Legal Quitclaim Deed Document for the State of New York

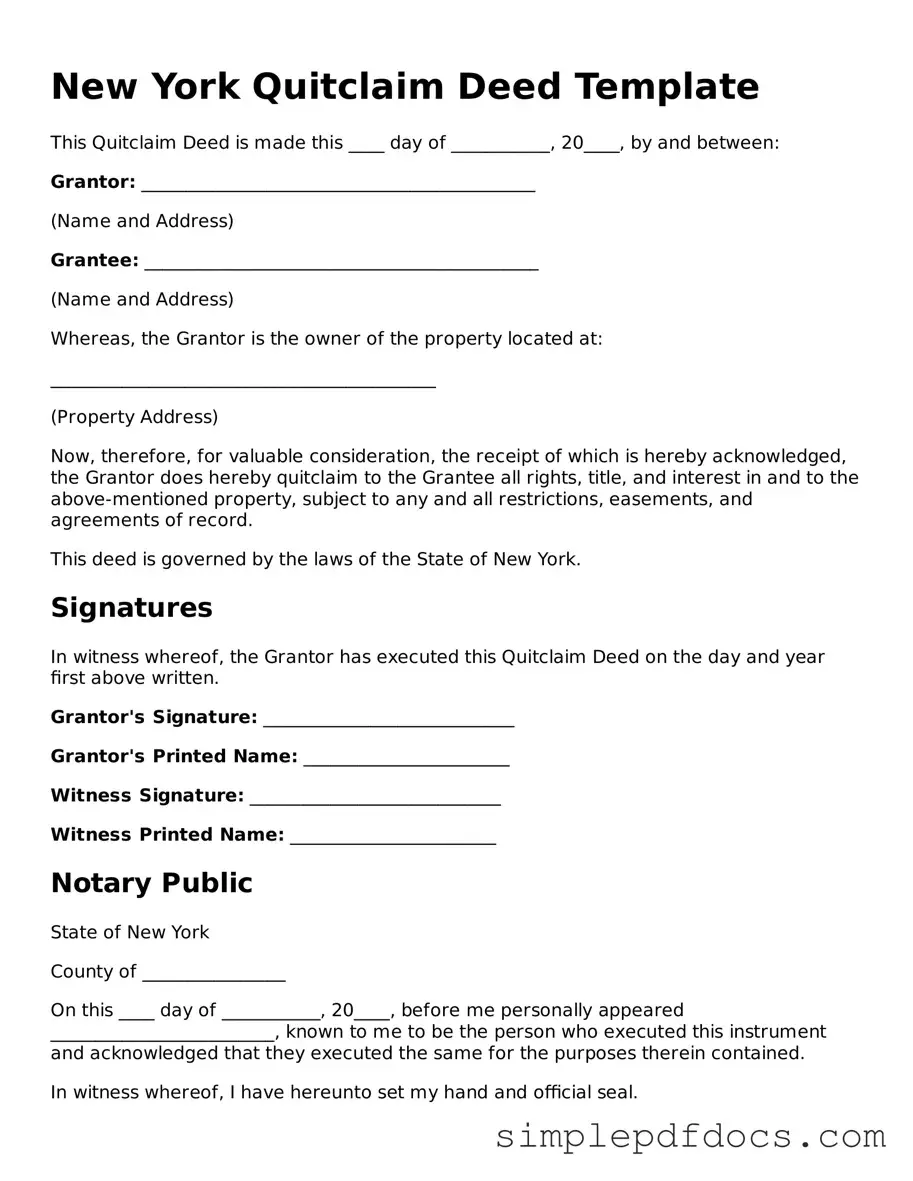

The New York Quitclaim Deed form is an essential legal document that facilitates the transfer of property ownership between parties, often used in situations where the seller may not be able to guarantee a clear title. This form is particularly useful in various scenarios, such as transferring property between family members, resolving disputes, or handling property in a divorce. Unlike a warranty deed, which provides a guarantee of title, a quitclaim deed offers no such assurances, making it a simpler, more straightforward option. In New York, the form must include specific information such as the names of the grantor and grantee, a description of the property, and the date of the transfer. Additionally, it requires the signature of the grantor and may need to be notarized to ensure its validity. Understanding the implications of using a quitclaim deed is crucial, as it can significantly impact the rights and responsibilities of both parties involved in the transaction.

Consider Other Common Quitclaim Deed Templates for Specific States

Where Do I Get a Quitclaim Deed Form - This document is best suited for situations where the grantor trusts the grantee not to exploit potential claims.

