Fill Your Mortgage Statement Form

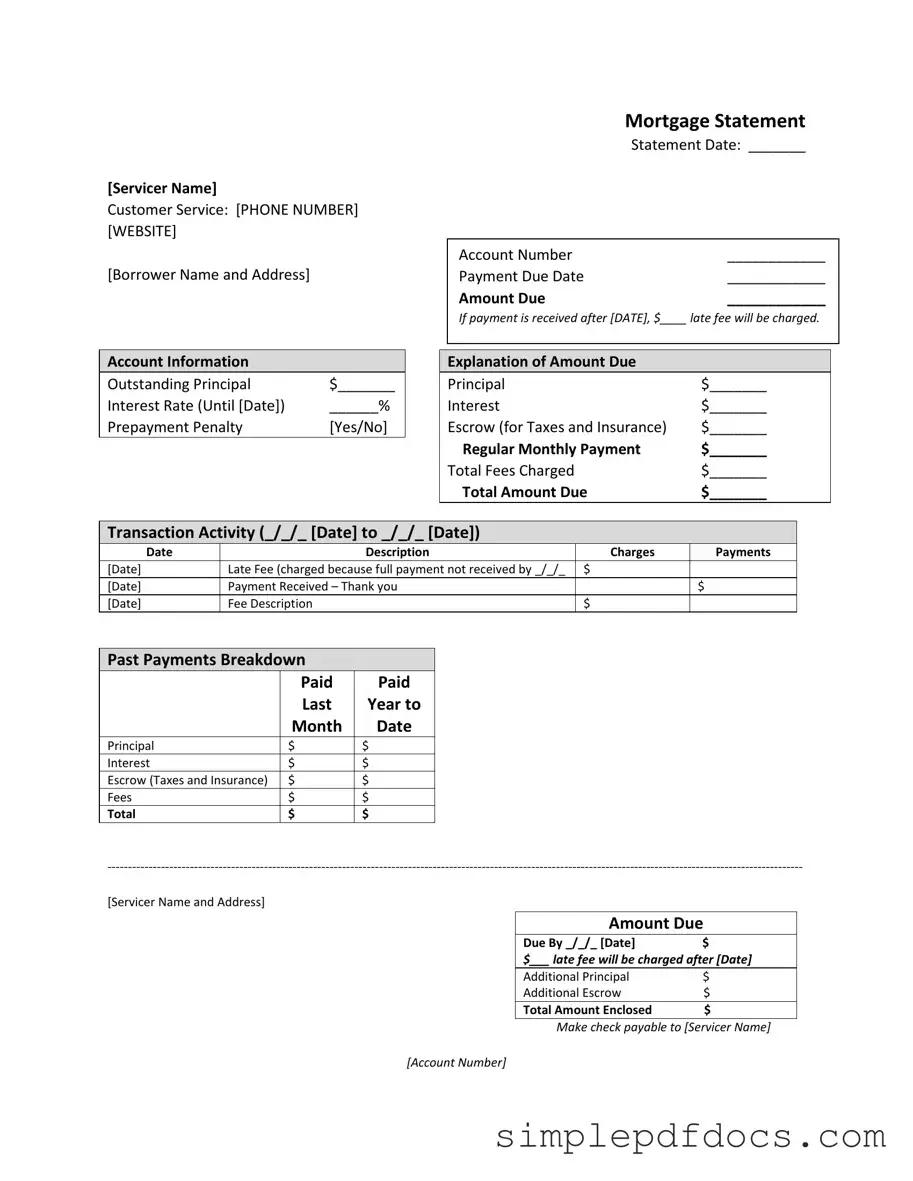

The Mortgage Statement form is an essential document that provides borrowers with a detailed overview of their mortgage account. It includes vital information such as the servicer's name and contact details, allowing homeowners to reach out for assistance when needed. Each statement features the borrower's name and address, along with crucial dates like the statement date, payment due date, and the account number. The form clearly outlines the amount due, which encompasses the outstanding principal, interest rate, and any applicable fees. Additionally, it informs borrowers about potential late fees if payments are not received by the specified date. The statement also breaks down the total amount due into categories, including principal, interest, and escrow for taxes and insurance. This transparency helps homeowners understand their financial obligations. Moreover, transaction activity is recorded, showing a history of charges and payments over a specified period. Important messages regarding partial payments and delinquency are included, highlighting the potential consequences of late payments. For those facing financial difficulties, the form offers guidance on seeking mortgage counseling or assistance, making it a comprehensive tool for managing mortgage responsibilities.

More PDF Templates

Navpers 1336 3 - Understanding the form's requirements can prevent unnecessary delays in processing.

