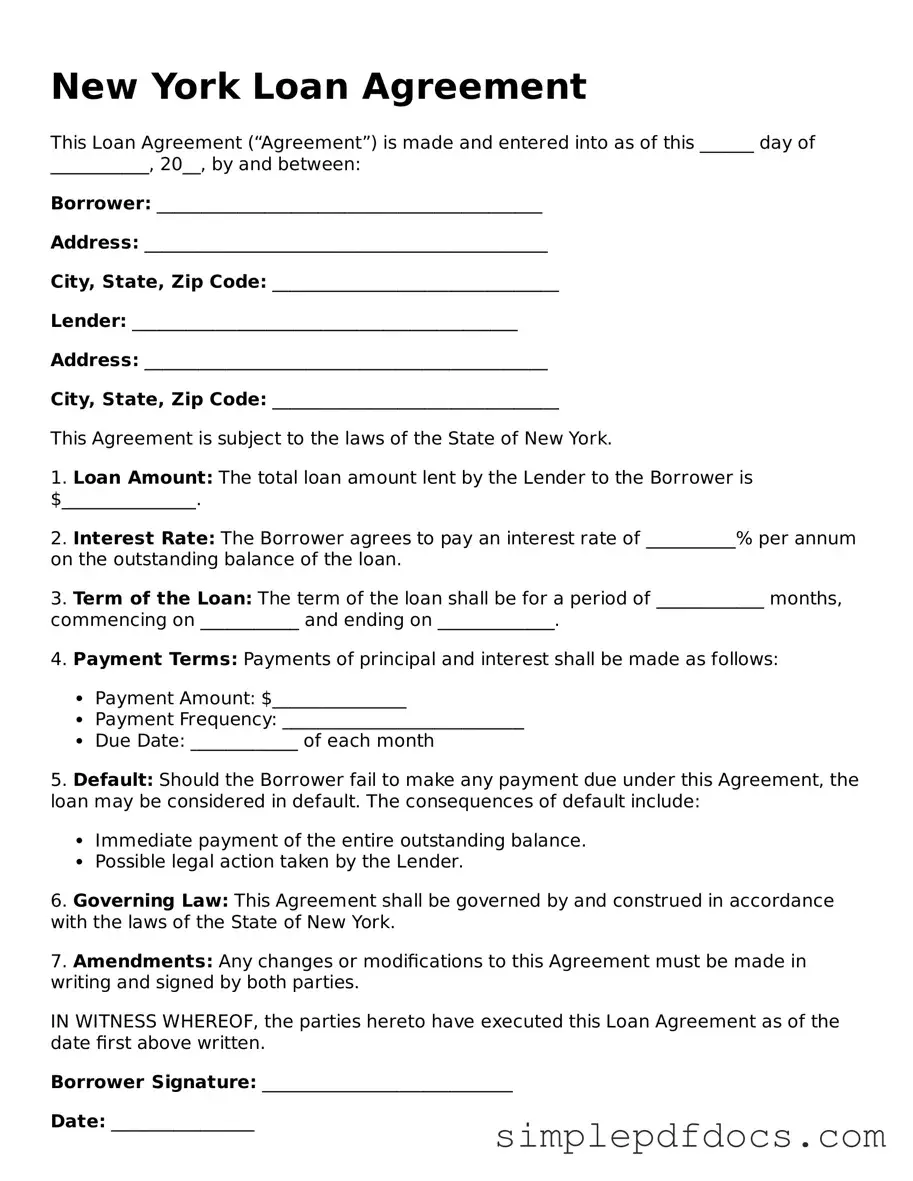

Legal Loan Agreement Document for the State of New York

When it comes to borrowing or lending money in New York, a well-structured Loan Agreement form is an essential tool that protects both parties involved. This document outlines the terms of the loan, ensuring clarity and mutual understanding. Key elements typically included in the form are the principal amount being borrowed, the interest rate, and the repayment schedule. Additionally, the agreement may specify the consequences of default, providing a safety net for the lender. Notably, the form should also include details about any collateral involved, which can provide additional security for the lender. By clearly defining the roles and responsibilities of both the borrower and the lender, the Loan Agreement helps to prevent misunderstandings and disputes down the line. Understanding these components is crucial for anyone looking to navigate the financial landscape in New York, whether they are securing a personal loan or facilitating a business transaction.

