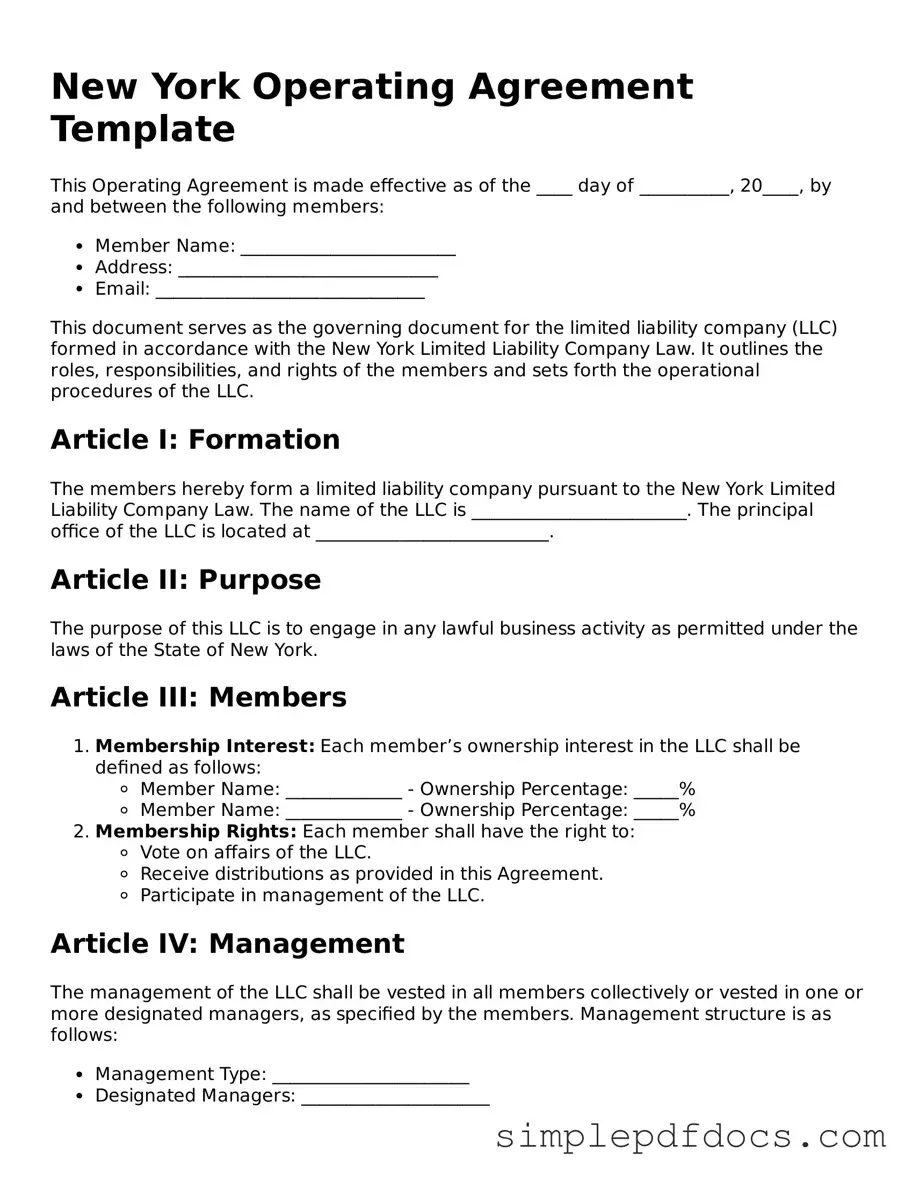

Legal Operating Agreement Document for the State of New York

The New York Operating Agreement form serves as a crucial document for Limited Liability Companies (LLCs) operating within the state. This form outlines the internal structure and operational guidelines of the LLC, ensuring that all members are aligned on key aspects of the business. It typically includes provisions regarding management responsibilities, voting rights, profit distribution, and procedures for adding or removing members. By establishing clear rules, the Operating Agreement helps prevent disputes among members and provides a framework for decision-making. Additionally, it addresses the dissolution process, should the need arise, ensuring that all parties understand their rights and obligations. This document not only enhances the credibility of the LLC but also serves to protect its members by delineating expectations and responsibilities. Understanding the importance of this form is essential for any LLC looking to operate smoothly and effectively in New York.

