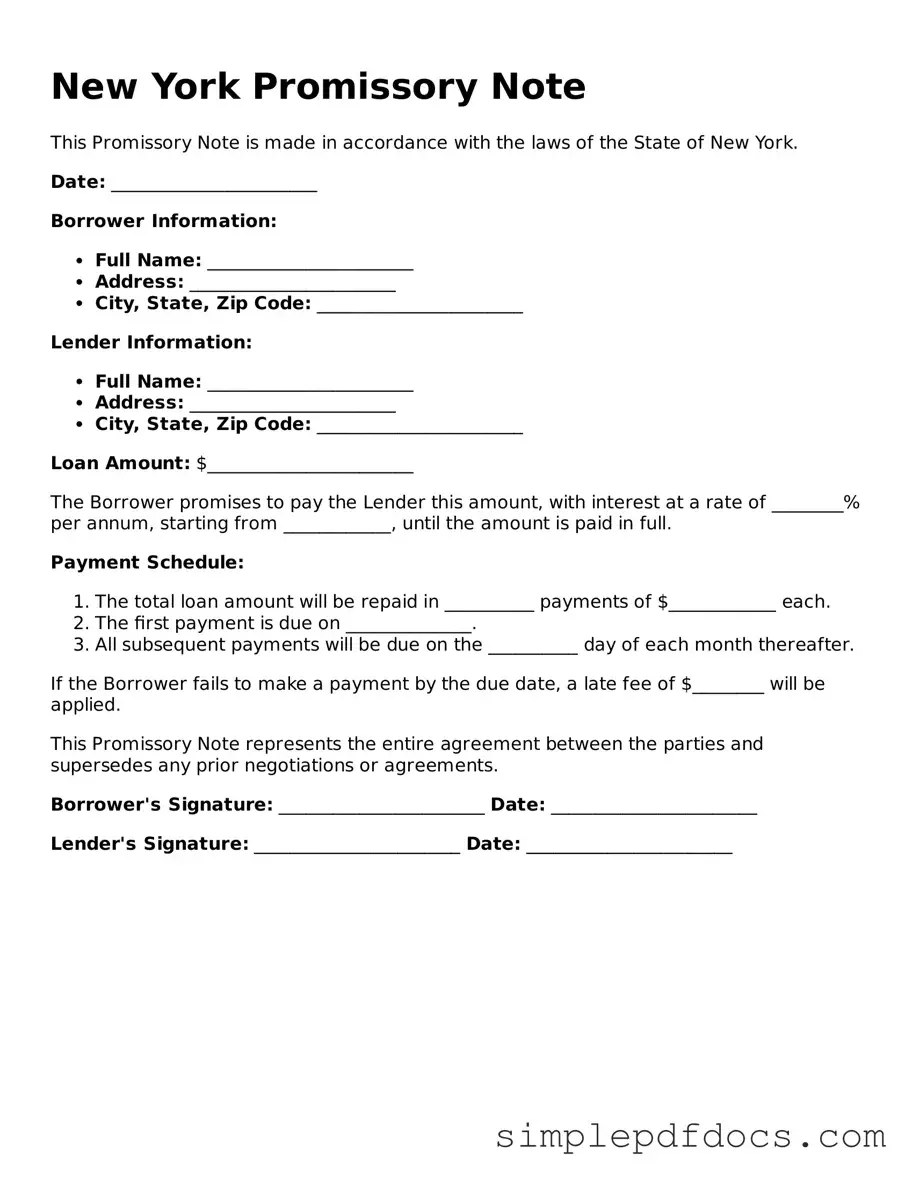

Legal Promissory Note Document for the State of New York

When navigating the world of personal and business finance, understanding the New York Promissory Note form is essential for anyone involved in lending or borrowing money. This document serves as a written promise from the borrower to repay a specific amount of money to the lender, detailing the terms of the loan, including the interest rate, repayment schedule, and any applicable fees. It is crucial to note that a promissory note can be either secured or unsecured, which affects the level of risk for the lender. Additionally, the form must include important information such as the names and addresses of both parties, the date of the agreement, and the signature of the borrower, which validates the commitment to repay the loan. By providing clarity and structure, the New York Promissory Note form helps to protect both parties involved in the transaction, ensuring that expectations are clear and legally enforceable. Understanding its components can empower individuals and businesses to make informed financial decisions while minimizing potential disputes.

Consider Other Common Promissory Note Templates for Specific States

Texas Promissory Note Requirements - Promissory notes can be sold or transferred, allowing the lender to assign the debt to another party.

Free Promissory Note Template Ohio - A borrower may use a promissory note to establish a credit history with a lender.

