Legal Durable Power of Attorney Document for the State of North Carolina

In North Carolina, the Durable Power of Attorney form serves as a vital legal tool for individuals seeking to plan for the future and ensure their financial and personal affairs are managed according to their wishes. This document empowers a designated person, known as the agent or attorney-in-fact, to make decisions on behalf of the individual, known as the principal, in the event they become incapacitated or unable to communicate their preferences. The form can cover a wide range of responsibilities, from managing bank accounts and investments to handling real estate transactions and making healthcare decisions. Importantly, the durable aspect of this power of attorney means that it remains effective even if the principal loses the capacity to make decisions. Understanding the nuances of this form, including how to properly execute it and the rights and responsibilities of both the principal and the agent, is crucial for anyone looking to safeguard their interests and ensure their wishes are respected during challenging times.

Consider Other Common Durable Power of Attorney Templates for Specific States

Ohio Power of Attorney Requirements - Prepare for the unexpected with this essential legal document.

Durable Power of Attorney Form Pa - This document can be part of your broader estate planning strategy.

For those seeking to understand the intricacies of the ownership transfer process, having a comprehensive Tractor Bill of Sale is vital. This document not only protects the interests of both parties involved but also outlines important information needed for the transaction. Learn more about how to create this document at your guide to an essential Tractor Bill of Sale.

What Is Statutory Power of Attorney - This document allows family members to honor your preferences regarding financial matters in critical times.

Power of Attorney Form Texas Pdf - This arrangement is designed to protect your interests during vulnerability.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney in North Carolina allows an individual (the principal) to appoint someone else (the agent) to manage their financial and legal affairs, even if the principal becomes incapacitated. |

| Governing Law | The North Carolina Durable Power of Attorney is governed by North Carolina General Statutes Chapter 32A. |

| Durability | This form remains effective even if the principal becomes mentally incapacitated, ensuring continuous management of their affairs. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

