Attorney-Approved Mortgage Lien Release Form

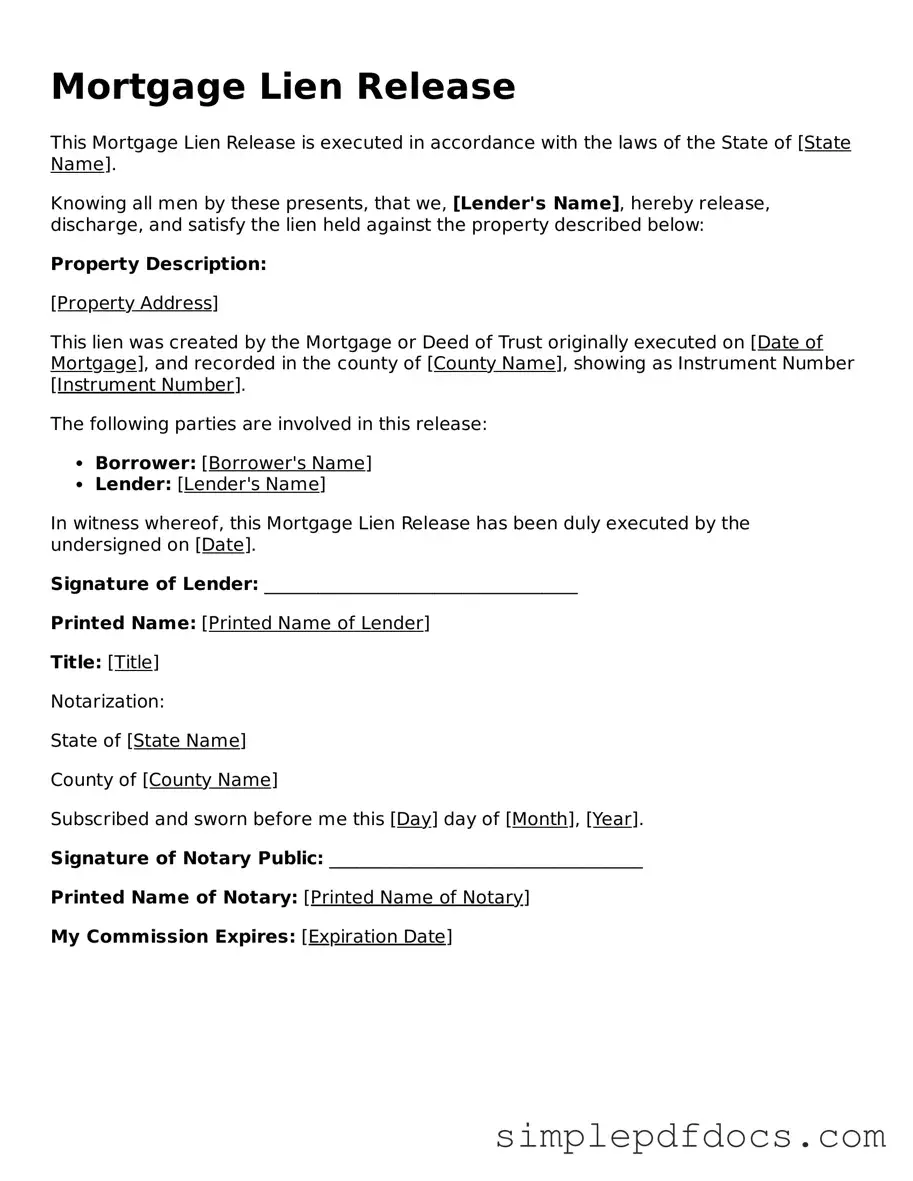

When a homeowner pays off their mortgage, a crucial step in the process is the completion of a Mortgage Lien Release form. This document serves as a formal declaration that the lender no longer has a claim to the property, effectively removing the lien that was placed on it during the loan period. The form typically includes essential details such as the names of both the borrower and the lender, the property address, and the loan number. By signing this form, the lender acknowledges that the debt has been satisfied, thereby allowing the homeowner to enjoy full ownership without any encumbrances. It is important for homeowners to ensure that this document is properly filed with the local land records office, as it provides legal proof that the mortgage obligation has been fulfilled. Failure to complete this step can lead to complications in future property transactions, as potential buyers or lenders may be unaware that the lien has been released. Understanding the significance of the Mortgage Lien Release form is essential for any homeowner looking to secure their property rights and move forward with peace of mind.

