Legal Articles of Incorporation Document for the State of Ohio

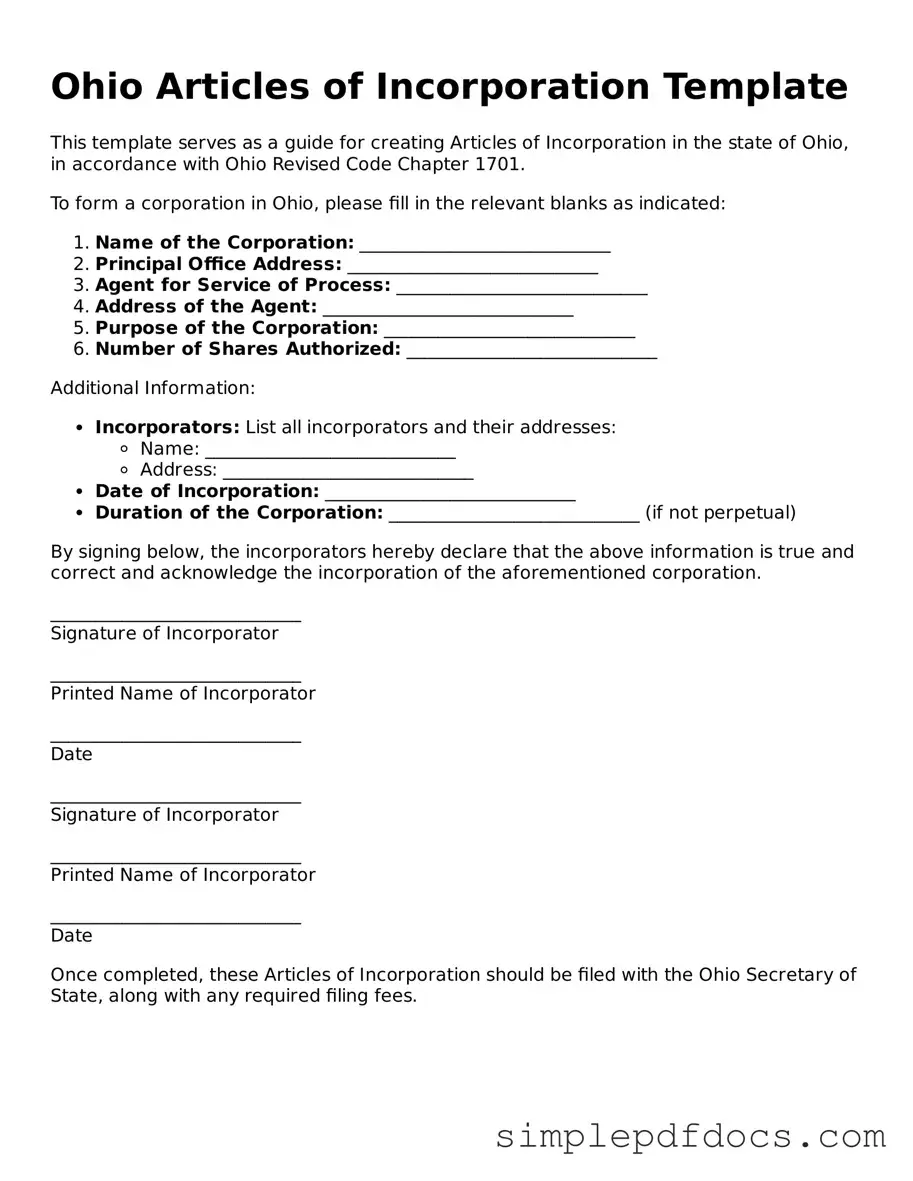

In Ohio, the Articles of Incorporation form serves as a crucial document for individuals looking to establish a corporation. This form outlines essential information about the corporation, including its name, purpose, and the address of its principal office. Additionally, it requires details about the initial directors and the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. The form also includes provisions for the number of shares the corporation is authorized to issue, which is important for potential investors. By filing the Articles of Incorporation with the Ohio Secretary of State, individuals can officially create a legal entity that is separate from its owners, providing limited liability protection and enabling the corporation to conduct business in compliance with state laws. Understanding each section of the form is vital for ensuring that the corporation is set up correctly and meets all legal requirements.

Consider Other Common Articles of Incorporation Templates for Specific States

Ny Sos - The form should reflect the corporation’s intended business activities.