For those navigating the intricacies of buying or selling a tractor in Georgia, our invaluable guide on the essential components of a Tractor Bill of Sale can provide the clarity you need. This document ensures that all pertinent details are recorded accurately, facilitating a seamless transfer of ownership. For more information, visit the guidelines for completing your Tractor Bill of Sale.

Create a Promissory Note - Can include a grace period before late fees apply.

Blank Promissory Note - It is beneficial to consult templates or examples of promissory notes for guidance in drafting one.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a certain time. |

| Governing Law | New York General Obligations Law governs promissory notes in New York. |

| Parties Involved | The note involves two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Interest Rates | Interest rates can be fixed or variable and should be clearly stated in the note. |

| Payment Terms | Payment terms, including due dates and methods of payment, must be explicitly outlined. |

| Signatures | The maker's signature is required for the note to be valid, and it may also require the payee's acknowledgment. |

| Enforceability | A properly executed promissory note is legally enforceable in a court of law. |

How to Write New York Promissory Note

Once you have the New York Promissory Note form in hand, it’s time to fill it out carefully. Make sure you have all the necessary information ready, such as the names of the parties involved, the loan amount, and any terms you want to specify. Follow these steps to complete the form accurately.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate what the document is.

- Identify the Parties: In the first section, list the names and addresses of the borrower and the lender. Ensure that the names are spelled correctly.

- State the Loan Amount: Write the exact amount of money being borrowed. This should be clear and in both numbers and words for accuracy.

- Specify the Interest Rate: If applicable, indicate the interest rate that will be charged on the loan. Make sure to clarify if it’s a fixed or variable rate.

- Outline Payment Terms: Detail how and when the borrower will repay the loan. Include the frequency of payments (monthly, quarterly, etc.) and the due date for the first payment.

- Include Late Fees: If there are penalties for late payments, specify the amount or percentage that will be charged.

- Signatures: Both the borrower and lender must sign the document. Include the date of signing next to each signature.

- Witness or Notary: Depending on your preference, you may want to have the document witnessed or notarized for additional legal standing.

After completing the form, review it carefully to ensure all information is accurate. Once finalized, both parties should keep a copy for their records. This helps to avoid any misunderstandings in the future.

Dos and Don'ts

When filling out the New York Promissory Note form, it's important to follow certain guidelines to ensure the document is valid and enforceable. Here are nine things to keep in mind:

- Do include the names and addresses of both the borrower and the lender.

- Do specify the amount of money being borrowed clearly.

- Do outline the interest rate, if applicable, and how it will be calculated.

- Do state the repayment terms, including the payment schedule and due dates.

- Do sign and date the note in the presence of a witness or notary, if required.

- Don't leave any sections blank; fill in all required information.

- Don't use vague language; be specific about all terms and conditions.

- Don't forget to keep a copy of the signed note for your records.

- Don't ignore state laws that may affect the note, such as maximum interest rates.

Documents used along the form

A New York Promissory Note is an important document that outlines the terms of a loan between a borrower and a lender. However, several other forms and documents often accompany it to ensure clarity and legal protection for both parties involved. Here’s a list of some common documents that may be used alongside a Promissory Note.

- Loan Agreement: This document details the terms and conditions of the loan, including interest rates, repayment schedules, and any collateral involved. It provides a comprehensive overview of the obligations of both the borrower and the lender.

- Florida Traffic Crash Report: This crucial document must be completed following a traffic incident that results in property damage, providing detailed information about the crash. For more information, visit Florida Forms.

- Security Agreement: If the loan is secured by collateral, this agreement outlines the specific assets pledged by the borrower. It explains the lender’s rights in case of default.

- Personal Guarantee: This document may be signed by a third party, often a business owner, who agrees to repay the loan if the primary borrower defaults. It adds an extra layer of security for the lender.

- Disclosure Statement: This form provides essential information about the loan, including the total cost, fees, and any potential penalties for late payments. It ensures transparency and helps borrowers understand their financial commitment.

- Amortization Schedule: This document breaks down each payment over the life of the loan, showing how much goes toward principal and interest. It helps borrowers plan their finances effectively.

- Default Notice: If the borrower fails to meet their obligations, this notice formally alerts them of the default. It often outlines the steps the lender may take to recover the owed amount.

- Release of Liability: Once the loan is paid off, this document confirms that the borrower has fulfilled their obligations. It releases them from any further liability related to the loan.

Having these documents in place can help protect both parties and clarify their responsibilities. It's always advisable to seek guidance from a legal professional when preparing or reviewing these forms to ensure they meet specific needs and comply with local laws.