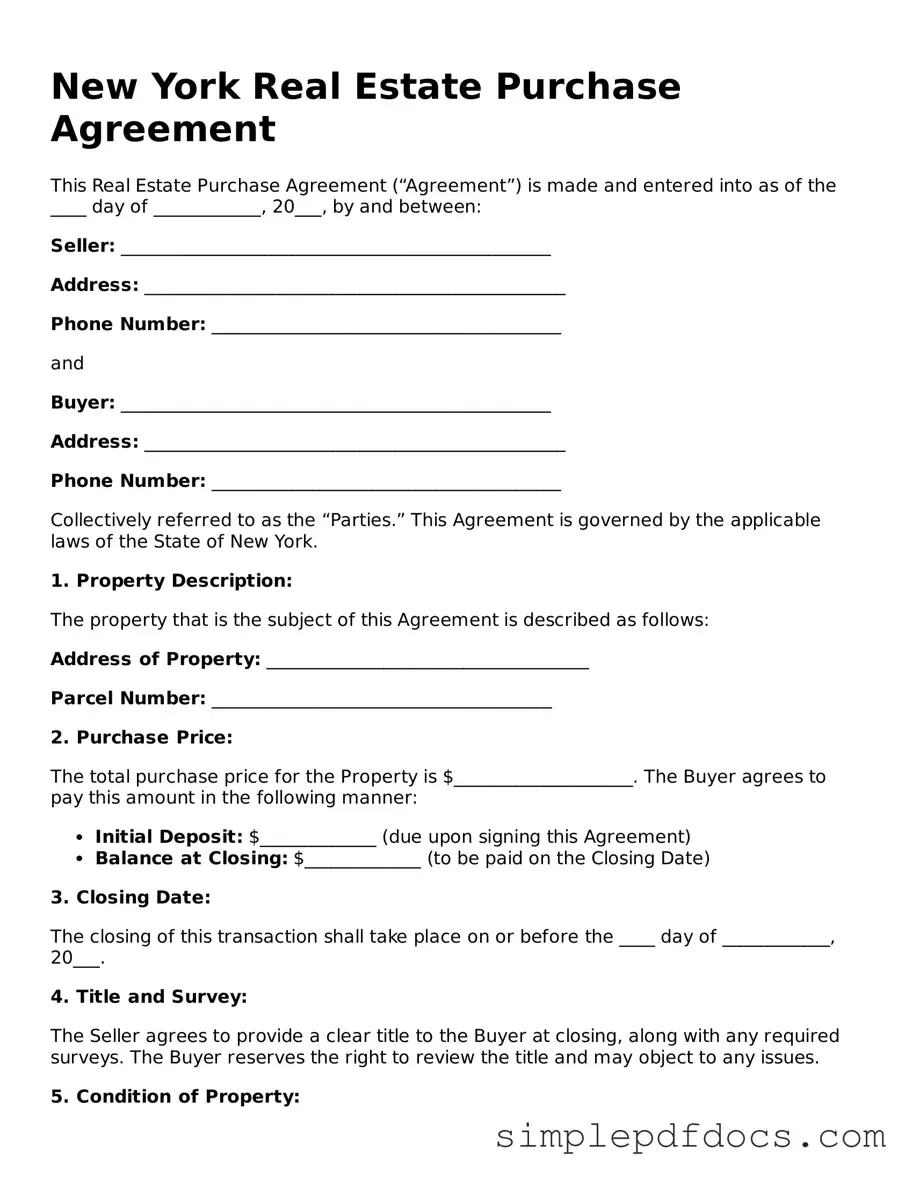

Legal Real Estate Purchase Agreement Document for the State of New York

The New York Real Estate Purchase Agreement is a crucial document in the home buying process, serving as the foundation for the transaction between buyers and sellers. This form outlines the essential terms of the sale, including the purchase price, the property description, and the closing date. It also delineates the responsibilities of each party, such as the buyer's obligation to conduct inspections and the seller's duty to provide clear title. Additionally, the agreement addresses contingencies, which are conditions that must be met for the sale to proceed, such as securing financing or satisfactory appraisal results. The form includes provisions for earnest money deposits, which demonstrate the buyer's commitment to the purchase, and it stipulates what happens if either party fails to fulfill their obligations. By clearly laying out these details, the New York Real Estate Purchase Agreement helps to protect the interests of both buyers and sellers, ensuring a smoother transaction and minimizing the potential for disputes. Understanding this document is essential for anyone involved in real estate transactions in New York, as it not only sets the stage for the sale but also reflects the legal rights and responsibilities of the parties involved.

