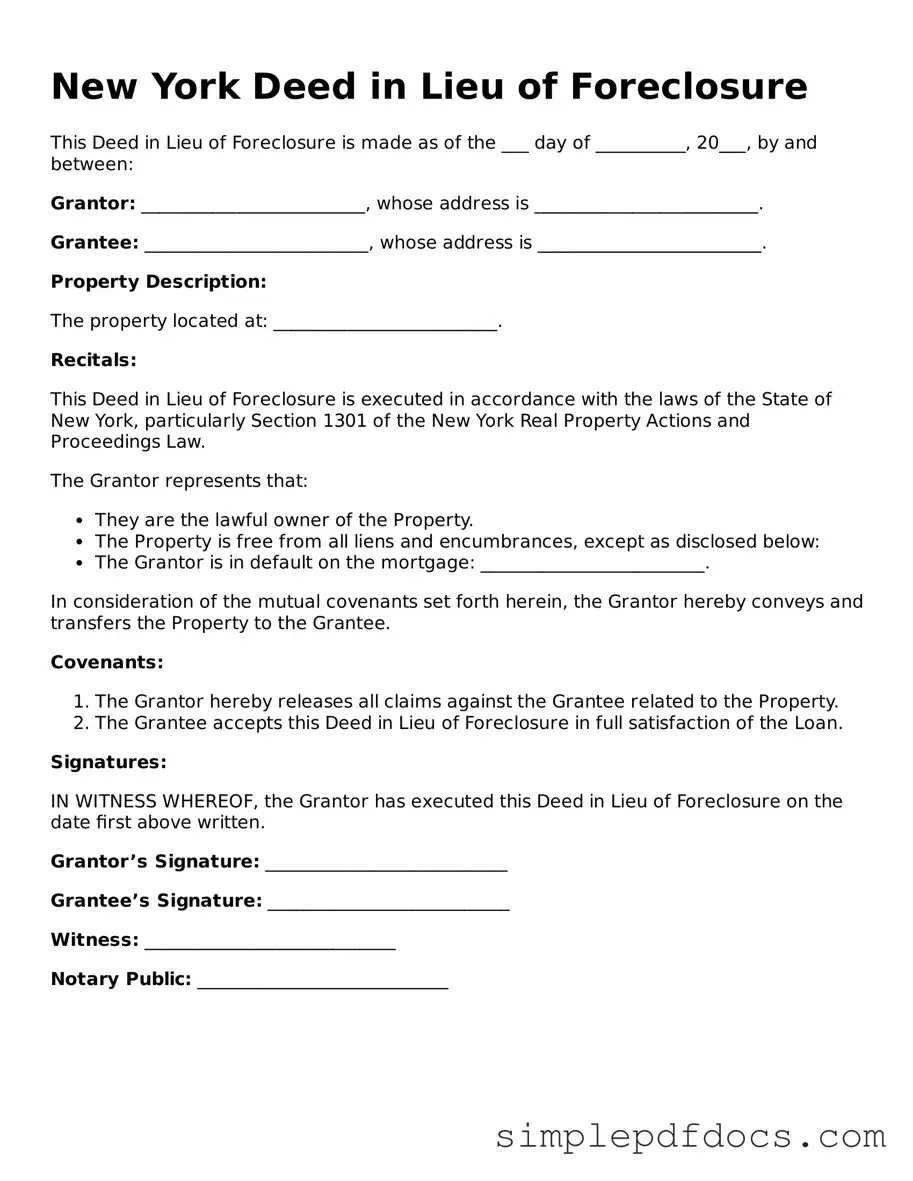

Legal Deed in Lieu of Foreclosure Document for the State of New York

In the bustling landscape of real estate and homeownership, the Deed in Lieu of Foreclosure offers a unique alternative for homeowners facing financial difficulties. This legal tool allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively sidestepping the lengthy and often stressful foreclosure process. By choosing this route, individuals can mitigate the negative impacts on their credit score and regain some control over their financial situation. The Deed in Lieu of Foreclosure form captures essential details, including the property description, the parties involved, and any relevant encumbrances. It’s crucial for homeowners to understand the implications of this decision, as it not only affects their current housing situation but also their future ability to secure financing. This process can be beneficial for both the homeowner and the lender, as it can lead to a quicker resolution and potentially lower costs associated with foreclosure. As you navigate this option, it’s important to consider the specific requirements and potential consequences outlined in the form, ensuring that you make an informed choice that aligns with your financial goals.