Consider Other Common Operating Agreement Templates for Specific States

Creating an Operating Agreement - An Operating Agreement provides a written framework for member interactions.

How to Write an Operating Agreement - This form may also address confidentiality of business operations.

In addition to understanding the details of the ADP Pay Stub form, employees may find it useful to access various resources that can simplify financial management, such as Free Business Forms which offer templates and tools to assist with payroll documentation and other business needs.

Llc Template - This document can define the roles and responsibilities of each member explicitly.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | The New York Operating Agreement outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Governing Law | The agreement is governed by the New York Limited Liability Company Law. |

| Members | All members of the LLC should be included in the agreement to clarify their rights and responsibilities. |

| Flexibility | The Operating Agreement allows for flexibility in management, allowing members to choose between member-managed or manager-managed structures. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help prevent costly litigation. |

| Amendments | Members can amend the Operating Agreement as needed, provided that the process for amendments is clearly outlined in the document. |

| Not Mandatory | While not required by law, having an Operating Agreement is highly recommended to protect members' interests. |

| Tax Treatment | The Operating Agreement can specify how profits and losses are allocated among members for tax purposes. |

How to Write New York Operating Agreement

After gathering the necessary information, you are ready to fill out the New York Operating Agreement form. This document outlines the management structure and operating procedures of your limited liability company (LLC). Follow these steps carefully to ensure accurate completion.

- Begin by entering the name of your LLC at the top of the form. Ensure that the name matches the one registered with the state.

- Next, provide the principal office address. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members of the LLC. Each member's full name and residential address are required.

- Specify the percentage of ownership for each member. This indicates how profits and losses will be distributed.

- Detail the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Include provisions regarding meetings. State how often meetings will be held and how members will be notified.

- Outline the voting rights of members. Specify how decisions will be made and the voting process.

- Address the process for adding new members. Include any conditions or requirements for membership changes.

- Define how profits and losses will be allocated among members. This should align with the ownership percentages.

- Finally, have all members sign and date the agreement. Ensure that each signature is dated correctly.

Dos and Don'ts

When filling out the New York Operating Agreement form, it's essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do ensure all member names and addresses are accurate.

- Do specify the management structure clearly.

- Do outline the distribution of profits and losses.

- Don't leave any required fields blank.

- Don't use vague language that may lead to misunderstandings.

Documents used along the form

When forming a Limited Liability Company (LLC) in New York, several key documents accompany the Operating Agreement. Each of these forms plays a crucial role in establishing the legal framework and operational guidelines for the business. Here’s a list of commonly used documents that you should consider alongside the Operating Agreement:

- Articles of Organization: This is the official document filed with the state to create your LLC. It includes basic information such as the company name, address, and registered agent.

- Last Will and Testament Form: To ensure your final wishes are honored, utilize the complete Last Will and Testament instructions to guide you through the process of asset distribution and care for dependents.

- Member Agreement: This document outlines the rights and responsibilities of each member within the LLC. It can be a standalone document or incorporated into the Operating Agreement.

- Bylaws: While not required for LLCs, bylaws can help establish internal rules and procedures for the organization. They cover topics like meetings, voting rights, and decision-making processes.

- Initial Resolution: This document records the initial decisions made by the members of the LLC, such as appointing officers or approving the Operating Agreement.

- Employer Identification Number (EIN) Application: This form is necessary for tax purposes. An EIN is required to open a business bank account and hire employees.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can include information about management structure, financial procedures, and member roles.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can help clarify each member's stake in the business.

- State Compliance Documents: Depending on your industry, you may need additional permits or licenses to operate legally. These documents ensure compliance with local, state, and federal regulations.

Understanding these forms and documents is essential for the successful formation and operation of your LLC in New York. Each plays a specific role in ensuring that your business runs smoothly and remains compliant with state laws. Take the time to prepare these documents carefully to protect your interests and facilitate effective management.