Fill Your Louisiana act of donation Form

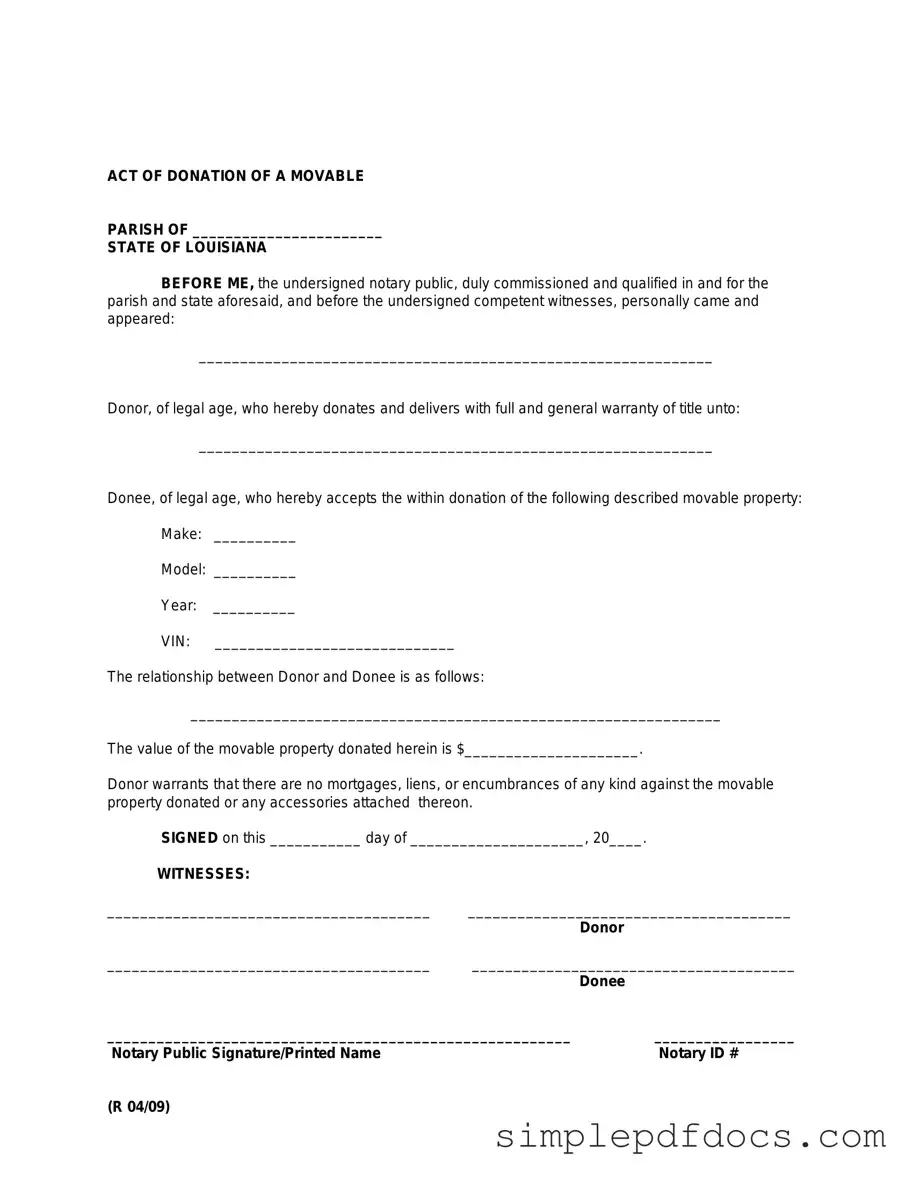

The Louisiana act of donation form serves as a crucial legal document that facilitates the transfer of property or assets from one individual to another without any exchange of payment. This form is particularly significant in the context of estate planning and familial transfers, allowing individuals to gift property while retaining certain rights or conditions. The act of donation can encompass various types of assets, including real estate, personal property, and financial assets. It typically requires detailed information about the donor and the recipient, a clear description of the property being donated, and any stipulations that may govern the donation, such as conditions or restrictions. Furthermore, the form must be executed in accordance with Louisiana law to ensure its validity, often necessitating notarization and, in some cases, witnesses. Understanding the nuances of this form is essential for anyone looking to navigate the complexities of property transfer in Louisiana, as it not only impacts the immediate transaction but also carries implications for tax obligations and future ownership rights.