When dealing with property transfers, understanding the role of a quitclaim deed form is essential for ensuring a clear change of ownership. This document offers a straightforward solution for parties familiar with each other, enabling them to relinquish or confirm property rights effectively.

Ohio Quit Claim Deed Template - Does not include warranties of any nature regarding the property.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real property without any warranties regarding the title. |

| Governing Law | The Quitclaim Deed in New York is governed by the New York Real Property Law, specifically Section 258. |

| Parties Involved | The deed involves two parties: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Consideration | Consideration is not always required, but it is common to include a nominal amount to validate the transaction. |

| Recording | To protect the grantee's interest, the Quitclaim Deed should be recorded with the county clerk's office where the property is located. |

| Limitations | The Quitclaim Deed does not guarantee that the grantor has clear title to the property, which can lead to potential risks for the grantee. |

How to Write New York Quitclaim Deed

After you have gathered the necessary information and documents, it's time to fill out the New York Quitclaim Deed form. This form is essential for transferring property ownership. Completing it accurately ensures a smooth process for both the grantor and the grantee.

- Obtain the Form: Download the New York Quitclaim Deed form from a reputable source or visit your local county clerk's office to get a physical copy.

- Identify the Grantor: Fill in the full name and address of the person transferring the property. This is the individual or entity granting the interest in the property.

- Identify the Grantee: Enter the full name and address of the person receiving the property. Ensure that the name is spelled correctly to avoid issues later.

- Describe the Property: Provide a detailed description of the property being transferred. Include the address, county, and any relevant parcel identification numbers.

- State Consideration: Indicate the amount of money or other value exchanged for the property. If the transfer is a gift, you may state "for love and affection" or a similar phrase.

- Sign the Document: The grantor must sign the deed in the presence of a notary public. Ensure that the signature matches the name provided earlier.

- Notarization: Have the notary public complete their section, confirming the identity of the grantor and the authenticity of the signature.

- File the Deed: Submit the completed Quitclaim Deed to the county clerk’s office where the property is located. There may be a filing fee, so check in advance.

Once the Quitclaim Deed is filed, it will become a public record. This means that anyone can access it, which provides transparency in property ownership. Keep a copy for your records, as it serves as proof of the transfer.

Dos and Don'ts

When filling out the New York Quitclaim Deed form, it is essential to approach the task with care and attention to detail. The following list outlines key practices to follow and avoid in order to ensure a smooth process.

- Do ensure that all names are spelled correctly and match the names on the title.

- Do include a complete legal description of the property being transferred.

- Do provide the correct date of the transaction.

- Do sign the form in the presence of a notary public.

- Don't leave any fields blank; all required information must be filled out.

- Don't use outdated forms; always ensure you have the latest version of the Quitclaim Deed.

- Don't forget to check local recording requirements, as they may vary by county.

- Don't overlook the need for proper identification when signing the document.

By adhering to these guidelines, individuals can navigate the process of completing the Quitclaim Deed form with greater confidence and accuracy.

Documents used along the form

When transferring property ownership in New York, a Quitclaim Deed is often the primary document used. However, several other forms and documents may accompany it to ensure a smooth and legally sound transaction. Here’s a brief overview of some commonly used documents in conjunction with a Quitclaim Deed.

- Title Search Report: This document outlines the history of ownership for the property. It identifies any existing liens, claims, or encumbrances that could affect the transfer.

- Property Transfer Tax Return: Required by the state, this form reports the sale price of the property and calculates the applicable transfer taxes that must be paid during the transaction.

- Affidavit of Title: This sworn statement confirms that the seller has the legal right to transfer ownership and that there are no undisclosed claims against the property.

- Closing Statement: Also known as a HUD-1, this document summarizes all financial transactions involved in the sale, including fees, taxes, and the final purchase price.

- Marriage License Application: Couples intending to marry in Florida must complete this application as a preliminary step to obtain their marriage license. For further details and forms, visit Florida Forms.

- Power of Attorney: If the seller cannot be present at the closing, this document allows another person to act on their behalf, facilitating the transfer process.

- Notice of Sale: This document serves as formal notification to interested parties about the sale of the property, ensuring transparency in the transaction.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and any fees associated with the community.

- Deed of Trust: In some cases, this document may be used to secure a loan on the property, outlining the lender's rights in case of default.

Understanding these additional documents can help streamline the property transfer process. Each plays a vital role in ensuring that the transaction is clear, fair, and legally binding. Being well-informed can lead to a smoother experience for everyone involved.