Legal Operating Agreement Document for the State of North Carolina

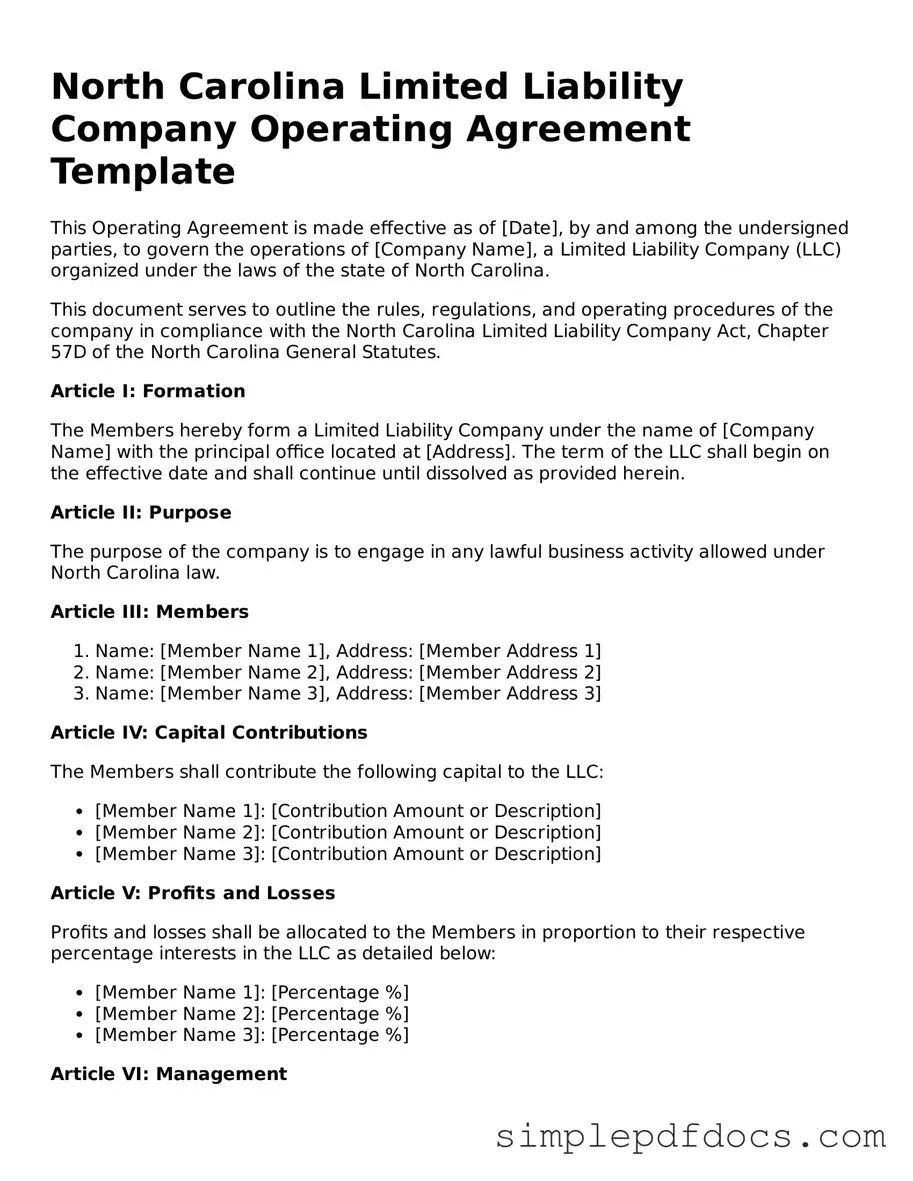

In North Carolina, the Operating Agreement form plays a crucial role in outlining the internal structure and operational guidelines for limited liability companies (LLCs). This document serves as a blueprint for how the business will be managed, detailing the roles and responsibilities of members and managers. It addresses key aspects such as profit distribution, decision-making processes, and procedures for adding or removing members. Additionally, the Operating Agreement can specify how disputes will be resolved, ensuring that all members are on the same page when challenges arise. By providing clarity and structure, this form not only helps in preventing misunderstandings among members but also strengthens the LLC’s credibility in the eyes of potential investors and partners. Understanding the importance of this agreement can lead to smoother operations and a more cohesive business environment.