A Florida Hold Harmless Agreement is a legal document designed to protect one party from liability for certain risks or damages that may arise during a specific activity or event. By signing this agreement, individuals acknowledge their understanding of the potential dangers involved and agree not to hold the other party responsible for any resulting injuries or losses. This form is commonly used in various situations, including recreational activities, property use, and events, ensuring that all parties are aware of their responsibilities and risks. For more information on this type of agreement, you can refer to Florida Forms.

How to Incorporate in Nc - This document outlines the basic information needed to legally form a corporation.

Pennsylvania Corporation Commission - Can address issues of transferability of shares.

How Much Does a Llc Cost in Texas - The Articles can impact the corporation’s ability to raise capital or issue stocks.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Articles of Incorporation form is used to officially create a corporation in the state of Ohio. |

| Governing Law | The form is governed by the Ohio Revised Code, specifically Chapter 1701. |

| Filing Requirement | To file the Articles of Incorporation, a fee is required, which varies based on the type of corporation. |

| Information Needed | The form requires basic information such as the corporation's name, principal office address, and the name and address of the statutory agent. |

| Submission Method | Applicants can submit the form online, by mail, or in person at the Ohio Secretary of State's office. |

How to Write Ohio Articles of Incorporation

After completing the Ohio Articles of Incorporation form, the next step is to submit it to the Ohio Secretary of State. This process includes paying the required filing fee. Once submitted, the state will review the application, and upon approval, your business will be officially incorporated.

- Obtain the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or office.

- Fill in the name of your corporation. Ensure it complies with Ohio naming requirements.

- Provide the principal office address. This must be a physical address, not a P.O. Box.

- List the purpose of your corporation. Be clear and concise about your business activities.

- Indicate the duration of the corporation. Most corporations are set up to exist perpetually unless stated otherwise.

- Fill in the name and address of the statutory agent. This is the person or entity designated to receive legal documents.

- Include the names and addresses of the initial directors. Typically, a minimum of one director is required.

- Sign and date the form. The incorporator must sign the document.

- Review the completed form for accuracy and completeness.

- Submit the form along with the required filing fee to the Ohio Secretary of State.

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid:

- Do: Provide accurate and complete information in all sections of the form.

- Do: Use clear and legible handwriting or type the information to avoid misinterpretation.

- Do: Include the name of your corporation exactly as you want it to appear on official documents.

- Do: Ensure that the registered agent's name and address are correct and up-to-date.

- Do: Review the form for any errors before submission to prevent delays.

- Don't: Leave any required fields blank; incomplete forms may be rejected.

- Don't: Use abbreviations or informal names for your corporation.

- Don't: Forget to sign and date the form; an unsigned form is invalid.

- Don't: Submit the form without the required filing fee; payments must be included.

- Don't: Rely solely on electronic submissions without confirming receipt; always verify that your documents have been processed.

Documents used along the form

When incorporating a business in Ohio, several forms and documents may be required in addition to the Articles of Incorporation. These documents help establish the legal framework for the corporation and ensure compliance with state regulations. Below is a list of common forms and documents used in conjunction with the Articles of Incorporation.

- Bylaws: These are the rules that govern the internal management of the corporation. Bylaws outline the responsibilities of officers, the process for holding meetings, and how decisions are made.

- Initial Report: This document provides information about the corporation's initial operations, including its address and the names of its officers. It is often required shortly after incorporation.

- Employer Identification Number (EIN) Application: This form, also known as Form SS-4, is submitted to the IRS to obtain a unique identification number for tax purposes.

- Operating Agreement: For LLCs, this document outlines the management structure and operating procedures. It details the rights and responsibilities of members.

- Statement of Continued Existence: This document may be required to confirm that the corporation is still active and in compliance with state laws.

- Business Licenses and Permits: Depending on the nature of the business, various local, state, or federal licenses may be needed to operate legally.

- Shareholder Agreements: This document outlines the rights and obligations of shareholders, including how shares can be bought or sold.

- Residential Lease Agreement: To ensure a clear understanding between landlords and tenants, utilizing a floridaforms.net/blank-residential-lease-agreement-form/ is essential for outlining the terms and conditions of the rental agreement.

- Minutes of Organizational Meeting: These are the notes taken during the first meeting of the board of directors, documenting key decisions made during the meeting.

- Registered Agent Consent Form: This form confirms the appointment of a registered agent who will receive legal documents on behalf of the corporation.

- Annual Report: Corporations may be required to file this report annually, providing updated information about the business and confirming its active status.

These documents serve various purposes, from establishing governance to ensuring compliance with tax regulations. It is important to understand the requirements for each document to facilitate a smooth incorporation process in Ohio.