Fill Your Netspend Dispute Form

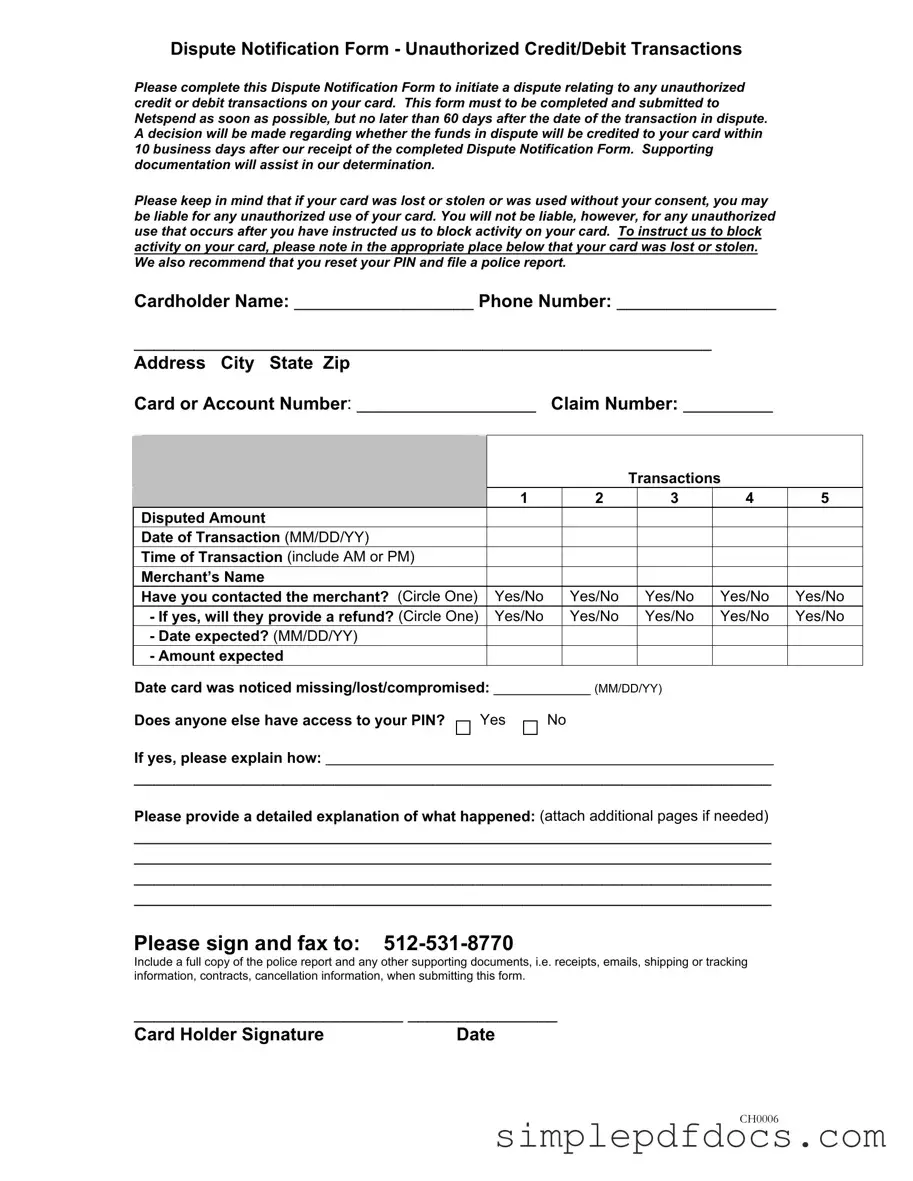

The Netspend Dispute Notification Form serves as a crucial tool for cardholders seeking to address unauthorized credit or debit transactions. This form must be completed and submitted to Netspend within 60 days of the disputed transaction to ensure timely resolution. Upon receipt of the completed form, Netspend commits to making a decision regarding the disputed funds within 10 business days. It is important to provide supporting documentation, such as receipts or emails, to strengthen your case. If a card has been lost or stolen, the cardholder must indicate this on the form, as it allows Netspend to block further unauthorized activity. While cardholders may be held liable for unauthorized transactions prior to reporting the loss, liability ceases once the card is reported compromised. The form requires essential details, including the cardholder's name, contact information, and specifics about each transaction being disputed. Additionally, it prompts users to indicate whether they have contacted the merchant involved and if a refund is expected. This comprehensive approach aims to streamline the dispute process and provide cardholders with the necessary support in resolving unauthorized transaction issues.

More PDF Templates

Donation Slips - Your donated goods help fund essential services for individuals in need.

A Florida Hold Harmless Agreement is a legal document designed to protect one party from liability for certain risks or damages that may arise during a specific activity or event. By signing this agreement, individuals acknowledge their understanding of the potential dangers involved and agree not to hold the other party responsible for any resulting injuries or losses. This form is commonly used in various situations, including recreational activities, property use, and events, ensuring that all parties are aware of their responsibilities and risks. For those interested in accessing or drafting such documents, they can visit Florida Forms for further assistance.