How to Write North Carolina Durable Power of Attorney

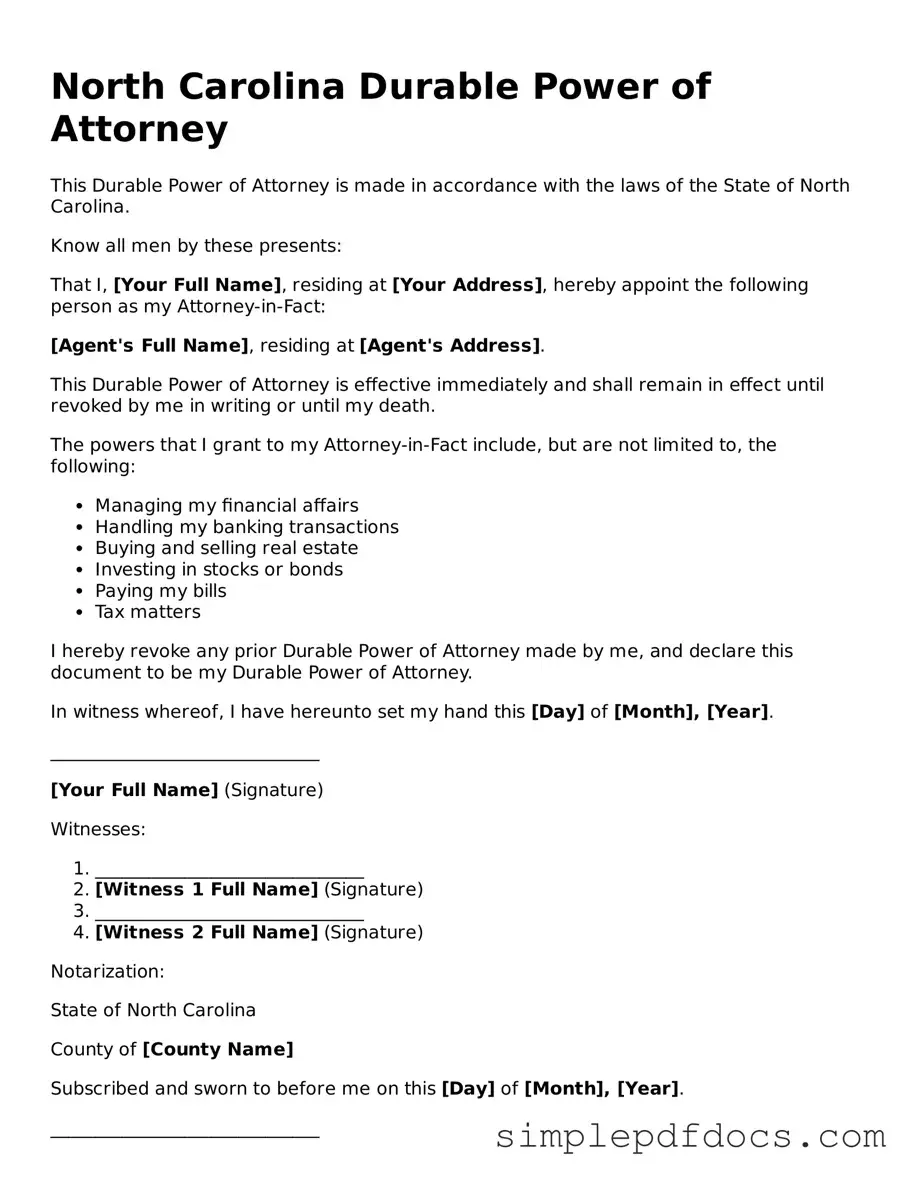

Filling out the North Carolina Durable Power of Attorney form is an important step in designating someone to manage your financial and legal affairs if you become unable to do so yourself. To ensure that the document accurately reflects your wishes, follow these detailed steps carefully.

- Begin by downloading the North Carolina Durable Power of Attorney form from a reliable source, ensuring that it is the most current version.

- At the top of the form, provide your full name and address. This identifies you as the principal, the person granting the authority.

- Next, enter the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Clearly specify the powers you wish to grant to your agent. You can choose to give broad powers or limit them to specific tasks. Be precise to avoid any confusion.

- If desired, include any limitations or specific instructions regarding how your agent should act. This can help guide your agent’s decisions in line with your wishes.

- Designate an alternate agent in case the primary agent is unable or unwilling to serve. This ensures that someone is always available to manage your affairs.

- Review the form thoroughly to ensure all information is accurate and complete. Mistakes or omissions can lead to complications later.

- Sign and date the form in the presence of a notary public. This step is crucial, as notarization adds a layer of authenticity to the document.

- After notarization, provide copies of the completed form to your agent and any relevant financial institutions or healthcare providers. This ensures they are aware of your appointed agent.

Following these steps will help ensure that the Durable Power of Attorney form is filled out correctly and in accordance with your intentions. It is always wise to consult with a legal professional if you have any questions or concerns during the process.

Dos and Don'ts

When filling out the North Carolina Durable Power of Attorney form, it's important to be careful and thorough. Here are some things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do ensure that you understand the powers you are granting to your agent.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Do discuss your decisions with your chosen agent beforehand.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any blank spaces on the form; fill in all required information.

- Don't forget to date the form when you sign it.

- Don't assume that your agent knows your wishes; communicate clearly.

- Don't use outdated forms; always use the most current version.

Documents used along the form

When creating a Durable Power of Attorney in North Carolina, it is important to consider other related documents that can complement this legal instrument. Each of these documents serves a unique purpose and can help ensure that your wishes are honored and your affairs are managed effectively. Below is a list of commonly used forms that often accompany a Durable Power of Attorney.

- Advance Directive for Health Care: This document allows individuals to specify their preferences for medical treatment in the event they become unable to communicate their wishes. It often includes a living will and a health care power of attorney.

- Florida Traffic Crash Report: This form is essential for drivers involved in accidents, providing necessary details for insurance purposes and compliance with state law. For more information, visit Florida Forms.

- Living Will: A living will outlines your preferences regarding life-sustaining treatment and end-of-life care. It provides guidance to healthcare providers and family members about your wishes in critical situations.

- Health Care Power of Attorney: This form designates a trusted person to make medical decisions on your behalf if you are incapacitated. It complements the advance directive by ensuring someone can advocate for your health care preferences.

- Will: A will is a legal document that outlines how your assets will be distributed after your death. It can also name guardians for minor children and appoint an executor to manage your estate.

- Trust Agreement: A trust can be used to manage your assets during your lifetime and after your death. It allows for specific instructions on how assets should be handled, providing flexibility and control over your estate.

- HIPAA Release Form: This document allows you to authorize certain individuals to access your medical records and information. It ensures that your health care agent can communicate effectively with medical providers.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document specifically grants someone the authority to manage your financial affairs. It can be useful if you want to delegate financial responsibilities separately from health care decisions.

- Declaration of Guardian: This document allows you to name a guardian for yourself in case you become unable to care for yourself. It can help ensure that your personal preferences are respected when it comes to your care.

Incorporating these documents into your estate planning can provide peace of mind. They work together to create a comprehensive plan that addresses both your health care and financial needs. Taking these steps ensures that your wishes are respected and that your loved ones are equipped to make decisions on your behalf when necessary.