Legal Prenuptial Agreement Document for the State of New York

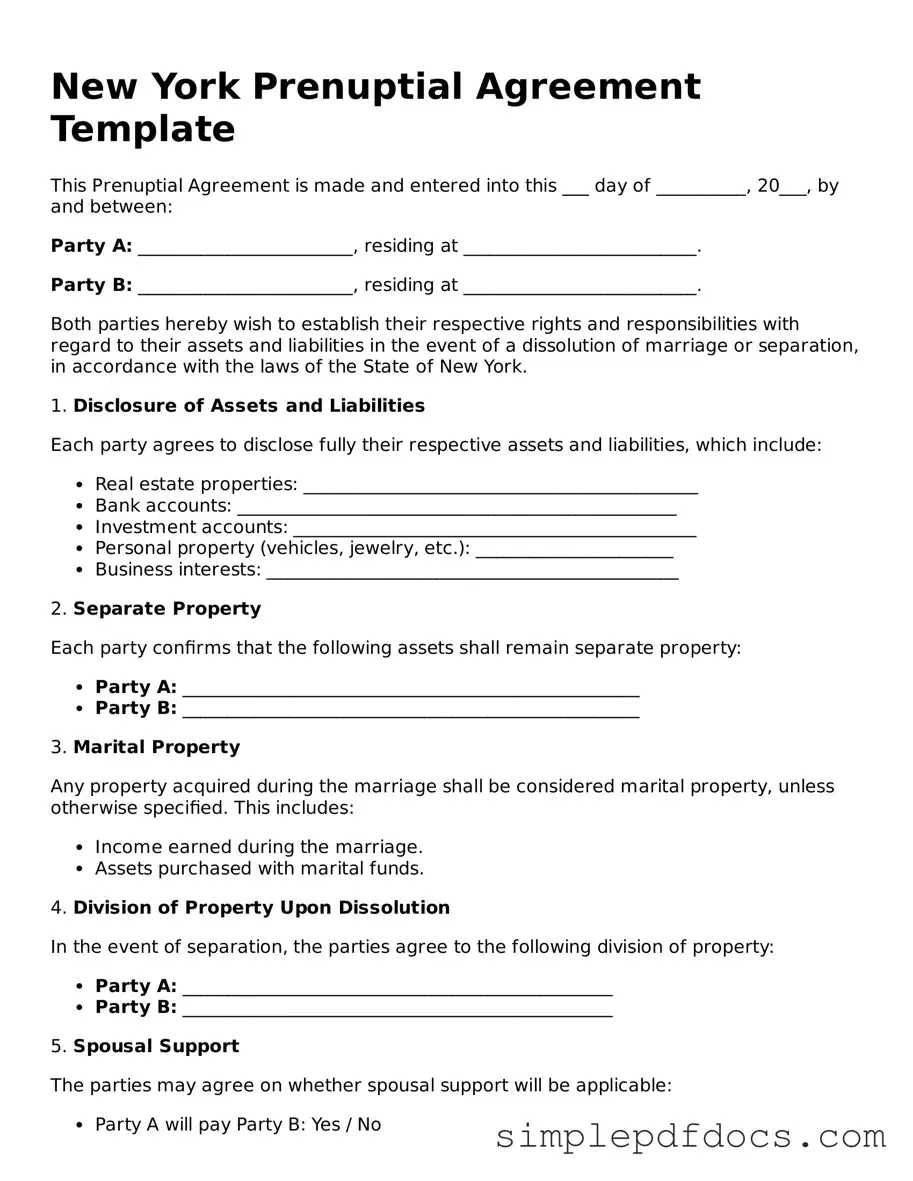

Entering into a marriage is a significant milestone, and many couples in New York are considering how to protect their individual assets and future interests through a prenuptial agreement. This legal document serves as a proactive measure to clarify financial rights and responsibilities before tying the knot. A New York Prenuptial Agreement typically outlines how property will be divided in the event of a divorce, addresses spousal support, and specifies the management of debts. Importantly, it can also include provisions for the distribution of assets acquired during the marriage. By clearly stating each party's expectations and intentions, this agreement can help prevent misunderstandings and conflicts down the road. Understanding the key components of the form, including the necessity for full disclosure of assets and the requirement for both parties to voluntarily agree to its terms, is essential for couples considering this route. Ultimately, a well-drafted prenuptial agreement can provide peace of mind and allow couples to focus on building their future together.

Consider Other Common Prenuptial Agreement Templates for Specific States

North Carolina Prenuptial Contract - This document can clarify the intentions for property acquired during marriage.