CBP Declaration Form 6059B - The form might be required for all types of travel, including leisure and business.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is designed to initiate a dispute for unauthorized credit or debit transactions on your Netspend card. |

| Submission Deadline | You must complete and submit the form within 60 days of the disputed transaction date. |

| Decision Timeline | Netspend will make a decision on your dispute within 10 business days after receiving your completed form. |

| Liability for Unauthorized Use | If your card is lost or stolen, you may be liable for unauthorized transactions unless you have reported the loss and requested a block on the card. |

| Documentation Requirement | Supporting documents, such as receipts or police reports, are encouraged to assist in resolving your dispute. |

| Cardholder Information | Cardholder name, phone number, address, and card/account number must be provided on the form. |

| Transaction Details | You can dispute up to five transactions on a single form, providing specific details for each. |

| Contacting the Merchant | You must indicate whether you have contacted the merchant regarding the disputed transaction. |

| State-Specific Governing Laws | Governing laws vary by state; it is advisable to consult local regulations regarding unauthorized transactions. |

How to Write Netspend Dispute

Filling out the Netspend Dispute form is a crucial step for addressing unauthorized transactions on your card. Once you complete the form, you will need to submit it to Netspend along with any supporting documents. This process helps initiate the investigation into your dispute, and you can expect a decision regarding your claim within ten business days after they receive your completed form.

- Begin by entering your Cardholder Name in the designated space.

- Fill in your Phone Number for contact purposes.

- Provide your Address, including City, State, and Zip Code.

- Write your Card or Account Number in the appropriate field.

- Input your Claim Number if you have one.

- List the transactions you are disputing. You can submit up to five transactions on one form. For each transaction, fill in the following details:

- Disputed Amount

- Date of Transaction (in MM/DD/YY format)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Have you contacted the merchant? (Circle Yes or No)

- If yes, will they provide a refund? (Circle Yes or No)

- If yes, Date expected? (in MM/DD/YY format)

- If yes, Amount expected

- Indicate the Date card was noticed missing/lost/compromised in MM/DD/YY format.

- Answer whether anyone else has access to your PIN by circling Yes or No. If Yes, provide an explanation.

- Write a detailed explanation of what happened regarding the unauthorized transactions. If necessary, attach additional pages.

- Sign and date the form in the designated areas at the bottom.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any other supporting documents, such as receipts, emails, or tracking information, when submitting this form.

Dos and Don'ts

When filling out the Netspend Dispute form, it’s crucial to approach the process carefully. Here are six important dos and don'ts to consider:

- Do submit the form as soon as possible, ideally within the 60-day window from the transaction date.

- Don't delay in reporting unauthorized transactions. Time is of the essence in these situations.

- Do provide clear and detailed explanations for each disputed transaction. The more information you include, the better.

- Don't forget to attach any supporting documentation, such as receipts or police reports, which can strengthen your case.

- Do check that all your contact information is accurate. This ensures that Netspend can reach you for any follow-up.

- Don't leave any sections of the form incomplete. Every detail matters in processing your dispute effectively.

By following these guidelines, you can enhance your chances of a successful resolution to your dispute.

Documents used along the form

When disputing unauthorized transactions on your Netspend card, it is essential to gather and submit various forms and documents to support your claim. Each document plays a crucial role in ensuring that your dispute is handled efficiently and effectively. Below is a list of important forms and documents that are often used alongside the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report serves as official documentation of the incident. This report can substantiate your claim and may be required for processing your dispute.

- Transaction Receipts: Providing copies of receipts related to the disputed transactions can help establish the legitimacy of your claim. These documents may show the date, amount, and merchant involved.

- Residential Lease Agreement: To ensure clarity in rental agreements, it is essential to understand and provide a copy of the lease, such as the https://floridaforms.net/blank-residential-lease-agreement-form/, which outlines the terms between landlords and tenants.

- Merchant Correspondence: Any communication with the merchant regarding the disputed transaction should be included. This may consist of emails or letters that detail your attempts to resolve the issue directly with the merchant.

- Cancellation Confirmation: If you canceled a transaction or service, documentation confirming the cancellation can support your dispute. This may include confirmation emails or letters from the merchant.

- Tracking Information: If the dispute involves a shipment or delivery, providing tracking information can clarify the timeline of events and support your claim regarding unauthorized charges.

- Account Statements: Recent account statements showing the disputed transaction can provide additional context and evidence of the unauthorized activity on your account.

- Identity Verification Documents: To protect against fraud, you may be asked to submit a copy of your identification, such as a driver’s license or passport, to verify your identity.

- Affidavit of Loss: In some cases, you may be required to complete an affidavit declaring that your card was lost or stolen. This document serves as a formal statement regarding the circumstances of the loss.

Gathering these documents will not only strengthen your dispute but also expedite the resolution process. Being thorough and organized can make a significant difference in how quickly your claim is addressed. By providing all necessary information, you enhance your chances of a favorable outcome.