Attorney-Approved Letter of Intent to Purchase Business Form

When considering the purchase of a business, a Letter of Intent (LOI) to Purchase Business serves as a crucial first step in the negotiation process. This document outlines the preliminary terms and conditions agreed upon by both the buyer and the seller, setting the stage for a more detailed purchase agreement. It typically includes essential elements such as the purchase price, payment structure, and any contingencies that must be met before the sale is finalized. Additionally, the LOI may address timelines for due diligence, confidentiality requirements, and the responsibilities of each party during the negotiation phase. By clearly articulating these key points, the Letter of Intent helps to ensure that both parties are on the same page, reducing the potential for misunderstandings down the line. This form not only facilitates smoother discussions but also signals a serious commitment to the transaction, paving the way for a successful business acquisition.

More Letter of Intent to Purchase Business Types:

Letter of Intent to Homeschool - Assures legal compliance while homeschooling within the state framework.

For families considering homeschooling in California, understanding the process is crucial, and the California Homeschool Letter of Intent requirements are an important first step to ensure compliance with state education laws.

Intention to Marry Within 90 Days of Entry - The Letter of Intent can be a helpful tool for conflict resolution ahead of marriage.

PDF Details

| Fact Name | Details |

|---|---|

| Purpose | A Letter of Intent (LOI) outlines the preliminary understanding between parties intending to enter into a business purchase agreement. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning it expresses intent but does not legally obligate the parties to complete the transaction. |

| Key Components | Common elements include the purchase price, payment terms, and any contingencies that must be met before finalizing the sale. |

| Confidentiality Clause | Often, an LOI includes a confidentiality clause to protect sensitive information shared during negotiations. |

| State-Specific Forms | Some states may have specific requirements or forms for LOIs, so it's essential to check local laws. |

| Governing Law | The LOI should specify which state's laws will govern the agreement, ensuring clarity in case of disputes. |

| Due Diligence | LOIs often allow for a due diligence period, giving the buyer time to investigate the business before finalizing the deal. |

| Termination Clause | Many LOIs include a termination clause, outlining conditions under which either party can withdraw from negotiations without penalty. |

