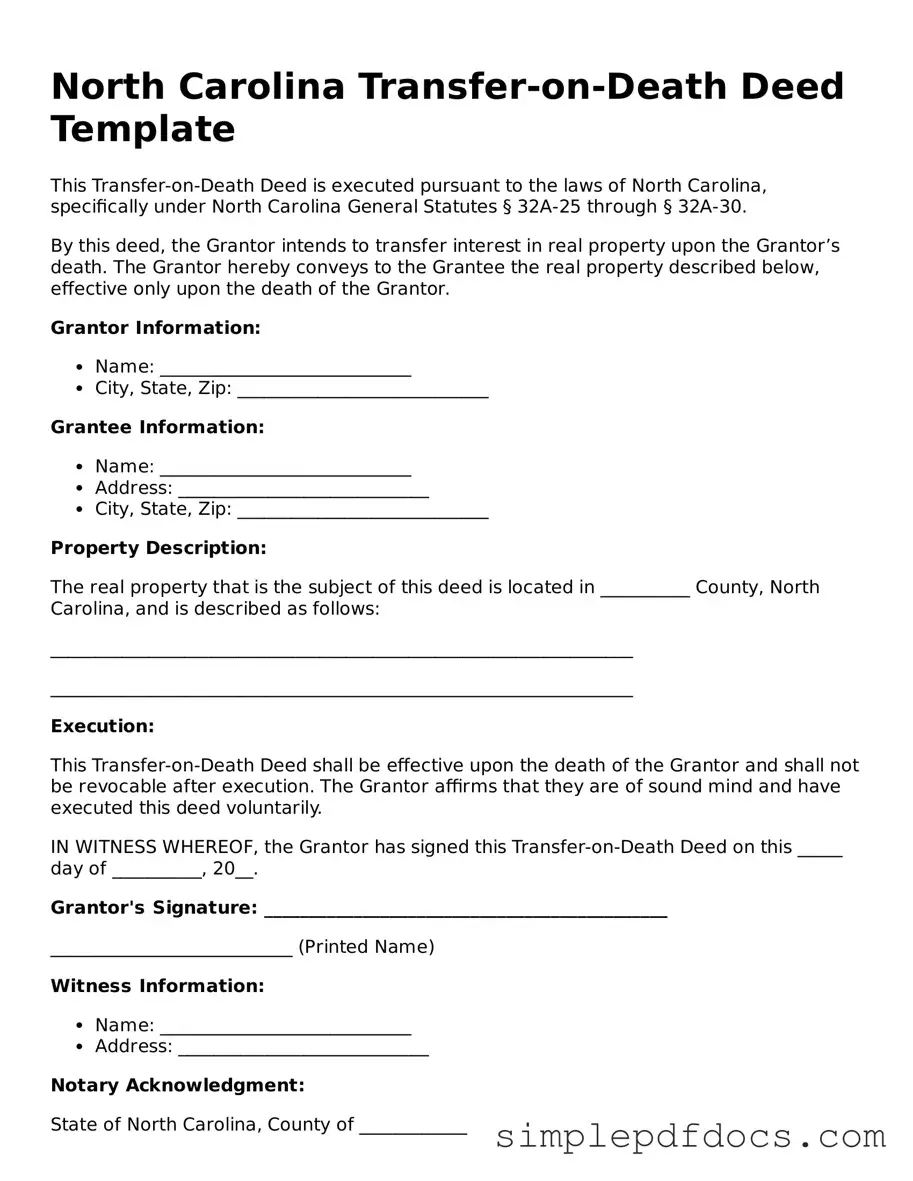

Legal Transfer-on-Death Deed Document for the State of North Carolina

The North Carolina Transfer-on-Death Deed form provides a straightforward mechanism for property owners to transfer real estate to designated beneficiaries upon their death, effectively bypassing the often lengthy probate process. This deed allows individuals to retain full control over their property during their lifetime, ensuring they can sell, mortgage, or alter the property as they see fit without any impact on the beneficiaries. Once the property owner passes away, the deed automatically transfers ownership to the named beneficiaries, provided the deed is properly executed and recorded. This form is particularly advantageous for those looking to simplify the transfer of property to heirs, as it can help avoid potential disputes and complications that may arise in traditional inheritance scenarios. Additionally, the Transfer-on-Death Deed does not impose any immediate tax consequences, making it an appealing option for many property owners in North Carolina. Understanding the nuances of this deed, including the necessary requirements for execution and recording, is essential for anyone considering this estate planning tool.

