Legal Articles of Incorporation Document for the State of New York

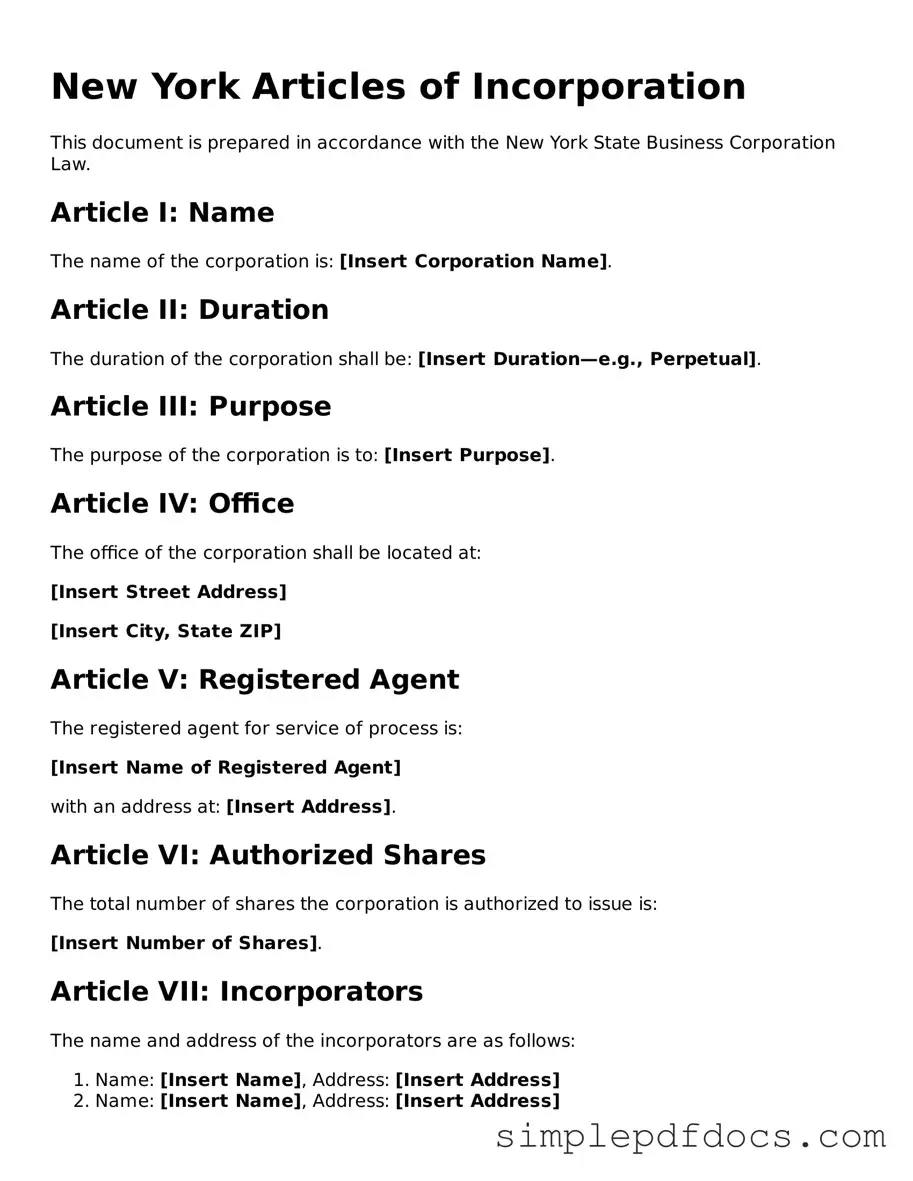

Incorporating a business in New York requires careful attention to the Articles of Incorporation, a crucial document that establishes a corporation's existence. This form outlines essential details such as the corporation's name, which must be unique and not misleading. It also specifies the purpose of the corporation, providing clarity on the business activities it intends to pursue. The form requires the identification of the corporation's registered agent, who will serve as the official point of contact for legal matters. Additionally, it includes information about the initial board of directors, including their names and addresses, ensuring transparency in governance. Finally, the Articles of Incorporation must be filed with the New York Department of State, and a filing fee is typically required. Understanding these components is vital for anyone looking to successfully navigate the incorporation process in New York.

Consider Other Common Articles of Incorporation Templates for Specific States

How to Incorporate in Nc - It serves as a public record of a corporation's existence and structure.

