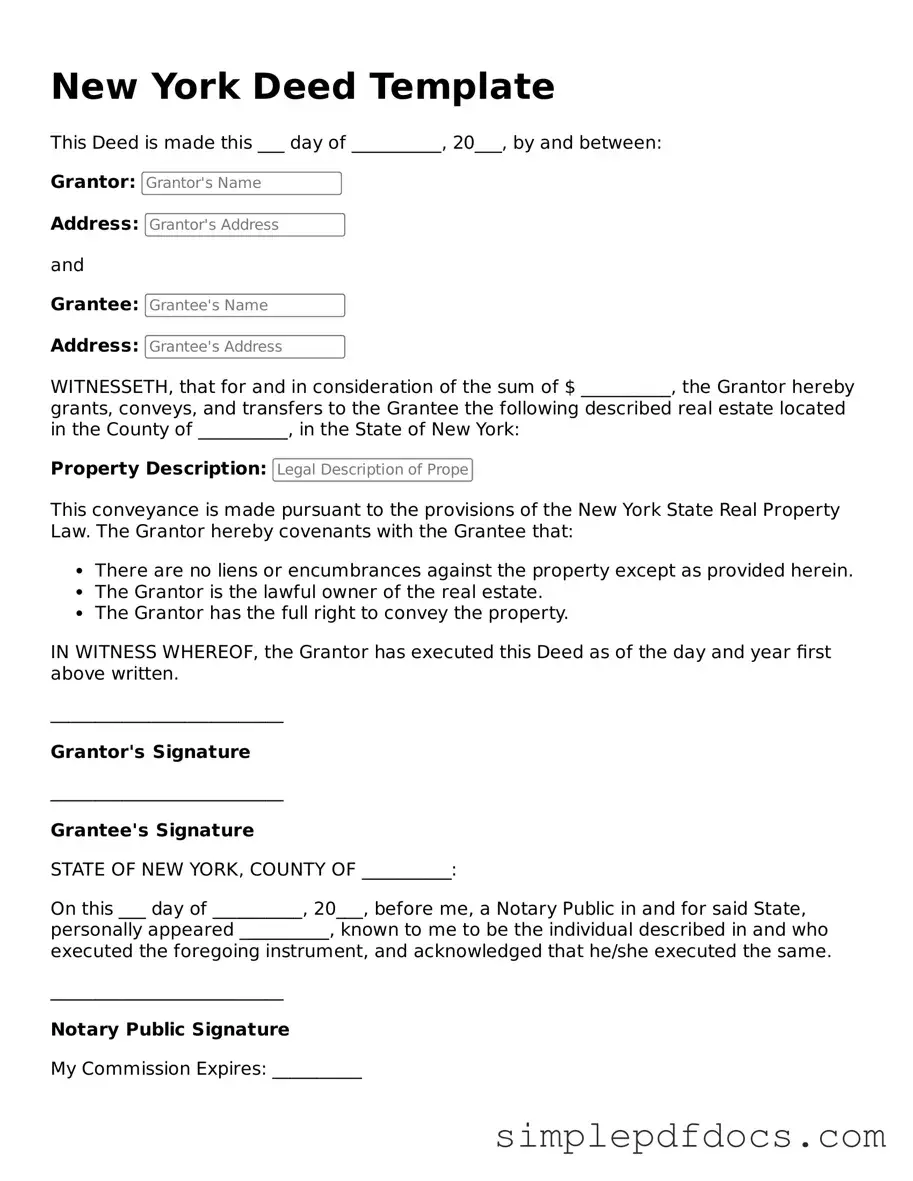

Legal Deed Document for the State of New York

The New York Deed form plays a crucial role in the transfer of real estate ownership, serving as a legal document that solidifies the transaction between the seller and the buyer. This form captures essential information, including the names of the parties involved, the property’s legal description, and the terms of the sale. It is vital to ensure that the deed is properly executed and notarized to prevent any future disputes or claims. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each offering varying levels of protection to the buyer. Understanding the nuances of these forms is essential for anyone looking to navigate the complexities of real estate transactions in New York. Furthermore, the deed must be filed with the county clerk’s office to make the transfer public, which is a critical step in establishing clear title to the property. Without a properly executed deed, the rights to the property can become murky, leading to potential legal challenges down the line. Thus, familiarity with the New York Deed form is not just beneficial; it is imperative for anyone involved in real estate dealings in the state.

