Legal Promissory Note Document for the State of North Carolina

In North Carolina, a Promissory Note is a vital document that outlines the terms of a loan agreement between a borrower and a lender. This form serves as a written promise from the borrower to repay the borrowed amount, often with interest, by a specified date. Key aspects of the Promissory Note include the principal amount, interest rate, payment schedule, and any penalties for late payments. Additionally, it may address the rights of the lender in case of default and the governing laws that apply to the agreement. Understanding the structure and components of this document is essential for both parties involved, as it helps to clarify expectations and protect their interests. Whether you are lending money to a friend or seeking a loan for business purposes, having a well-drafted Promissory Note can provide peace of mind and ensure a smoother transaction.

Consider Other Common Promissory Note Templates for Specific States

Personal Loan Promissory Note - A well-prepared promissory note can reduce potential legal conflicts between parties.

For those looking to sell or purchase a recreational vehicle in Georgia, understanding the significance of the important RV Bill of Sale documentation is crucial. This form plays a vital role in documenting the transfer of ownership and safeguarding the interests of both parties involved.

Texas Promissory Note Requirements - They can serve as a source of legal recourse if disputes arise over repayment.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specific time. |

| Governing Law | North Carolina General Statutes, Chapter 25, Article 3 governs promissory notes in North Carolina. |

| Requirements | The note must include the amount owed, the interest rate, payment terms, and signatures of the parties involved. |

| Enforceability | Promissory notes are legally enforceable contracts, provided they meet the necessary legal requirements. |