Consider Other Common Operating Agreement Templates for Specific States

How to Write an Operating Agreement - The Operating Agreement can limit liability exposure for members.

To facilitate the reporting process, taxpayers can access the necessary documentation and guidance for the Florida Sales Tax form through resources like Florida Forms, ensuring they have all the tools needed to comply with state tax regulations effectively.

Llc Template - The document can outline how outside consultants or advisors are engaged by the LLC.

How to Create an Operating Agreement - An Operating Agreement can outline conditions for amending the agreement.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the North Carolina Limited Liability Company Act, found in Chapter 57D of the North Carolina General Statutes. |

| Flexibility | Members can customize the agreement to suit the specific needs and preferences of the LLC, allowing for various management structures. |

| Importance | Having an Operating Agreement helps prevent disputes among members and provides clarity on roles, responsibilities, and profit distribution. |

How to Write North Carolina Operating Agreement

Completing the North Carolina Operating Agreement form is an important step in establishing the framework for your business. This document outlines the management structure and operational guidelines of your limited liability company (LLC). Follow these steps to ensure that you fill out the form accurately and effectively.

- Begin by entering the name of your LLC at the top of the form. Make sure the name matches the one registered with the North Carolina Secretary of State.

- Next, provide the principal office address of your LLC. This should be a physical address where your business operates.

- List the names and addresses of all members of the LLC. Each member should be included, even if they have no ownership interest.

- Specify the management structure of your LLC. Indicate whether it will be member-managed or manager-managed.

- Outline the voting rights of each member. Clearly state how decisions will be made within the LLC.

- Detail the distribution of profits and losses among members. This should reflect each member's ownership interest.

- Include provisions for adding new members or transferring ownership. This helps to clarify the process for future changes.

- Finally, have all members sign and date the form to validate the agreement. Ensure that each member receives a copy for their records.

After completing the form, you may want to keep it in a safe place, as it serves as an essential reference for your LLC's operations. Consider consulting with a legal professional to ensure that all aspects of your agreement comply with North Carolina laws.

Dos and Don'ts

When filling out the North Carolina Operating Agreement form, it's important to approach the task with care. Here are some dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do ensure that all members of the LLC agree on the terms outlined in the agreement.

- Do provide accurate information regarding the LLC's name and address.

- Do include the purpose of the LLC clearly and concisely.

- Don't leave any sections blank; if a section does not apply, indicate that clearly.

- Don't use vague language; be specific about roles and responsibilities.

- Don't forget to have all members sign the agreement after it is completed.

Documents used along the form

The North Carolina Operating Agreement is an essential document for limited liability companies (LLCs) in the state. It outlines the management structure and operating procedures of the LLC. In addition to this agreement, there are several other forms and documents that are often used to support the establishment and operation of an LLC. Below is a list of these important documents, along with brief descriptions of each.

- Articles of Organization: This document is filed with the North Carolina Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Operating Agreement: This internal document governs the management and operations of the LLC. It details the rights and responsibilities of members and managers.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They can cover various topics, including changes in management or financial decisions.

- Power of Attorney Form: A crucial document that allows designated individuals to manage your affairs, particularly in circumstances where you may be unable to do so yourself. For more information, visit floridaforms.net/blank-power-of-attorney-form.

- Bylaws: While not required for LLCs, bylaws can outline the rules for the internal governance of the LLC, including meetings and voting procedures.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Financial Statements: Regular financial statements provide an overview of the LLC's financial health. They include balance sheets, income statements, and cash flow statements.

- Tax Forms: LLCs must file various tax forms, such as the IRS Form 1065 for partnerships or Schedule C for single-member LLCs. These documents are essential for compliance with federal and state tax laws.

- Annual Reports: North Carolina requires LLCs to file an annual report with the Secretary of State. This report updates the state on the LLC's status and any changes in its management or structure.

Each of these documents plays a crucial role in the formation and ongoing management of an LLC in North Carolina. Properly maintaining and filing these forms helps ensure compliance with state regulations and promotes the smooth operation of the business.