Consider Other Common Deed in Lieu of Foreclosure Templates for Specific States

Sale in Lieu of Foreclosure - Documentation should outline the property's condition and any existing liens.

Understanding the importance of the Florida Notice to Quit form is vital for both landlords and tenants, as it acts as a formal warning of lease violations. For detailed guidance on utilizing this legal document, landlords can refer to resources available at floridaforms.net/blank-notice-to-quit-form/, ensuring they follow the appropriate procedures and timelines in the eviction process.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Using this deed means the borrower will not have to go through the foreclosures' public auction process.

Pennsylvania Deed in Lieu of Foreclosure - This process can allow homeowners to move forward with their lives without the burden of foreclosure hanging over their heads.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | This process is governed by New York State Real Property Actions and Proceedings Law (RPAPL). |

| Advantages | Homeowners may avoid the lengthy foreclosure process and can potentially limit their financial liability. |

| Requirements | Typically, the homeowner must be in default on their mortgage and must negotiate the deed with the lender. |

How to Write New York Deed in Lieu of Foreclosure

Once you have the New York Deed in Lieu of Foreclosure form ready, you’ll need to carefully fill it out to ensure all required information is accurately provided. After completing the form, it will be necessary to have it signed and notarized before submitting it to the appropriate parties.

- Begin by entering the date at the top of the form. This is the date when the deed is being executed.

- Provide the full name of the borrower(s) in the designated section. Ensure that the names match those on the mortgage documents.

- Next, enter the address of the property being transferred. This should include the street number, street name, city, state, and zip code.

- In the section for the lender's information, write the full name of the lender or financial institution receiving the deed.

- Include the legal description of the property. This may be found in the original mortgage documents or property deed. It is important to be precise in this section.

- Indicate the reason for the deed in lieu of foreclosure in the appropriate area. This typically involves a brief explanation of the circumstances leading to this decision.

- Sign the form where indicated. If there are multiple borrowers, each person must sign the document.

- Have the signatures notarized. This step is crucial, as the notarization validates the authenticity of the signatures.

- Make copies of the completed and notarized form for your records.

- Submit the original deed to the lender or the designated party as instructed.

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it’s essential to approach the process with care. Here are some key do's and don'ts to keep in mind:

- Do ensure that all information is accurate and complete.

- Do consult with a legal professional if you have any questions.

- Do provide a clear description of the property being conveyed.

- Do sign the document in the presence of a notary public.

- Don't rush through the form; take your time to review each section.

- Don't leave any blank spaces; fill in all required fields.

- Don't forget to include any necessary supporting documents.

- Don't overlook the importance of understanding the implications of the deed.

By following these guidelines, you can help ensure a smoother process when completing the Deed in Lieu of Foreclosure form.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender in order to avoid foreclosure. In addition to this form, several other documents are often used in conjunction with the Deed in Lieu of Foreclosure. Below is a list of these documents, along with brief descriptions of each.

- Loan Modification Agreement: This document outlines the terms of a change to the original loan, which may include adjustments to the interest rate, repayment period, or principal amount to make payments more manageable for the borrower.

- Notice of Default: This is a formal notification from the lender to the borrower indicating that they have defaulted on their mortgage payments and that foreclosure proceedings may begin if the situation is not rectified.

- Release of Liability: This document releases the borrower from any further obligations related to the loan after the property has been transferred to the lender, ensuring they are not held responsible for any remaining debt.

- Divorce Settlement Agreement: This form is crucial in divorce proceedings, as it defines the terms between the parties involved, covering important matters such as asset distribution and support obligations. For more information, visit Florida Forms.

- Property Inspection Report: A report detailing the condition of the property, often required by the lender to assess its value and any necessary repairs before accepting the Deed in Lieu of Foreclosure.

- Title Search Report: This report confirms the ownership of the property and checks for any liens or claims against it, ensuring the lender receives clear title upon transfer.

- Closing Statement: A summary of the financial details of the transaction, including any costs associated with the Deed in Lieu of Foreclosure process, which is provided at the closing of the transaction.

- Affidavit of Title: A sworn statement by the borrower affirming that they hold clear title to the property and disclosing any known issues that could affect the property’s ownership.

- Settlement Agreement: This document outlines the terms agreed upon between the borrower and lender regarding the transfer of the property, including any concessions or agreements made during negotiations.

Each of these documents plays a crucial role in the process surrounding a Deed in Lieu of Foreclosure. They help ensure that both the lender and borrower understand their rights and obligations, and they facilitate a smoother transition of property ownership.