When navigating the complexities of Florida's auto insurance requirements, it's essential to understand the role of the FR-44 Florida form, a key document that ensures compliance with the state's Financial Responsibility Law. This form mandates that drivers have adequate liability coverage, with specified limits for bodily injury and property damage. To learn more about this process and access necessary documentation, you can visit Florida Forms for additional resources and assistance.

Fake Insurance Cards - Keep this card in your vehicle at all times.

Document Specifics

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy contact. |

| Payment Details | It specifies the payment due date, amount due, and any applicable late fees if payment is not received on time. |

| Account Information | Outstanding principal, interest rate, and any prepayment penalties are clearly outlined for the borrower’s understanding. |

| Transaction Activity | A detailed record of charges and payments made during a specific period is provided, allowing borrowers to track their payments. |

| Delinquency Notice | A notice warns borrowers of late payments and the potential consequences, including fees and foreclosure. |

| Financial Assistance | Information about mortgage counseling or assistance is available for borrowers experiencing financial difficulties. |

How to Write Mortgage Statement

Once you have the Mortgage Statement form in front of you, it's time to fill it out accurately. This form contains important information about your mortgage account, including payment details and account history. Follow these steps to complete the form correctly.

- Start by entering the Servicer Name at the top of the form.

- Provide the Customer Service Phone Number and Website for your mortgage servicer.

- Fill in your Borrower Name and Address.

- Write the Statement Date in the designated space.

- Enter your Account Number.

- Fill in the Payment Due Date.

- Write the Amount Due on the statement.

- Specify the date after which a late fee will be charged and enter the amount of the late fee.

- Provide the Outstanding Principal amount.

- Enter the Interest Rate and the applicable date.

- Indicate if there is a Prepayment Penalty (Yes/No).

- Break down the Amount Due into Principal, Interest, Escrow, and any Regular Monthly Payment.

- List the Total Fees Charged and the Total Amount Due.

- In the Transaction Activity section, fill in the date range and provide details for each transaction, including charges and payments.

- Complete the Past Payments Breakdown by entering the amounts for Principal, Interest, Escrow, and Fees for the last year.

- Fill in the Amount Due and the date it is due, along with the late fee details.

- Write the Total Amount Enclosed if you are sending a payment.

- Make sure to sign your check payable to the Servicer Name and include your Account Number.

Dos and Don'ts

Filling out a Mortgage Statement form can seem daunting, but it doesn't have to be. Here’s a helpful list of things to do and avoid to ensure you complete the form accurately and efficiently.

- Do double-check all your personal information. Accuracy is key.

- Do clearly write your account number. This helps the servicer identify your account quickly.

- Do review the payment due date. Make sure you understand when your payment is expected.

- Do include any additional payments. If you’re sending extra money, specify how it should be applied.

- Don't leave any sections blank. Fill out every part of the form, even if it seems unnecessary.

- Don't ignore late fees. Be aware of how much you may owe if payments are late.

- Don't forget to sign the form. An unsigned form can delay processing.

- Don't submit without keeping a copy for your records. Having a reference can be invaluable later.

By following these guidelines, you can navigate the Mortgage Statement form with confidence. Take your time, and don’t hesitate to reach out for help if needed. Your home is worth it!

Documents used along the form

The Mortgage Statement form is an essential document for borrowers, providing detailed information about their mortgage account. Alongside this form, several other documents are often utilized to support the mortgage process and facilitate communication between the borrower and the lender. Below is a list of four common forms and documents that may accompany the Mortgage Statement.

- Loan Agreement: This document outlines the terms and conditions of the mortgage loan. It includes details such as the loan amount, interest rate, repayment schedule, and any fees associated with the loan. The Loan Agreement serves as a binding contract between the borrower and the lender.

- Residential Lease Agreement: It is essential for landlords and tenants to clearly outline the terms of their rental arrangement, ensuring both parties are protected. For more information, you can refer to the https://floridaforms.net/blank-residential-lease-agreement-form.

- Escrow Disclosure Statement: This statement provides information about the escrow account, which is used to collect funds for property taxes and insurance. It details the estimated amounts that will be collected, disbursed, and any adjustments that may occur over the life of the loan.

- Payment History Statement: This document summarizes the borrower’s payment history over a specified period. It includes information on payments made, any late fees incurred, and the current balance. The Payment History Statement helps borrowers track their financial progress and understand their standing with the lender.

- Delinquency Notice: This notice is issued when a borrower falls behind on mortgage payments. It informs the borrower of their delinquency status, the amount overdue, and potential consequences, such as late fees or foreclosure. The Delinquency Notice serves as a critical communication tool to prompt borrowers to take action to remedy their situation.

Understanding these documents is vital for borrowers to manage their mortgage effectively. Each form plays a unique role in ensuring transparency and facilitating communication between borrowers and lenders. By being informed, borrowers can navigate their mortgage obligations with greater confidence.