Legal Transfer-on-Death Deed Document for the State of New York

In the realm of estate planning, the New York Transfer-on-Death Deed (TOD) form serves as a powerful tool for individuals looking to streamline the transfer of their property upon death. This legal document allows property owners to designate beneficiaries who will automatically receive the property, bypassing the often lengthy and costly probate process. By utilizing the TOD deed, individuals can maintain control over their property during their lifetime while ensuring a smooth transition to their chosen heirs after they pass away. It is important to note that this form is only applicable to real estate, and it must be properly executed and recorded to be effective. Additionally, property owners can revoke or change the beneficiaries at any time before their death, providing flexibility in their estate planning. Understanding the nuances of the New York Transfer-on-Death Deed can empower individuals to make informed decisions about their property and legacy, ultimately fostering peace of mind for both themselves and their loved ones.

Consider Other Common Transfer-on-Death Deed Templates for Specific States

Ohio Transfer on Death Form - Beneficiaries must be clearly identified to avoid ambiguity in property transfer upon the owner's death.

When completing the transaction for your trailer, it is important to utilize the New York Trailer Bill of Sale form, which can be found at nyforms.com. This legal document ensures that all necessary details, such as the purchase price, trailer description, and parties' information, are clearly outlined to facilitate a smooth transfer of ownership and help the buyer with the registration process in New York.

Transfer Deed Upon Death - The deed takes effect only after the death of the property owner, meaning you retain full control while alive.

Right of Survivorship Deed Pennsylvania - After the owner's death, the property automatically transfers to the named beneficiary without the need for probate.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death, without the need for probate. |

| Governing Law | The Transfer-on-Death Deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 2-1.11. |

| Eligibility | Any individual who owns real property in New York can create a Transfer-on-Death Deed. |

| Beneficiary Designation | The deed allows for one or more beneficiaries to be designated, who will receive the property upon the owner's death. |

| Revocation | The Transfer-on-Death Deed can be revoked by the property owner at any time during their lifetime. |

| Execution Requirements | The deed must be signed by the property owner and acknowledged before a notary public. |

| Recording | To be effective, the deed must be recorded in the county where the property is located before the owner's death. |

| Impact on Taxes | The property is not subject to estate taxes at the time of the owner's death, as it transfers directly to the beneficiary. |

| Limitations | Transfer-on-Death Deeds cannot be used for certain types of property, such as property held in a trust. |

| Legal Advice | It is advisable to consult with an attorney to ensure the deed is properly executed and meets all legal requirements. |