Consider Other Common Real Estate Purchase Agreement Templates for Specific States

Nc Real Estate Sales Contract - Can incorporate clauses for disputes and mediation processes.

Creating a Durable Power of Attorney is a crucial step in planning for the future, ensuring that your financial and legal matters are managed according to your wishes. To help you navigate this process effectively, consider utilizing resources like Florida Forms, which provides necessary documentation and guidance tailored to your needs.

Free Ohio Real Estate Purchase Contract for Sale by Owner - This form can be beneficial in securing financing and evaluating investment potential.

Pa Agreement of Sale 2023 Pdf - Key elements such as property description and identification are specified in the agreement.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The New York Real Estate Purchase Agreement is governed by the laws of the State of New York. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be identified clearly in the document. |

| Property Description | A detailed description of the property being sold must be included, specifying the address and any relevant legal descriptions. |

| Contingencies | Common contingencies such as financing, inspections, and appraisals are often outlined to protect both parties during the transaction. |

How to Write New York Real Estate Purchase Agreement

Once you have obtained the New York Real Estate Purchase Agreement form, you are ready to fill it out. This document is essential for formalizing the sale of real estate. Completing it accurately ensures that both the buyer and seller are clear on the terms of the transaction.

- Identify the Parties: Begin by filling in the names and contact information of both the buyer and the seller. Make sure to include their legal names as they appear on official documents.

- Property Description: Provide a detailed description of the property being sold. This includes the address, any specific lot or unit numbers, and a brief description of the property type (e.g., single-family home, condo).

- Purchase Price: Clearly state the agreed-upon purchase price for the property. Ensure this amount is correct and reflects any negotiations that have taken place.

- Deposit Amount: Indicate the amount of the deposit that the buyer will provide. This is typically a percentage of the purchase price and shows the buyer's commitment.

- Financing Terms: If the buyer is obtaining financing, specify the type of financing (e.g., conventional loan, FHA loan) and any relevant details about the lender.

- Closing Date: Enter the proposed closing date when the transaction will be finalized. This is the date when ownership will officially transfer from the seller to the buyer.

- Contingencies: List any contingencies that must be met before the sale can proceed. Common contingencies include home inspections and financing approval.

- Signatures: Ensure that both parties sign and date the agreement. This step is crucial as it indicates that both the buyer and seller agree to the terms outlined in the document.

After completing the form, it is advisable to review it carefully for any errors or omissions. Once verified, the agreement can be submitted to the appropriate parties for processing.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, attention to detail is crucial. Here are six essential dos and don'ts to guide you through the process:

- Do read the entire agreement carefully before starting to fill it out. Understanding the terms is vital.

- Don't leave any sections blank unless instructed otherwise. Every part of the form serves a purpose.

- Do provide accurate and complete information. Misinformation can lead to complications later.

- Don't use abbreviations or shorthand. Clarity is key, and full terms should always be used.

- Do double-check all figures and dates. A simple error can create significant issues.

- Don't rush through the process. Take your time to ensure everything is correct and complete.

Documents used along the form

When engaging in a real estate transaction in New York, several documents complement the Real Estate Purchase Agreement. Each document serves a specific purpose and helps clarify the terms and conditions of the sale. Below is a list of commonly used forms and documents in conjunction with the purchase agreement.

- Disclosure Statement: This document outlines any known issues or defects with the property. Sellers must provide this information to buyers to ensure transparency.

- Title Report: A title report reveals the legal ownership of the property and any liens or encumbrances that may affect the sale. Buyers should review this report to confirm clear title.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead hazards. It ensures compliance with federal regulations.

- Financing Addendum: If the buyer is obtaining a mortgage, this document outlines the financing terms. It includes details about loan amounts, interest rates, and contingencies.

- Inspection Report: Buyers often conduct a home inspection to identify any structural or mechanical issues. This report provides a detailed assessment of the property's condition.

- Operating Agreement: For those engaging in business, the floridaforms.net/blank-operating-agreement-form is a fundamental document that outlines the operational framework and governance structure of an LLC, ensuring clarity and minimizing potential disputes among members.

- Closing Statement: This document summarizes all financial transactions involved in the closing process. It details costs, fees, and the final amount due at closing.

- Escrow Agreement: An escrow agreement outlines the terms under which a neutral third party holds funds until all conditions of the sale are met. This protects both the buyer and seller.

- Power of Attorney: If a party cannot attend the closing, a power of attorney allows someone else to sign documents on their behalf. This ensures the transaction can proceed smoothly.

Understanding these documents is crucial for a successful real estate transaction. Each plays a vital role in protecting the interests of both buyers and sellers throughout the process.