How to Write Letter of Intent to Purchase Business

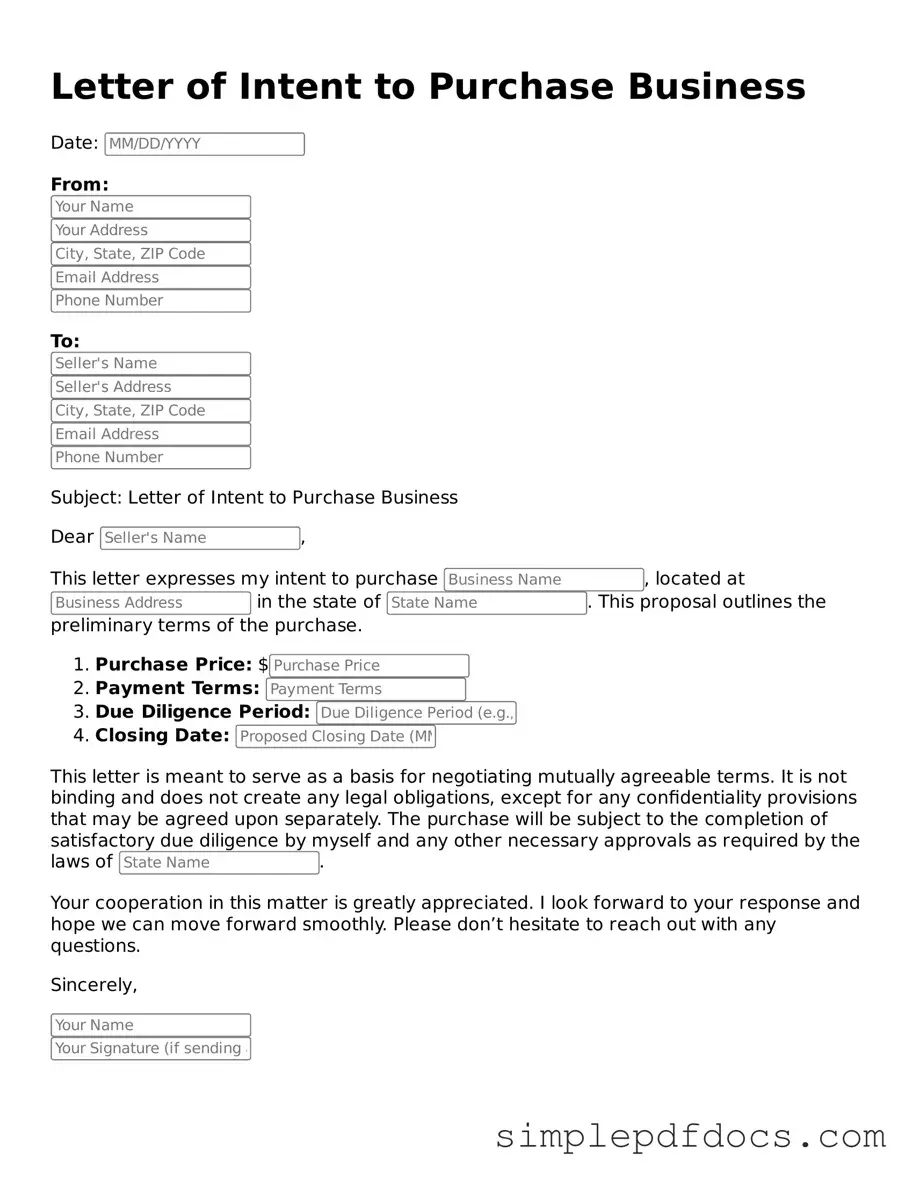

After gathering all necessary information, you are ready to complete the Letter of Intent to Purchase Business form. This document outlines your intentions regarding the purchase of a business and serves as a preliminary agreement between you and the seller. Follow these steps to ensure accurate completion of the form.

- Review the form: Familiarize yourself with all sections of the form before filling it out. Understand what information is required.

- Provide your information: Enter your full name, address, and contact details in the designated fields.

- Identify the seller: Clearly state the name and contact information of the business owner or seller.

- Describe the business: Include the name of the business you intend to purchase, along with its address and any relevant identifiers.

- Outline the purchase terms: Specify the proposed purchase price and any payment terms or conditions you wish to include.

- Include contingencies: Note any conditions that must be met before the purchase can proceed, such as financing or inspections.

- Sign and date: After reviewing the completed form for accuracy, sign and date it to validate your intent.

- Provide a copy: Keep a copy for your records and provide a copy to the seller for their acknowledgment.

Dos and Don'ts

When filling out a Letter of Intent to Purchase a Business, it’s essential to approach the process thoughtfully. This document outlines your intention to buy a business and sets the stage for negotiations. Here are some important dos and don'ts to consider:

- Do be clear and concise. Clearly state your intention to purchase the business and include all relevant details.

- Do include your contact information. Ensure that your name, phone number, and email address are easy to find.

- Do specify the terms of the offer. Outline the proposed purchase price and any other terms that are important to you.

- Do express your interest in due diligence. Indicate that you would like to review financial statements and other important documents.

- Don't make unrealistic offers. Avoid proposing a price that is far below market value without justification.

- Don't forget to proofread. Check for spelling and grammatical errors, as these can undermine your professionalism.

Documents used along the form

A Letter of Intent to Purchase a Business is a crucial first step in the acquisition process. It outlines the basic terms and conditions under which a buyer intends to purchase a business. However, several other documents often accompany this letter to ensure clarity and protect the interests of both parties involved. Below is a list of these important documents.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains confidential. It protects the seller's proprietary information and trade secrets from being disclosed to third parties.

- Homeschool Intent Letter: To notify the state about the decision to homeschool, parents must submit a Homeschool Intent Letter to comply with educational regulations.

- Due Diligence Checklist: A detailed list that outlines the necessary steps and documents needed for the buyer to evaluate the business thoroughly. This checklist may include financial statements, tax returns, and operational details, allowing the buyer to make an informed decision.

- Purchase Agreement: This legally binding document finalizes the terms of the sale. It includes specifics about the purchase price, payment terms, and any contingencies, ensuring that both parties have a clear understanding of their obligations.

- Disclosure Statement: This statement provides essential information about the business being sold. It typically includes details about liabilities, assets, and any potential risks, helping the buyer to assess the value and condition of the business accurately.

These documents work together to facilitate a smoother transaction process. They help establish trust and transparency between the buyer and seller, ultimately leading to a more successful business acquisition.