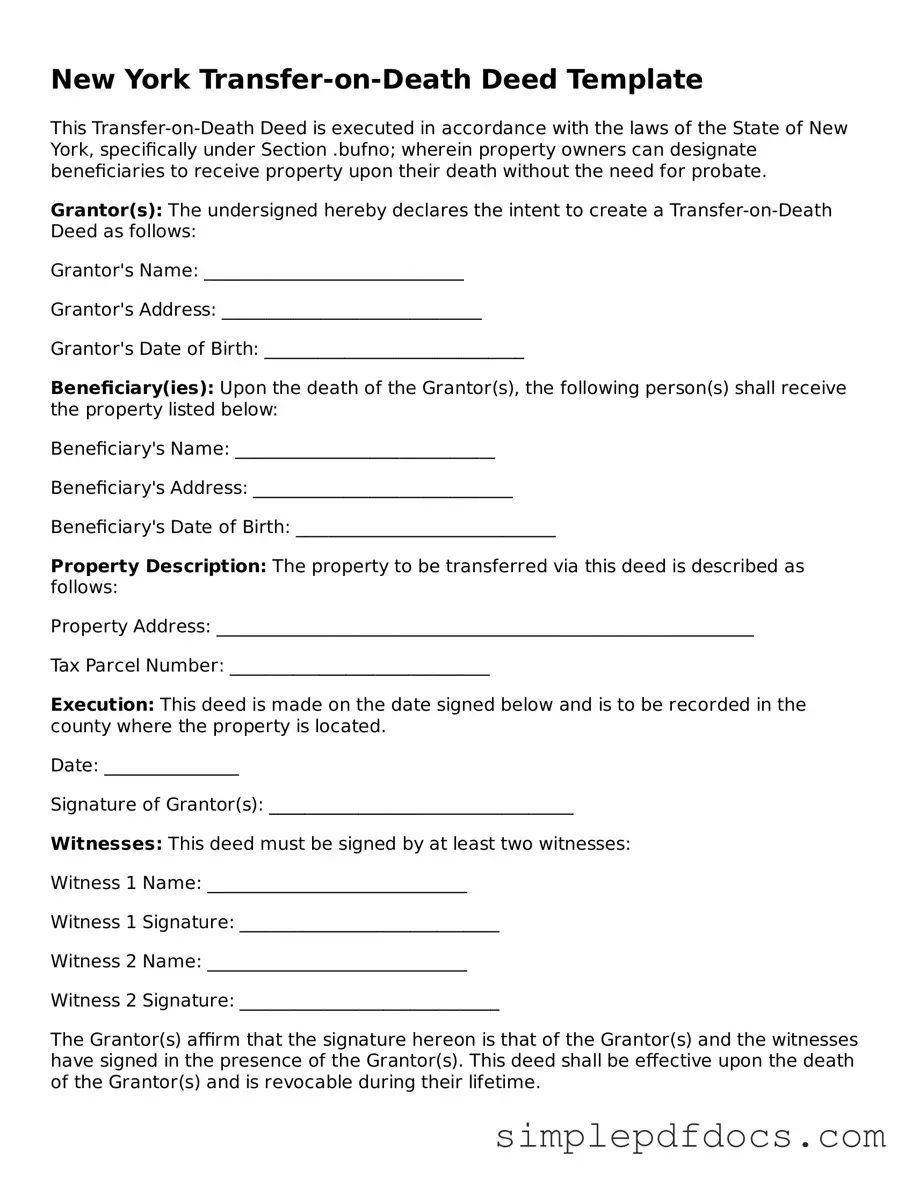

How to Write New York Transfer-on-Death Deed

After obtaining the New York Transfer-on-Death Deed form, you will need to complete it carefully. Make sure to have all necessary information at hand before you start filling it out. Follow these steps to ensure accuracy and completeness.

- Begin by entering your name and address in the designated fields at the top of the form.

- Provide the name and address of the beneficiary or beneficiaries you wish to designate.

- Describe the property you are transferring. Include the address and any relevant details that identify the property clearly.

- Indicate whether the transfer will be to one beneficiary or multiple beneficiaries. If there are multiple, specify how the property will be divided among them.

- Sign and date the form in the appropriate section. Ensure your signature matches the name provided at the top of the form.

- Have the form notarized. A notary public must witness your signature and provide their seal.

- Submit the completed form to the county clerk's office in the county where the property is located. Make sure to keep a copy for your records.

Once the form is submitted, it will be recorded and become part of the public record. This step is crucial for the transfer to take effect upon your passing.

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it is essential to approach the process with care. Here are some key dos and don'ts to consider:

- Do: Ensure that you accurately identify the property you wish to transfer. This includes providing the correct address and legal description.

- Do: Sign the deed in the presence of a notary public. This step is crucial for the validity of the document.

- Do: Provide clear information about the beneficiaries. Make sure their names are spelled correctly and include any necessary identifying details.

- Do: Record the deed with the county clerk's office where the property is located. This step makes the transfer official and public.

- Don't: Forget to review the form for errors before submission. Mistakes can lead to complications down the line.

- Don't: Leave out any required signatures or information. Incomplete forms can be rejected.

- Don't: Assume that verbal agreements are sufficient. Always document your intentions in writing.

- Don't: Delay in recording the deed. Timeliness is essential to ensure the transfer takes effect as intended.

Documents used along the form

When preparing to use a New York Transfer-on-Death Deed, it’s essential to consider other related documents that may be necessary for a smooth transfer of property. These documents help clarify ownership, ensure proper legal procedures, and provide necessary information to all parties involved.

- Property Deed: This document shows current ownership of the property. It includes details like the legal description of the property and the names of the current owners.

- Will: A will outlines how a person's assets will be distributed upon their death. It may complement the Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Motor Vehicle Power of Attorney: This essential document, which allows one person to manage vehicle-related tasks for another, can be particularly helpful in situations where the vehicle owner is unable to act on their own behalf. For further information, visit https://floridaforms.net/blank-motor-vehicle-power-of-attorney-form.

- Affidavit of Heirship: This document helps establish who the legal heirs are if the deceased did not leave a will. It can assist in clarifying ownership issues.

- Power of Attorney: This document allows someone to make decisions on behalf of another person. It can be useful if the property owner is unable to manage their affairs.

- Notice of Death: This document formally notifies relevant parties, such as banks or other institutions, of the property owner’s passing. It can help initiate the transfer process.

- Title Search: Conducting a title search confirms the property's ownership history and reveals any liens or claims against it. This is crucial for ensuring a clear title transfer.

- Transfer Tax Return: This form may be required by the state to report the transfer of property and ensure that any applicable taxes are paid.

- Estate Tax Return: If applicable, this document reports the value of the deceased's estate for tax purposes. It is important for settling any tax obligations before transferring property.

Having these documents ready can streamline the process of transferring property through a Transfer-on-Death Deed. Each document plays a role in ensuring that the transfer is legally sound and that all parties involved are informed and protected.