Consider Other Common Transfer-on-Death Deed Templates for Specific States

Ohio Transfer on Death Form - It is a simple form that must be filled out and filed to become effective at the property owner's death.

In Florida, individuals often utilize a Hold Harmless Agreement to mitigate liability risks associated with specific activities or events. This legal document is crucial for clarifying responsibilities and ensuring all parties understand the potential dangers involved. To obtain a Hold Harmless Agreement form, you can visit Florida Forms, where you will find the necessary resources to create a comprehensive agreement that serves to protect all parties involved.

Right of Survivorship Deed Pennsylvania - Properties held in Trust cannot be transferred using a Transfer-on-Death Deed.

Transfer Deed Upon Death - It is a straightforward way to manage who will inherit your real estate without a will.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by North Carolina General Statutes § 32A-1.1. |

| Eligibility | Any individual who owns real property in North Carolina can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Revocation | The deed can be revoked or changed at any time before the property owner's death, provided the owner follows the proper procedures. |

| Filing Requirements | To be effective, the Transfer-on-Death Deed must be recorded in the county where the property is located before the owner's death. |

| Tax Implications | Transferring property through a Transfer-on-Death Deed does not trigger gift taxes; however, the property may still be subject to estate taxes. |

How to Write North Carolina Transfer-on-Death Deed

Completing the North Carolina Transfer-on-Death Deed form is an important step in ensuring that your property is transferred according to your wishes after your passing. Follow these steps carefully to fill out the form correctly.

- Obtain the Form: Download the North Carolina Transfer-on-Death Deed form from a reliable source or obtain a hard copy from a legal stationery store.

- Property Description: Fill in the legal description of the property you wish to transfer. This includes the address and any parcel identification number.

- Grantor Information: Provide your full name and address as the current owner of the property. Ensure this information is accurate.

- Beneficiary Information: Enter the full name and address of the person or people who will receive the property upon your death. You can name multiple beneficiaries.

- Sign the Form: Sign and date the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public complete their section, which includes their signature and seal.

- Record the Deed: Submit the completed and notarized deed to the Register of Deeds in the county where the property is located. There may be a recording fee.

After filling out and submitting the form, keep a copy for your records. This ensures that you have proof of your intentions regarding the property transfer. It is also advisable to inform your beneficiaries about the deed to avoid confusion in the future.

Dos and Don'ts

When filling out the North Carolina Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure the process goes smoothly. Below is a list of things you should and shouldn't do.

- Do: Ensure all property details are accurate and up-to-date.

- Do: Include the full legal names of all parties involved.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Do: File the deed with the appropriate county register of deeds office.

- Don't: Leave any sections of the form blank.

- Don't: Use nicknames or abbreviations for names.

- Don't: Forget to check for any local filing fees that may apply.

- Don't: Submit the form without verifying all signatures are present.

- Don't: Ignore deadlines for filing the deed after signing.

Documents used along the form

When preparing a North Carolina Transfer-on-Death Deed, several other documents may be needed to ensure a smooth transfer of property. Below is a list of forms and documents that are often used in conjunction with the Transfer-on-Death Deed.

- Property Deed: This document establishes ownership of the property. It contains details about the property and the current owner's name.

- Affidavit of Heirship: This is used to declare the heirs of a deceased person. It helps clarify who is entitled to inherit the property.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It may include specific instructions regarding the property in question.

- Title Search Report: This report confirms the current ownership of the property and checks for any liens or encumbrances that may affect the transfer.

- Notice of Death: This document informs interested parties of the death of the property owner. It may be required in some situations to complete the transfer.

- Tax Records: These records provide information about property taxes owed and can help determine if there are any outstanding tax obligations that need to be settled before the transfer.

- Identification Documents: Personal identification for the parties involved may be required. This can include driver's licenses or social security cards to verify identity.

- Residential Lease Agreement: This essential document outlines the rental terms between landlords and tenants; for more information, visit https://floridaforms.net/blank-residential-lease-agreement-form.

- Recording Request Form: This form is submitted to the county clerk to officially record the Transfer-on-Death Deed in public records.

Each of these documents plays a role in the overall process of transferring property ownership. Having them prepared and organized can help ensure that the transfer is completed without unnecessary delays.