Legal Durable Power of Attorney Document for the State of New York

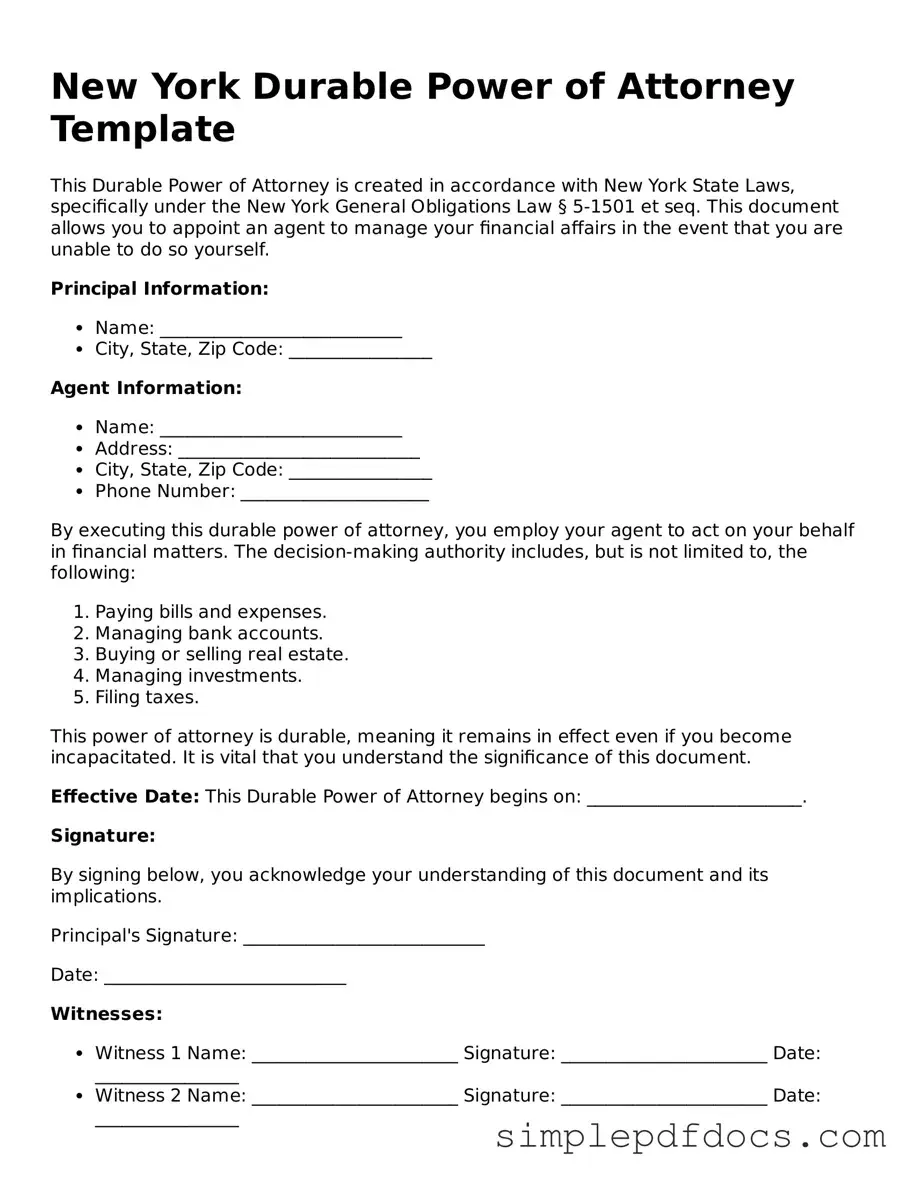

The New York Durable Power of Attorney form is an essential legal document that empowers an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs can continue to be managed seamlessly. Key aspects of the form include the specific powers granted to the agent, which can range from managing bank accounts to handling real estate transactions. Additionally, the principal has the option to include limitations or conditions on the agent's authority, providing a level of control over how their affairs are conducted. Importantly, the form must be signed in the presence of a notary public and, in some cases, witnesses to be legally binding. Understanding the nuances of this document is crucial for anyone looking to safeguard their interests and ensure their wishes are honored, especially during times of incapacity.

Consider Other Common Durable Power of Attorney Templates for Specific States

Ohio Power of Attorney Requirements - The Durable Power of Attorney can cover decisions about real estate transactions.