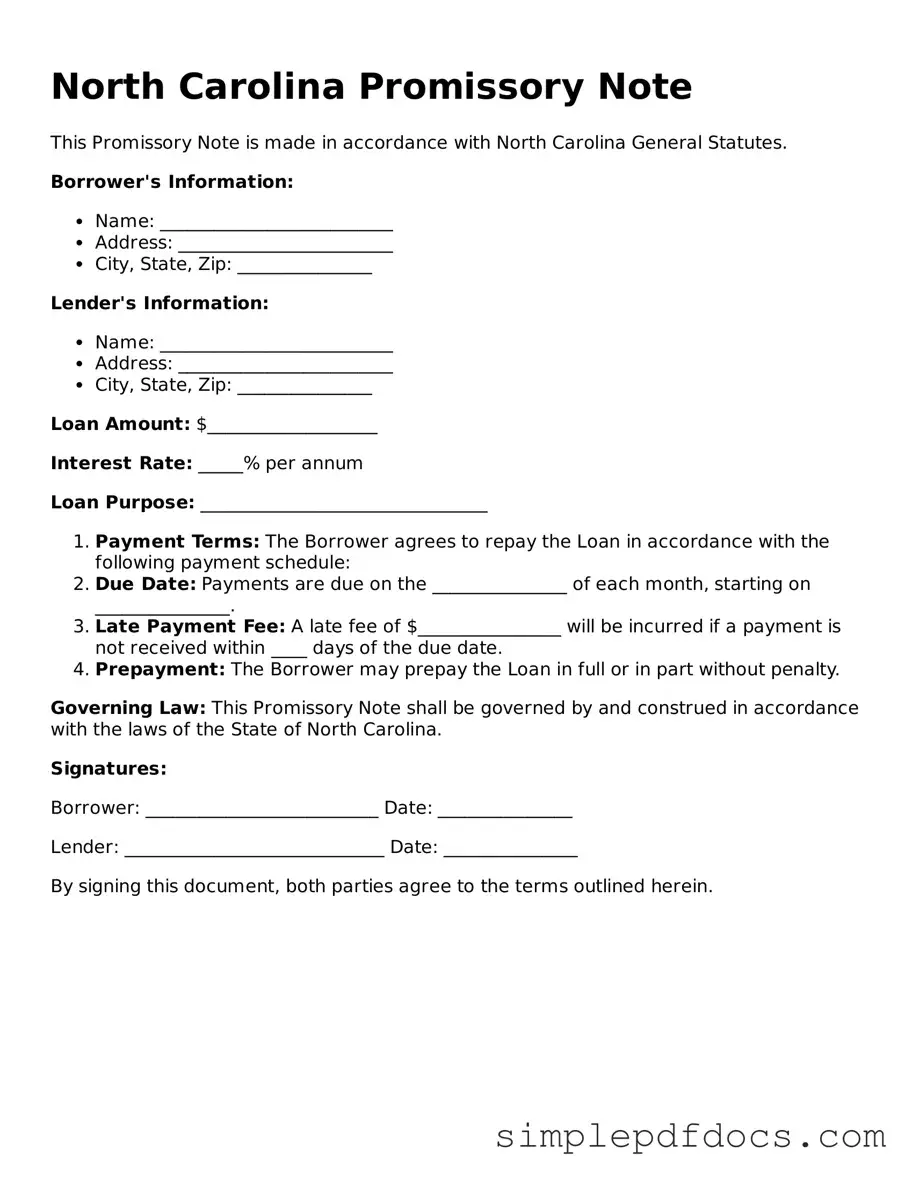

How to Write North Carolina Promissory Note

After you have gathered the necessary information, you can begin filling out the North Carolina Promissory Note form. This form will need to be completed carefully to ensure all details are accurate. Once filled out, it will serve as a written agreement between the lender and the borrower.

- Begin by entering the date at the top of the form. This should be the date you are completing the note.

- Next, write the full name and address of the borrower. Ensure that this information is clear and correct.

- Then, provide the full name and address of the lender. This is the person or entity that is providing the loan.

- Indicate the principal amount being borrowed. This is the total amount that the borrower agrees to pay back.

- Specify the interest rate. Make sure to write this as a percentage.

- Fill in the repayment schedule. This should include the frequency of payments (e.g., monthly, quarterly) and the total number of payments to be made.

- Include any late fees or penalties for missed payments, if applicable. Clearly outline the terms for these fees.

- Sign the form where indicated. The borrower should sign, and if necessary, the lender should also sign.

- Finally, date the signatures. This indicates when the agreement was officially made.

Dos and Don'ts

When filling out the North Carolina Promissory Note form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are five key dos and don’ts:

- Do read the entire form carefully before starting. Understanding each section will help you provide the necessary information correctly.

- Do include all required details such as the names of the borrower and lender, the loan amount, and the interest rate.

- Do sign and date the document. An unsigned note may not be enforceable.

- Don't leave any sections blank. If a section does not apply, clearly indicate that with “N/A” to avoid confusion.

- Don't use white-out or any correction fluid. If a mistake is made, it is best to cross it out neatly and initial the correction.

Documents used along the form

When dealing with a North Carolina Promissory Note, several other documents often accompany it to ensure clarity and legality in the lending process. Each of these forms serves a specific purpose and helps protect the interests of both the lender and the borrower.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral and the rights of the lender in case of default.

- Florida Traffic Crash Report: This important document is necessary to complete following an incident that causes property damage on Florida roads. It includes critical details such as vehicle information, accident location, and witness accounts, making it a vital component in complying with state law and assisting with insurance claims. For more details, visit Florida Forms.

- Disclosure Statement: This form provides important information about the loan, including fees, interest rates, and the total cost of borrowing.

- Guaranty Agreement: A guarantor may sign this document, agreeing to take responsibility for the loan if the borrower defaults.

- Amortization Schedule: This schedule breaks down each payment into principal and interest, showing how the loan balance decreases over time.

- Credit Application: Borrowers typically complete this form to provide the lender with necessary financial information to assess creditworthiness.

- Promissory Note Addendum: This document is used to modify or clarify terms in the original promissory note, such as changes in payment amounts or due dates.

- Payment Receipt: A record that confirms a payment has been made towards the loan, providing proof for both parties.

- Default Notice: If the borrower fails to meet payment obligations, this notice formally informs them of the default status and any necessary actions.

Utilizing these documents in conjunction with the North Carolina Promissory Note can help streamline the lending process and minimize potential disputes. Each document plays a crucial role in ensuring that all parties are aware of their rights and responsibilities.