Consider Other Common Loan Agreement Templates for Specific States

Promissory Note Texas - A well-structured Loan Agreement helps prevent misunderstandings between parties.

When entering into a lease arrangement, it's crucial to utilize a comprehensive Florida Commercial Lease Agreement to avoid misunderstandings between parties. This contract defines the rental amount, lease duration, and responsibilities of landlords and tenants, which is vital for fostering a transparent relationship. For more information on this important document, you can refer to Florida Forms.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York, specifically under New York General Obligations Law. |

| Key Components | The form typically includes details such as loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures Required | Both parties must sign the agreement to indicate their acceptance of the terms, making it a legally binding document. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to remain enforceable. |

How to Write New York Loan Agreement

After gathering all necessary information, you are ready to fill out the New York Loan Agreement form. This document requires specific details about the loan, the parties involved, and the terms of repayment. Follow these steps to ensure you complete the form accurately.

- Start with the date at the top of the form. Write the date when you are completing the agreement.

- Identify the lender. Enter the full name and address of the lender in the designated section.

- Next, provide the borrower's information. Include the full name and address of the borrower.

- Specify the loan amount. Clearly write the total amount being loaned.

- Outline the interest rate. Indicate the interest rate applicable to the loan.

- Detail the repayment terms. Describe how and when the borrower will repay the loan.

- Include any fees or additional charges. List any fees associated with the loan that the borrower should be aware of.

- Sign and date the agreement. Both the lender and borrower must sign and date the form to make it legally binding.

Once you have completed the form, review it for accuracy. Ensure all information is correct before both parties sign. This step is crucial for avoiding any misunderstandings in the future.

Dos and Don'ts

When filling out the New York Loan Agreement form, it’s crucial to follow specific guidelines to ensure accuracy and compliance. Here’s what you should and shouldn’t do:

- Do: Read the entire form carefully before starting. Understanding each section will help you provide the correct information.

- Do: Use clear and legible handwriting or type your responses. This prevents misunderstandings and errors.

- Do: Double-check all figures and calculations. Ensure that the numbers match in all relevant sections.

- Do: Sign and date the form where required. An unsigned form may delay the process.

- Don't: Leave any required fields blank. Incomplete forms can lead to rejection or delays.

- Don't: Use abbreviations or shorthand. Clarity is essential for legal documents.

- Don't: Alter the form in any way. Making changes can invalidate the agreement.

- Don't: Rush through the process. Take your time to ensure accuracy and completeness.

Documents used along the form

When entering into a loan agreement in New York, several other documents may accompany the primary agreement to ensure clarity, compliance, and protection for all parties involved. Each of these documents serves a specific purpose in the loan process, making it essential to understand their roles.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It details the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Non-disclosure Agreement: To safeguard sensitive information during the loan process, a legally binding https://floridaforms.net/blank-non-disclosure-agreement-form may be utilized, ensuring confidentiality between parties involved in negotiations and arrangements.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security. It provides the lender with rights to the collateral if the borrower defaults.

- Loan Application: This form collects essential information about the borrower, including personal details, financial history, and the purpose of the loan. It helps lenders assess the borrower's creditworthiness.

- Credit Report Authorization: Borrowers often need to authorize lenders to obtain their credit reports. This document allows lenders to evaluate the borrower's financial background and credit history.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and other costs. It ensures that borrowers understand the financial implications of the loan.

- Closing Statement: At the loan closing, this statement summarizes the final terms of the loan, including any fees paid at closing. It provides a clear picture of the financial transaction.

- Personal Guarantee: In some cases, a personal guarantee may be required, especially for business loans. This document holds an individual personally responsible for the loan if the borrowing entity defaults.

Understanding these accompanying documents is crucial for both borrowers and lenders. Each plays a vital role in the loan process, helping to establish clear terms and protect the interests of all parties involved.