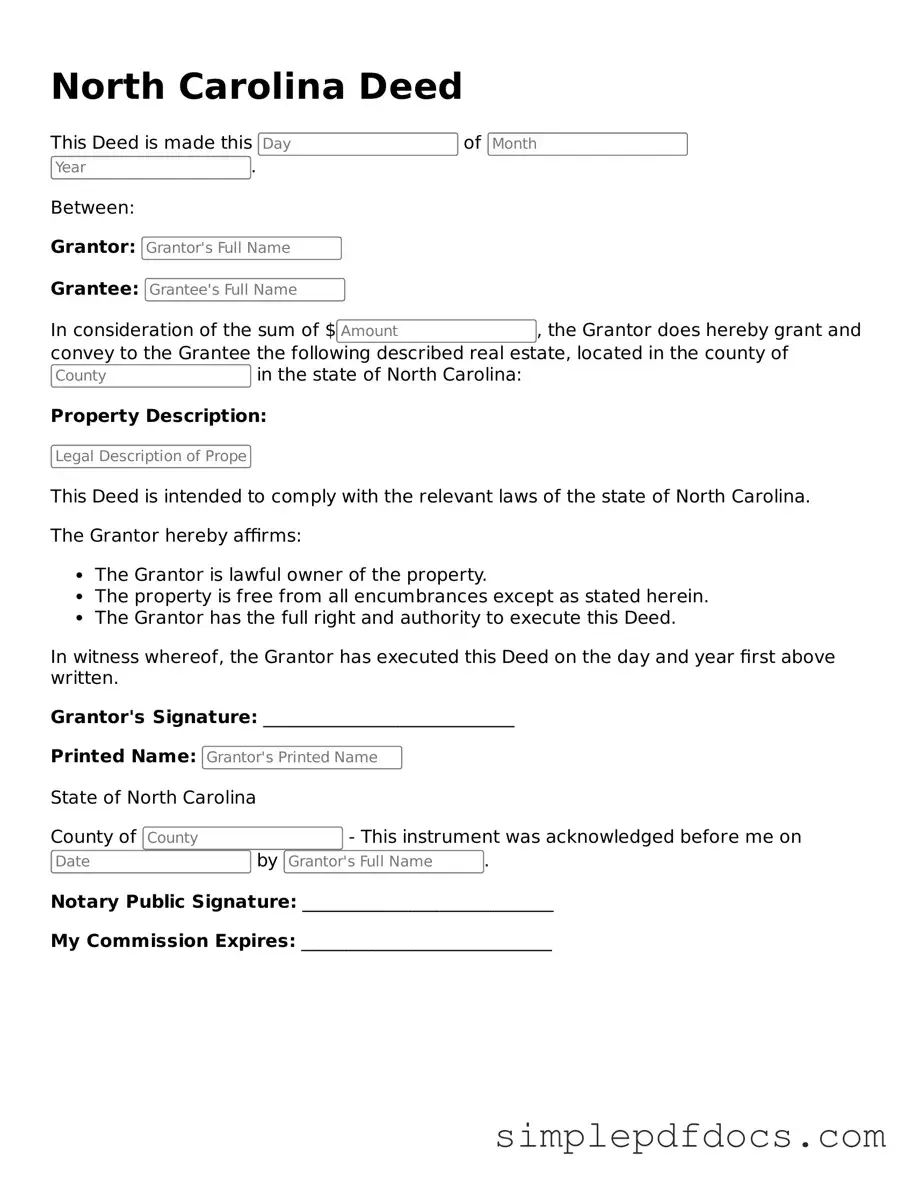

Legal Deed Document for the State of North Carolina

In the world of real estate transactions, the North Carolina Deed form plays a pivotal role in transferring property ownership. This essential document is not merely a piece of paper; it serves as a legal instrument that outlines the details of the transfer, including the names of the grantor (the person selling or transferring the property) and the grantee (the person receiving the property). Additionally, it specifies the property’s legal description, ensuring clarity about what is being transferred. Understanding the nuances of this form is crucial for both buyers and sellers, as it can affect their rights and responsibilities. The North Carolina Deed form also includes vital elements such as the date of the transaction and any relevant conditions or restrictions tied to the property. Furthermore, it often requires notarization to validate the transfer and may need to be recorded with the county to provide public notice of the change in ownership. By grasping the key components and implications of the North Carolina Deed form, individuals can navigate the complexities of property transactions with greater confidence and security.

Consider Other Common Deed Templates for Specific States

Sample Deed for House - Once executed, the Deed provides a legal claim to the property.