When considering the delegation of parental rights during times of absence, it is important to use the appropriate legal documentation, such as the Florida Power of Attorney for a Child form. This form allows parents to designate another adult to make crucial decisions for their child(ren), ensuring their needs are met. For more information on how to properly complete this document, parents can visit https://floridaforms.net/blank-power-of-attorney-for-a-child-form/, which provides guidance on the powers granted and the responsibilities assumed by the appointed guardian.

Pennsylvania Prenuptial Contract - A prenuptial agreement can be revisited and updated as circumstances change.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | A prenuptial agreement outlines the distribution of assets and responsibilities in the event of divorce or separation. |

| Governing Law | New York Domestic Relations Law governs prenuptial agreements in New York State. |

| Requirements | Both parties must voluntarily sign the agreement, and it must be in writing to be enforceable. |

| Disclosure | Full financial disclosure is required from both parties to ensure fairness and transparency. |

How to Write New York Prenuptial Agreement

Filling out a New York Prenuptial Agreement form is an important step for couples considering marriage. This form allows both parties to outline their financial rights and responsibilities in the event of a divorce or separation. To ensure everything is filled out correctly, follow these straightforward steps.

- Gather Personal Information: Collect full names, addresses, and dates of birth for both parties. This information is essential for the agreement.

- List Assets and Debts: Create a comprehensive list of all assets (property, savings, investments) and debts (loans, credit cards) for both individuals. Be as detailed as possible.

- Determine Ownership: Decide how you want to handle ownership of the assets and debts. Will they remain individual, or will they be shared? Clearly state this in the agreement.

- Include Provisions: Think about any specific provisions you want to include, such as spousal support or inheritance rights. Write these down clearly.

- Consult a Lawyer: While it’s not mandatory, it’s wise to consult with a lawyer to review your agreement. They can help ensure that everything is legally sound.

- Sign the Agreement: Once both parties are satisfied, sign the document in front of a notary public. This adds an extra layer of validity.

- Keep Copies: Make sure to keep copies of the signed agreement in a safe place. Both parties should have their own copies for future reference.

After completing these steps, you will have a properly filled-out Prenuptial Agreement. This document can provide peace of mind and clarity as you move forward with your marriage.

Dos and Don'ts

When filling out the New York Prenuptial Agreement form, it’s important to approach the task with care. Here’s a list of ten things to keep in mind, including both what to do and what to avoid.

- Do be open and honest about your financial situation. Transparency is key.

- Don't rush through the process. Take your time to ensure accuracy.

- Do consult with a qualified attorney. They can provide valuable guidance.

- Don't ignore state laws. Familiarize yourself with New York’s specific requirements.

- Do clearly outline your assets and debts. This helps prevent misunderstandings later.

- Don't use vague language. Be specific in your terms to avoid confusion.

- Do consider future changes. Address how you’ll handle potential shifts in circumstances.

- Don't forget to have both parties sign the agreement. This is essential for it to be valid.

- Do keep copies of the signed agreement. Store them in a safe place.

- Don't overlook the importance of reviewing the agreement regularly. Life changes, and so may your needs.

Documents used along the form

When preparing for marriage, many couples consider a prenuptial agreement to protect their individual assets and outline financial expectations. However, this document often works in conjunction with several other forms and documents. Understanding these can help ensure that both parties are fully informed and protected. Here’s a list of common documents used alongside a New York Prenuptial Agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage and can address the same issues, such as asset division and financial responsibilities.

- Financial Disclosure Statements: These statements require both parties to provide a complete picture of their assets, debts, and income, ensuring transparency and informed decision-making.

- Marriage License: This official document is required to legally marry in New York and must be obtained before the wedding ceremony.

- Florida Board Nursing Application: This form is essential for those seeking a nursing license in Florida, as it serves as the official request for licensure by examination, ensuring compliance with educational and professional standards. For more information, visit Florida Forms.

- Living Will: A living will outlines an individual's preferences regarding medical treatment and end-of-life decisions, which can be crucial for couples to discuss.

- Durable Power of Attorney: This document allows one partner to make financial decisions on behalf of the other if they become incapacitated, ensuring that their wishes are respected.

- Health Care Proxy: A health care proxy designates someone to make medical decisions for an individual if they are unable to do so themselves, which can be vital in emergencies.

- Estate Planning Documents: Wills and trusts are essential for outlining how assets will be distributed upon death, and they work hand-in-hand with prenuptial agreements.

- Debt Agreements: If either party has significant debts, a separate agreement may be necessary to clarify responsibility for those debts during and after the marriage.

- Separation Agreement: In the event of a separation, this document outlines the terms of the separation, including asset division and child custody arrangements.

These documents can serve as important tools for couples entering marriage. They help clarify expectations, protect individual interests, and foster open communication. Taking the time to understand and prepare these forms can lead to a stronger, more transparent partnership.