Legal Deed Document for the State of Ohio

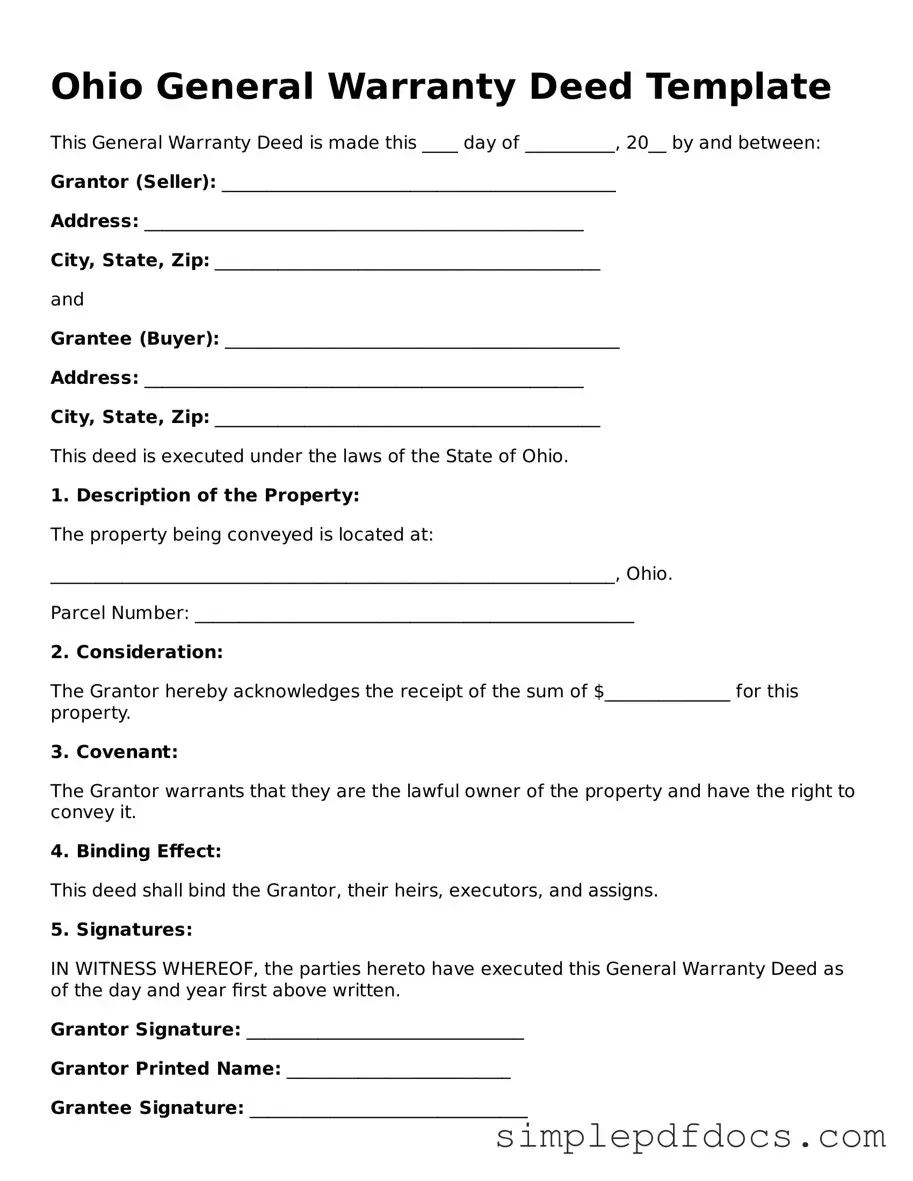

The Ohio Deed form is an essential document in real estate transactions, serving as a legal instrument to transfer property ownership from one party to another. This form includes vital information such as the names of the grantor and grantee, a detailed description of the property being transferred, and the date of the transaction. It also specifies any conditions or warranties associated with the transfer, ensuring that both parties understand their rights and obligations. Proper execution of the deed, including signatures and notarization, is crucial to validate the transfer. Understanding the various types of deeds available in Ohio, such as warranty deeds and quitclaim deeds, can help individuals choose the right one for their specific situation. Whether you are buying or selling property, knowing how to properly complete and file the Ohio Deed form is an important step in the process, providing peace of mind as you navigate the complexities of real estate ownership.