More PDF Templates

Insurance Claim Verizon - This form is essential for tracking the resolution of reported problems.

For additional information on the process involved, you can refer to this guide on how to properly handle a Notice to Quit when a lease is being terminated: guide to understanding Notice to Quit procedures.

Security Guard How to Write a Security Incident Report - Supervisor notification is mandated for serious incidents, reinforcing the chain of command in emergency situations.

Document Specifics

| Fact Name | Details |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 to 1476. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (in anticipation of death). |

| Requirements | The form must be signed by the donor and may require witnesses or notarization, depending on the type of property being donated. |

| Revocation | A donation can be revoked under certain conditions, such as if the donor becomes incapacitated or if the donee fails to fulfill obligations. |

| Tax Implications | Donations may have tax implications for both the donor and the recipient, including potential gift tax considerations. |

How to Write Louisiana act of donation

Filling out the Louisiana act of donation form is a straightforward process that requires attention to detail. Once you have completed the form, it will be ready for submission to the appropriate authorities. This ensures that your intentions regarding the donation are formally recognized and documented.

- Begin by gathering all necessary information about the donor and the recipient. This includes full names, addresses, and any relevant identification details.

- In the designated section, clearly state the item or property being donated. Be specific to avoid any confusion later on.

- Next, indicate the date of the donation. This is important for record-keeping and legal purposes.

- Provide a description of the condition of the item or property. This helps to clarify what the recipient is receiving.

- Both the donor and the recipient should sign the form. Ensure that all signatures are dated appropriately.

- Review the completed form for any errors or omissions. Double-check that all information is accurate and legible.

- Once verified, submit the form to the appropriate local office or authority as required by Louisiana law.

Dos and Don'ts

When filling out the Louisiana act of donation form, it is important to adhere to certain guidelines to ensure accuracy and compliance. Here are four things to do and not to do:

- Do read the instructions carefully before starting the form.

- Do provide accurate and complete information about the donor and recipient.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use white-out or correction fluid on the form.

- Don't forget to check for any additional documents that may be required.

- Don't submit the form without reviewing it for errors.

Documents used along the form

The Louisiana Act of Donation form is an important document used in the state to transfer ownership of property as a gift. Along with this form, there are several other documents that may be relevant in the process of making a donation. Each of these documents serves a specific purpose and can help ensure that the donation is legally recognized and properly recorded.

- Donation Agreement: This document outlines the terms and conditions of the donation. It specifies what is being donated, the intent of the donor, and any conditions that may apply to the donation.

- Divorce Settlement Agreement: Understanding the Florida Forms for divorce can help streamline the process, ensuring that all parties agree on terms like asset division and custody arrangements.

- Deed of Gift: A deed of gift is a formal document that transfers ownership of real property from one person to another without any exchange of money. It is often used in conjunction with the act of donation.

- Affidavit of Donation: This affidavit serves as a sworn statement confirming the details of the donation. It can provide additional evidence of the donor's intent and the circumstances surrounding the gift.

- Title Transfer Form: This form is used to officially transfer the title of property from the donor to the recipient. It is particularly important for real estate donations.

- Tax Exemption Certificate: If the donation is made to a qualified nonprofit organization, this certificate may be necessary to confirm that the organization is exempt from certain taxes.

- Gift Tax Return: Depending on the value of the donation, the donor may need to file a gift tax return with the IRS. This document reports the gift and ensures compliance with federal tax laws.

- Power of Attorney: In some cases, a donor may grant someone else the authority to act on their behalf regarding the donation. This document outlines that authority.

- Notice of Donation: This notice may be filed with local authorities to formally inform them of the donation. It can help establish a public record of the transfer.

- Beneficiary Designation Form: For certain types of assets, such as life insurance or retirement accounts, a beneficiary designation form may be necessary to ensure that the intended recipient receives the gift.

These documents can help clarify the intentions of the parties involved and ensure that the donation process is smooth and legally binding. It is important to consider each document's role in the overall transaction to avoid any potential misunderstandings or legal issues in the future.