Attorney-Approved Loan Agreement Form

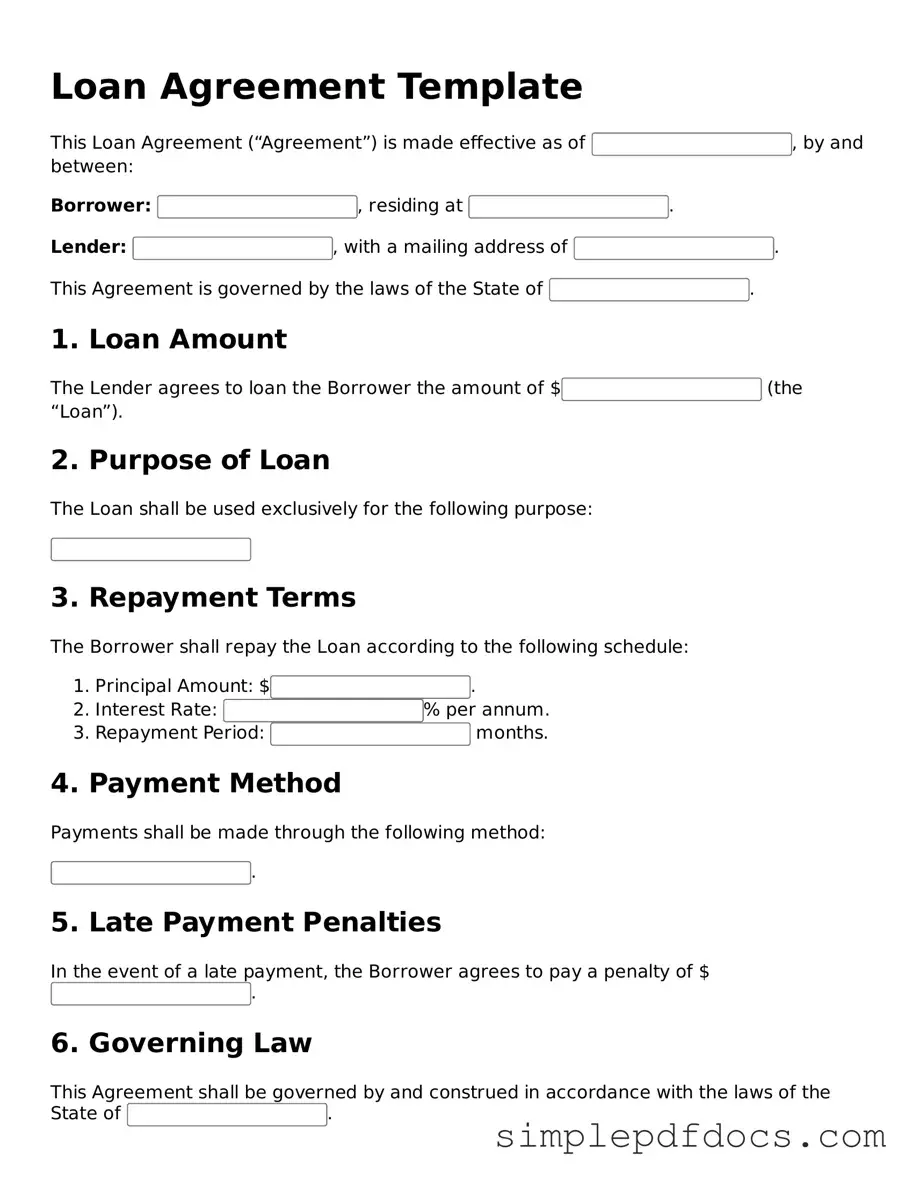

When entering into a financial arrangement, clarity and mutual understanding between the lender and borrower are paramount. A Loan Agreement form serves as a crucial document that outlines the terms and conditions of the loan, ensuring both parties are on the same page. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it often stipulates the rights and responsibilities of each party, providing a framework for resolving potential disputes. By clearly defining these elements, the Loan Agreement fosters trust and accountability, which are vital for a successful lending experience. Furthermore, it may include provisions for default, prepayment options, and other important clauses that protect the interests of both the lender and the borrower. Understanding these components is key to navigating the lending process effectively.