Durable Power of Attorney Form Pa - You don’t have to be wealthy to benefit from this important legal document.

How to Get Power of Attorney in Nc - The Durable Power of Attorney can save time and reduce stress during unexpected medical emergencies.

In the process of estate planning, it is crucial to create a Florida Last Will and Testament, which serves as a comprehensive legal document defining how an individual's assets will be distributed posthumously. To ensure clarity and prevent misunderstandings, utilizing resources like Florida Forms can greatly assist individuals in drafting this important document according to their specific wishes.

Power of Attorney Form Texas Pdf - With a Durable Power of Attorney, you choose who manages your affairs during a tough time.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A New York Durable Power of Attorney is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make financial decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The New York Durable Power of Attorney is governed by the New York General Obligations Law, specifically Article 5, Title 15. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally incapacitated, distinguishing it from a regular power of attorney that may become void under such circumstances. |

| Agent's Authority | The agent can be granted broad or limited powers, including managing bank accounts, paying bills, and making investment decisions, depending on the principal's preferences. |

| Execution Requirements | To be valid, the document must be signed by the principal in the presence of a notary public and, in some cases, witnesses may also be required. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. This revocation must be done in writing. |

How to Write New York Durable Power of Attorney

Filling out the New York Durable Power of Attorney form is an important step in ensuring that your financial matters can be managed by someone you trust in the event that you become unable to do so. After completing the form, it will need to be signed, witnessed, and possibly notarized to be legally effective.

- Obtain the New York Durable Power of Attorney form. You can find it online or at legal supply stores.

- Begin by filling in your name and address in the designated sections at the top of the form.

- Next, identify the person you are appointing as your agent. Provide their full name and address.

- Specify any limitations on the powers you are granting to your agent, if applicable. If you want to give full authority, you can skip this step.

- Indicate whether the powers granted will become effective immediately or only if you become incapacitated.

- Review the list of powers you are granting. You may check or uncheck boxes to customize what your agent can do on your behalf.

- Sign and date the form in the presence of a witness. In New York, you need at least one witness who is not your agent.

- Consider having the form notarized for additional validity, although it is not required in New York.

- Provide copies of the completed form to your agent and any relevant financial institutions or entities.

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, it is essential to follow certain guidelines to ensure that the document is valid and effective. Here are seven things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do ensure that you are of sound mind and acting voluntarily.

- Do choose a trustworthy agent who will act in your best interest.

- Do specify the powers you wish to grant clearly.

- Don't leave any sections blank; fill in all required information.

- Don't use the form if you are under duress or undue influence.

- Don't forget to sign the document in the presence of a notary public.

Documents used along the form

When creating a New York Durable Power of Attorney, it’s essential to consider other documents that can complement this powerful legal tool. Each of these forms plays a unique role in ensuring that your financial and healthcare wishes are honored. Below is a list of commonly used forms that often accompany a Durable Power of Attorney.

- Health Care Proxy: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. It ensures that your healthcare preferences are respected.

- Bill of Sale Form: For those needing to document ownership transfers, our informative Bill of Sale form guidelines ensure all transactions are legally validated.

- Living Will: A Living Will outlines your wishes regarding medical treatment and end-of-life care. This document can guide your healthcare proxy and medical providers in critical situations.

- Last Will and Testament: This legal document specifies how you want your assets distributed after your death. It can provide peace of mind by clearly stating your wishes.

- Revocable Trust: A revocable trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It can help avoid probate and maintain privacy.

- Advance Directive: Similar to a Living Will, an Advance Directive includes instructions for your medical care in case you are unable to communicate your wishes. It often combines both healthcare and end-of-life decisions.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. This ensures that these assets pass outside of probate according to your wishes.

- Financial Power of Attorney: While a Durable Power of Attorney covers a broad range of financial matters, a Financial Power of Attorney can specify particular financial transactions or responsibilities, providing clarity and focus.

- Guardianship Designation: This document allows you to designate a guardian for your minor children in the event of your passing. It ensures that your children are cared for by someone you trust.

By considering these additional forms, you can create a comprehensive plan that protects your interests and ensures your wishes are honored. Each document serves a specific purpose, and together they can provide a robust framework for your legal and financial affairs.