For individuals seeking to ensure their wishes are honored, a carefully drafted Last Will and Testament form can prove invaluable. This document facilitates the clear communication of asset distribution and caretaking arrangements after one's passing, making it a vital component of responsible estate planning.

Articles of Incorporation Ohio - Details the corporation's fiscal year.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The New York Articles of Incorporation form is used to officially create a corporation in New York State. |

| Governing Law | This form is governed by the New York Business Corporation Law. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Required Information | The form requires basic information, including the corporation's name, address, and purpose. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Approval Process | Once submitted, the New York Department of State reviews the application for compliance before approval. |

| Amendments | Changes to the corporation's structure or purpose require filing an amendment to the original Articles of Incorporation. |

How to Write New York Articles of Incorporation

Once you have your New York Articles of Incorporation form ready, it’s time to fill it out accurately. This form is essential for establishing your business as a legal entity in New York. Completing it correctly will help you avoid delays in the incorporation process.

- Begin by entering the name of your corporation. Ensure it complies with New York naming rules.

- Provide the purpose of your corporation. Be clear and concise about what your business will do.

- Fill in the county where your corporation will be located. This is important for jurisdictional purposes.

- List the address of your corporation's principal office. Include the street address, city, and ZIP code.

- Designate the initial registered agent. This is the person or entity responsible for receiving legal documents on behalf of the corporation.

- Include the registered agent's address. This must be a physical address in New York.

- State the number of shares your corporation is authorized to issue. Specify the classes of shares if applicable.

- Provide the names and addresses of the incorporators. These are the individuals who are forming the corporation.

- Sign and date the form. Make sure the signature is from one of the incorporators.

After completing the form, review it for accuracy and completeness. Then, you can submit it to the New York Department of State along with the required filing fee. Keep a copy for your records.

Dos and Don'ts

When filling out the New York Articles of Incorporation form, there are several important dos and don'ts to keep in mind. These guidelines can help ensure a smooth filing process and compliance with state requirements.

- Do provide accurate and complete information. Double-check all entries for errors.

- Do include the name of your corporation, ensuring it is unique and adheres to state naming rules.

- Do designate a registered agent who can receive legal documents on behalf of the corporation.

- Do specify the purpose of your corporation clearly. A vague purpose can lead to complications.

- Don't leave any sections blank. If a section does not apply, indicate that appropriately.

- Don't forget to sign and date the form. An unsigned form may be rejected.

- Don't use abbreviations or acronyms in the name of your corporation unless they are officially recognized.

Following these tips can help you navigate the incorporation process more effectively and avoid common pitfalls.

Documents used along the form

When forming a corporation in New York, the Articles of Incorporation is a crucial document. However, there are several other forms and documents that often accompany it to ensure compliance with state regulations and to facilitate smooth business operations. Here’s a brief overview of some of these important documents.

- Bylaws: This document outlines the internal rules and procedures for the corporation. Bylaws govern the management structure, including the roles of directors and officers, and set forth procedures for meetings and decision-making.

- Certificate of Incorporation: While this is essentially the same as the Articles of Incorporation, it may refer to specific details required by the state. It officially establishes the existence of the corporation.

- Initial Board of Directors Meeting Minutes: These minutes document the first meeting of the board of directors. They typically include the appointment of officers and the adoption of bylaws.

- Employer Identification Number (EIN) Application: This form, submitted to the IRS, is necessary for tax purposes. The EIN serves as a unique identifier for the corporation and is required for opening a bank account and hiring employees.

- New York State Department of Taxation and Finance Forms: Depending on the type of business, various tax forms may need to be filed to comply with state tax laws, including sales tax permits and franchise tax forms.

- Statement of Information: Some states require corporations to file a statement that provides updated information about the business, including its address and the names of its officers and directors.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders. It can include terms for buying and selling shares, as well as provisions for resolving disputes.

- Operating Agreement (for LLCs): If the corporation is structured as a limited liability company (LLC), this agreement details the management structure and operational guidelines of the business.

- ADP Pay Stub form: This crucial document outlines an employee's earnings and deductions, promoting transparency and understanding of one’s financial compensation. For further resources, consider Free Business Forms.

- Business Licenses and Permits: Depending on the industry and location, various licenses and permits may be required to legally operate the business. These can include local business licenses, health permits, and zoning permits.

- Annual Report: Corporations are often required to file annual reports with the state. This document provides updated information about the business and is essential for maintaining good standing.

Each of these documents plays a vital role in establishing and maintaining a corporation in New York. Ensuring that all necessary forms are completed and filed correctly can help avoid legal issues and promote a successful business operation.