Loan Agreement Document Categories

Check out Other Documents

How to Write a Reference for Someone - Robert possesses a wealth of knowledge in his field, making him a valuable resource.

The New York ATV Bill of Sale form is a vital resource for individuals looking to facilitate a transaction involving their all-terrain vehicle. For those seeking guidance, our informative guide on the absolutely necessary ATV Bill of Sale can help ensure all legal requirements are met during the sale process. You can find it here.

Partial Waiver of Lien Chicago Title - The waiver facilitates accountability among contractors regarding their financial obligations.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A loan agreement is a contract between a lender and a borrower outlining the terms of a loan. |

| Parties Involved | The agreement typically includes the lender and the borrower, both of whom must be clearly identified. |

| Loan Amount | The specific amount of money being borrowed is stated in the agreement. |

| Interest Rate | The agreement specifies the interest rate, which can be fixed or variable. |

| Repayment Terms | Details about how and when the borrower will repay the loan are included. |

| Governing Law | State-specific forms may reference the governing laws of that state, such as California Civil Code Section 1916. |

| Default Conditions | The agreement outlines conditions under which the borrower would be considered in default. |

| Collateral | If applicable, the agreement may specify any collateral securing the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | Any changes to the agreement must be documented and signed by both parties. |

How to Write Loan Agreement

Completing the Loan Agreement form is a crucial step in securing your loan. This form requires specific information to ensure that all parties involved understand their obligations and rights. After filling out the form, it will need to be reviewed and signed by all parties to finalize the agreement.

- Begin by entering your personal information at the top of the form. This includes your full name, address, and contact information.

- Next, provide the details of the loan amount you are requesting. Be clear and precise in this section.

- Indicate the purpose of the loan. This helps clarify how the funds will be used.

- Fill in the interest rate that will apply to the loan. Ensure that this rate is agreed upon by both parties.

- Specify the repayment terms. Include the duration of the loan and the frequency of payments (monthly, quarterly, etc.).

- Provide any collateral that will secure the loan, if applicable. Describe the asset and its value.

- Review the form for accuracy. Check that all information is complete and correct.

- Sign and date the form at the designated areas. Ensure all parties involved do the same.

- Make copies of the completed form for your records and provide copies to the other parties involved.

Dos and Don'ts

When filling out a Loan Agreement form, there are important guidelines to follow. Below is a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do check for any required signatures and dates.

- Do keep a copy of the completed form for your records.

- Do ask questions if any part of the form is unclear.

- Don't rush through the form; take your time.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand.

- Don't forget to double-check your spelling and numbers.

- Don't sign the form until you fully understand its terms.

Documents used along the form

When entering into a loan agreement, several additional documents may be required to ensure clarity and protection for all parties involved. Below is a list of commonly used forms and documents that often accompany a Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, and repayment schedule.

- Loan Application: The borrower completes this form to provide necessary personal and financial information to the lender. It helps the lender assess the borrower's creditworthiness.

- Collateral Agreement: If the loan is secured, this document specifies the assets pledged by the borrower as security for the loan. It protects the lender in case of default.

- Lease Agreement: This legal document outlines the terms and conditions of a rental arrangement, ensuring clarity between landlords and tenants. It is crucial to understand its components, such as the Lease Agreement form, to foster a positive landlord-tenant relationship.

- Disclosure Statement: This form provides important information about the loan terms, including fees and interest rates. It ensures that the borrower understands the costs associated with the loan.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party. This document holds the individual personally responsible for repaying the loan if the borrower defaults.

These documents work together to create a comprehensive understanding of the loan terms and responsibilities. Ensuring all necessary paperwork is completed can help prevent misunderstandings and protect the interests of all parties involved.