the form where indicated. The grantor must sign the document in the presence of a notary.

- Have the form notarized. This step is crucial for the document to be legally binding.

- Make copies of the completed form for your records.

- Submit the original form to the lender and file it with the local county recorder’s office.

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, it’s important to be thorough and accurate. Here’s a list of things to do and avoid:

- Do ensure that all property information is accurate, including the legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the document in the presence of a notary public.

- Do provide any required supporting documentation, such as a copy of the mortgage.

- Do check for any outstanding liens or claims against the property before submission.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't use outdated versions of the form; always use the most current version.

- Don't forget to keep copies of the completed form for your records.

- Don't rush through the process; take your time to ensure accuracy.

By following these guidelines, you can help ensure a smoother process when submitting the Deed in Lieu of Foreclosure in Ohio.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Ohio, several other documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the rights and responsibilities of the parties involved. Below is a list of commonly used forms that may accompany the Deed in Lieu of Foreclosure.

- Notice of Default: This document informs the borrower that they are in default on their mortgage payments. It outlines the specifics of the default and provides a timeframe for remedying the situation.

- Loan Modification Agreement: If the borrower and lender agree to change the terms of the existing loan, this document will detail the new terms, including interest rates and payment schedules.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the deed transfer. It ensures that the borrower will not be pursued for any remaining debt.

- Non-disclosure Agreement: In situations where sensitive information may be shared, it is prudent to use a Non-disclosure Agreement (NDA). This form lays the groundwork for confidentiality, ensuring protection for all parties involved. For more information, visit https://floridaforms.net/blank-non-disclosure-agreement-form.

- Property Condition Disclosure: This document provides information about the condition of the property. It helps the lender understand any issues that may affect the property's value.

- Affidavit of Title: This is a sworn statement by the borrower affirming their ownership of the property and disclosing any liens or encumbrances that may exist.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any fees, costs, and the final amounts involved in the deed transfer.

These documents play a crucial role in the process of executing a Deed in Lieu of Foreclosure. Ensuring that all necessary forms are completed accurately can help protect the interests of both the borrower and the lender.