More Mortgage Lien Release Types:

Tattoo Release Form for Actors - The Actor Release specifies which mediums the actor's likeness may appear in.

When completing the sale of a vehicle, it is essential to utilize the Vehicle Release of Liability form, which not only signifies the transfer of risk but also protects both the seller and the buyer from potential future liabilities. To avoid any ambiguities and ensure proper documentation, you can access the form at https://smarttemplates.net/fillable-vehicle-release-of-liability/.

How to Make a Waiver Letter - A tool for organizations to secure consent from participants regarding risks.

Why Does Fedex Need a Signature - Submission of this form does not guarantee delivery without a signature.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a document that officially removes a lien from a property after the mortgage has been paid in full. |

| Purpose | The primary purpose of this form is to provide clear evidence that the borrower has satisfied their mortgage obligations. |

| Governing Law | The laws governing mortgage lien releases vary by state. For example, in California, it is governed by Civil Code Section 2941. |

| Filing Requirements | Typically, the form must be filed with the county recorder’s office where the property is located. |

| Signature Requirement | The lender or mortgage holder must sign the form to validate the release of the lien. |

| Impact on Credit | Once the lien is released, it can positively impact the borrower’s credit score, as it shows that the debt has been settled. |

| Time Frame | The lender is usually required to file the release within a certain period after the mortgage is paid off, often 30 days. |

| Importance of Copies | It is advisable for the borrower to keep a copy of the released lien for their records as proof of payment. |

| Potential Fees | Some states may charge a fee for filing the Mortgage Lien Release form with the county. |

| State Variations | Each state has its own specific form and requirements; for instance, New York has its own prescribed format under Real Property Law Section 320. |

How to Write Mortgage Lien Release

Once you have the Mortgage Lien Release form ready, you can begin the process of filling it out. This form is essential for removing a mortgage lien from your property records. After completing the form, you will need to submit it to the appropriate authority, usually your local county clerk or recorder's office, to finalize the release.

- Begin by entering the date at the top of the form.

- Fill in your name and address as the borrower. Ensure that all details are accurate.

- Provide the lender's name and address. This is the institution that held the mortgage.

- Include the property address that the lien applies to. This should match the address on the original mortgage documents.

- State the loan number associated with the mortgage. This helps identify the specific loan being released.

- Sign the form. Your signature indicates your agreement to the release.

- Have the form notarized if required. Some jurisdictions may require a notary public to witness your signature.

- Make copies of the completed form for your records before submission.

- Submit the original form to your local county clerk or recorder's office. Check for any filing fees that may apply.

Dos and Don'ts

When filling out the Mortgage Lien Release form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do double-check all personal information for accuracy.

- Do include the correct property address associated with the mortgage.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Do submit the form to the correct county recorder's office.

- Don't leave any required fields blank.

- Don't use white-out or any correction fluid on the form.

- Don't forget to check for any additional documentation that may be required.

- Don't submit the form without reviewing it for errors.

Documents used along the form

The Mortgage Lien Release form is a crucial document that signifies the removal of a mortgage lien from a property. However, several other forms and documents are commonly associated with this process. Each plays a vital role in ensuring that the transaction is smooth and legally sound. Below is a list of these important documents.

- Mortgage Agreement: This document outlines the terms and conditions of the loan secured by the property. It details the borrower's obligations, the lender's rights, and the repayment schedule.

- Release of Liability: This document is essential for protecting parties from claims arising during activities, affirming that participants understand the risks involved and agree to waive their rights. For more information, visit Top Forms Online.

- Promissory Note: A promissory note is a written promise from the borrower to repay the loan amount, including interest, to the lender. It serves as evidence of the debt and is legally binding.

- Deed of Trust: This document is used in some states as an alternative to a mortgage. It involves three parties: the borrower, the lender, and a trustee who holds the title until the loan is paid off.

- Title Insurance Policy: This policy protects the lender and borrower against any claims or disputes regarding the property's title. It ensures that the property is free from liens or other encumbrances at the time of sale.

- Closing Statement: Also known as the settlement statement, this document summarizes the financial details of the transaction. It outlines all costs, fees, and credits associated with the closing process.

Understanding these documents is essential for anyone involved in the mortgage process. Each form contributes to a clearer picture of the financial obligations and rights associated with property ownership, ensuring that all parties are informed and protected.