Consider Other Common Deed Templates for Specific States

Sample Deed for House - The language in the Deed should be clear and unambiguous.

Texas Deed Forms - Properly executed deeds help protect your property rights.

The process of applying for the program can be streamlined by utilizing resources like the NY Templates, which offer guidance in completing the Access-A-Ride NYC Application form and ensuring all necessary documentation is in order for submission to the Transit Benefit Coordinator.

Ohio Warranty Deed - Always check for any attached documents that need to accompany a deed submission.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The New York Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | In New York, common types of deeds include warranty deeds, quitclaim deeds, and bargain and sale deeds. |

| Governing Law | The New York Real Property Law governs the use and requirements of deed forms in the state. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public for it to be valid. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county clerk's office. |

| Consideration | The deed must state the consideration, or payment, made for the transfer of property, even if it is a nominal amount. |

| Legal Description | A precise legal description of the property being transferred must be included in the deed. |

| Tax Implications | Transferring property may have tax implications, such as transfer taxes, which should be considered before executing the deed. |

How to Write New York Deed

Once you have your New York Deed form in hand, it’s time to fill it out accurately to ensure a smooth transfer of property ownership. Follow these steps carefully to complete the form correctly.

- Identify the Grantor: Write the full name and address of the person or entity transferring the property. This is the current owner.

- Identify the Grantee: Fill in the full name and address of the person or entity receiving the property. Make sure this information is accurate.

- Property Description: Provide a detailed description of the property being transferred. This should include the property address and any legal descriptions necessary.

- Consideration Amount: Enter the amount of money or value exchanged for the property. This is important for tax purposes.

- Signatures: The grantor must sign the form. If there are multiple grantors, each must sign.

- Notarization: Have the deed notarized. This step is crucial to validate the document legally.

- Filing: Submit the completed deed to the appropriate county clerk's office for recording. Check if there are any specific filing fees.

After filling out the form, ensure that all information is accurate and complete. This will help avoid any delays or issues during the property transfer process.

Dos and Don'ts

When filling out the New York Deed form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here are some things you should and shouldn’t do:

- Do: Double-check all names and addresses for accuracy.

- Do: Use clear and legible handwriting or type the information.

- Do: Include the correct legal description of the property.

- Do: Sign the form in the presence of a notary public.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Use correction fluid or tape on the form.

Following these guidelines can help avoid delays and ensure that your deed is processed smoothly. Take your time and review your work carefully.

Documents used along the form

When dealing with property transactions in New York, several forms and documents accompany the New York Deed form. Each of these documents plays a crucial role in ensuring that the transaction is complete and legally binding. Below is a list of commonly used forms that you may encounter.

- Title Search Report: This document provides a detailed history of the property's ownership. It helps identify any liens, encumbrances, or claims against the property, ensuring that the buyer is aware of any potential issues before the transaction is finalized.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and asserts that there are no undisclosed claims or issues. It serves to protect the buyer by providing assurance regarding the seller's legal right to sell the property.

- Dissolution Agreement: A dissolution agreement lays out the mutual terms both parties have accepted for their divorce, covering key issues like asset division and custody arrangements. For more information, you can refer to the Florida Forms for guidance on creating such an agreement.

- Property Transfer Tax Form: This form is required by the state to report the transfer of property and calculate any applicable taxes. It must be filed with the county clerk's office at the time of the transaction.

- Closing Statement: Also known as a HUD-1 statement, this document outlines all the costs and fees associated with the property transaction. It provides a detailed breakdown of what the buyer and seller will pay at closing.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be needed. These include the mortgage agreement and promissory note, which outline the terms of the loan and the buyer's repayment obligations.

Understanding these documents can simplify the property transaction process. Being informed helps ensure that all necessary paperwork is in order, reducing the likelihood of complications down the road.