Consider Other Common Deed Templates for Specific States

Property Deed Form - Some deeds may require additional disclosures depending on state laws.

New York State Deed Form - Use a Deed to formalize the sale or gift of property to another individual or entity.

In Florida, having a Do Not Resuscitate Order (DNRO) is crucial for anyone wishing to communicate their preferences for medical treatment in an emergency. This legal form not only provides clarity for healthcare providers but also honors the individual's wishes in a respectful manner. To navigate this process effectively and understand all related documentation, individuals can visit Florida Forms for guidance.

Sample Deed for House - Recording the Deed with the county office is essential to finalize the transaction.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Deed form is used to transfer ownership of real property from one party to another. |

| Governing Law | The transfer of property through a deed in Ohio is governed by the Ohio Revised Code, specifically Chapter 5301. |

| Types of Deeds | Ohio recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Recording Requirement | To ensure public notice of the transfer, the deed must be recorded with the county recorder's office where the property is located. |

How to Write Ohio Deed

Once you have obtained the Ohio Deed form, it's essential to fill it out accurately to ensure proper transfer of property ownership. After completing the form, you will need to have it notarized and then recorded with the appropriate county office. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Identify the grantor, or the current owner of the property. Provide their full name and address.

- Next, list the grantee, or the new owner of the property. Include their full name and address as well.

- Describe the property being transferred. This includes the legal description, which may be found in previous deeds or property records.

- State the consideration amount, which is the price paid for the property. If the transfer is a gift, indicate that appropriately.

- Include any additional information required, such as the type of deed (e.g., warranty deed, quitclaim deed).

- Sign the form where indicated. The grantor must sign in the presence of a notary public.

- Have the form notarized. The notary will verify the identity of the grantor and witness the signing.

- Make copies of the completed and notarized deed for your records.

- Finally, submit the original deed to the county recorder's office for recording.

Dos and Don'ts

When filling out the Ohio Deed form, it’s essential to ensure accuracy and compliance with state requirements. Here are some important dos and don’ts to keep in mind:

- Do use clear and legible handwriting or type the information.

- Do provide complete names and addresses for all parties involved.

- Do accurately describe the property being transferred, including boundaries.

- Do include the date of the transfer.

- Do sign the deed in front of a notary public.

- Don't leave any required fields blank.

- Don't use abbreviations for names or addresses unless necessary.

- Don't forget to check for any local filing requirements.

- Don't submit the deed without ensuring all signatures are present.

By following these guidelines, you can help ensure a smooth process when transferring property in Ohio.

Documents used along the form

When transferring property in Ohio, the deed form is just one piece of the puzzle. Several other documents often accompany the deed to ensure a smooth transaction and to comply with legal requirements. Below is a list of common forms and documents used alongside the Ohio Deed form.

- Title Search Report: This document provides a history of the property’s ownership. It helps to identify any liens, encumbrances, or claims against the property, ensuring that the buyer is aware of any potential issues before the purchase is finalized.

- Property Disclosure Statement: Sellers are typically required to provide this statement, which outlines any known defects or issues with the property. This transparency helps protect both the buyer and seller by disclosing important information that could affect the sale.

- Operating Agreement: While not mandatory, a well-drafted operating agreement outlines the management structure and operational guidelines of an LLC, ensuring clarity and preventing disputes among members. More information can be found at https://floridaforms.net/blank-operating-agreement-form/.

- Affidavit of Title: This sworn statement is often used to confirm that the seller has clear title to the property. It assures the buyer that there are no outstanding legal claims against the property, providing peace of mind during the transaction.

- Closing Statement: Also known as a HUD-1 statement, this document summarizes the financial aspects of the transaction. It details all costs associated with the sale, including fees, taxes, and the final purchase price, ensuring that both parties are aware of their financial obligations.

- Transfer Tax Affidavit: This form is required to report the transfer of property to the county auditor for tax purposes. It helps ensure that any applicable transfer taxes are calculated and paid correctly during the closing process.

- Power of Attorney: In some cases, a seller may not be able to attend the closing in person. A power of attorney allows someone else to act on their behalf, signing documents and making decisions related to the sale.

Understanding these additional documents can help facilitate a smoother property transfer process. Each document plays a vital role in protecting the interests of all parties involved, ensuring that the transaction is legally sound and transparent.