In order to safeguard sensitive information, it is advisable to utilize a Florida Non-disclosure Agreement (NDA) form, which is a legally binding document that provides clarity on the handling of confidential materials. This form, compliant with the state's regulations, is essential for protecting proprietary information shared during business interactions. For those looking to obtain a comprehensive document, you can find a suitable template at https://floridaforms.net/blank-non-disclosure-agreement-form/, ensuring both parties are fully aware of their rights and obligations. This promotes a trustworthy atmosphere for collaboration while ensuring that privacy and confidentiality are respected.

Texas Deed Forms - Deeds can vary based on the state, so it's important to use the right form.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The North Carolina General Statutes govern deed forms, specifically Chapter 47. |

| Types of Deeds | Common types include General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. |

| Execution Requirements | Deeds must be signed by the grantor in the presence of a notary public. |

| Recording | Deeds should be recorded with the county register of deeds to protect the interests of the parties involved. |

| Consideration | The deed must state the consideration, which is the value exchanged for the property. |

| Property Description | A legal description of the property must be included in the deed. |

| Transfer of Title | The deed acts as a legal document to transfer title from the grantor to the grantee. |

| Tax Implications | North Carolina imposes a revenue stamp tax on the transfer of real estate. |

| Validity | To be valid, the deed must meet all statutory requirements and be executed properly. |

How to Write North Carolina Deed

After obtaining the North Carolina Deed form, it is essential to complete it accurately to ensure the transfer of property ownership is legally recognized. The following steps will guide you through the process of filling out the form effectively.

- Begin by entering the date at the top of the form. This should reflect the date when the deed is being executed.

- Identify the Grantor. Provide the full legal name of the person or entity transferring the property. Include their address and any relevant identification details.

- Next, identify the Grantee. This is the individual or entity receiving the property. Include their full legal name and address as well.

- Describe the property being transferred. Clearly outline the property’s legal description, including any parcel numbers or specific identifiers. This information can typically be found in previous deeds or property tax records.

- Include the consideration amount. This is the value exchanged for the property, which may be stated as a specific dollar amount or described as “for love and affection” if no money is involved.

- Sign the deed. The Grantor must sign the document in the presence of a notary public. Ensure that the signature matches the name provided in the Grantor section.

- Have the deed notarized. The notary public will verify the identity of the Grantor and affix their seal to the document.

- Finally, file the completed deed with the appropriate county register of deeds office. This step is crucial for the deed to be legally effective and recognized.

Dos and Don'ts

When filling out the North Carolina Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Read the instructions carefully before starting.

- Provide complete and accurate information about the property.

- Include the names of all parties involved in the transaction.

- Use black or blue ink for clarity.

- Sign the deed in the presence of a notary public.

Things You Shouldn't Do:

- Do not leave any sections blank; fill in all required fields.

- Avoid using abbreviations or shorthand that may confuse the reader.

- Do not forget to check for spelling errors in names and addresses.

- Never submit the deed without proper notarization.

- Do not assume that verbal agreements are sufficient; everything must be in writing.

Documents used along the form

When completing a real estate transaction in North Carolina, several forms and documents are commonly used alongside the Deed form. Each of these documents serves a specific purpose and is essential for ensuring that the transaction is legally sound and properly recorded.

- Title Search Report: This document provides a history of the property’s ownership and any liens or encumbrances that may affect the title. It helps buyers understand any potential issues before finalizing the purchase.

- Property Disclosure Statement: Sellers are often required to provide this statement, which outlines any known issues with the property. It ensures transparency and helps protect both parties in the transaction.

- Purchase Agreement: This contract outlines the terms of the sale, including the price, contingencies, and closing date. It serves as the foundation for the transaction and is crucial for both buyers and sellers.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all costs associated with the transaction. It provides a clear breakdown of fees and ensures that both parties understand their financial obligations.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and discloses any liens or claims against it. It helps protect the buyer from future disputes regarding ownership.

- Power of Attorney: In some cases, a party may choose to designate someone else to act on their behalf during the transaction. This legal document grants authority to another person to sign documents and make decisions related to the sale.

- Tax Certification: This document verifies that all property taxes have been paid up to date. It ensures that the buyer is not responsible for any outstanding tax liabilities after the sale.

- Commercial Lease Agreement: For those involved in leasing commercial properties, a Florida Forms provides a comprehensive outline of the terms and conditions between property owners and tenants, ensuring mutual understanding and compliance.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the property’s title. It provides peace of mind and financial security in case any issues arise after the transaction.

- Deed of Trust: Often used in conjunction with a mortgage, this document secures the loan by giving the lender a claim to the property until the loan is paid off. It outlines the terms of the loan and the responsibilities of both parties.

Understanding these documents is vital for anyone involved in a real estate transaction in North Carolina. Each plays a crucial role in ensuring a smooth process and protecting the interests of all parties involved.