Fill Your IRS W-9 Form

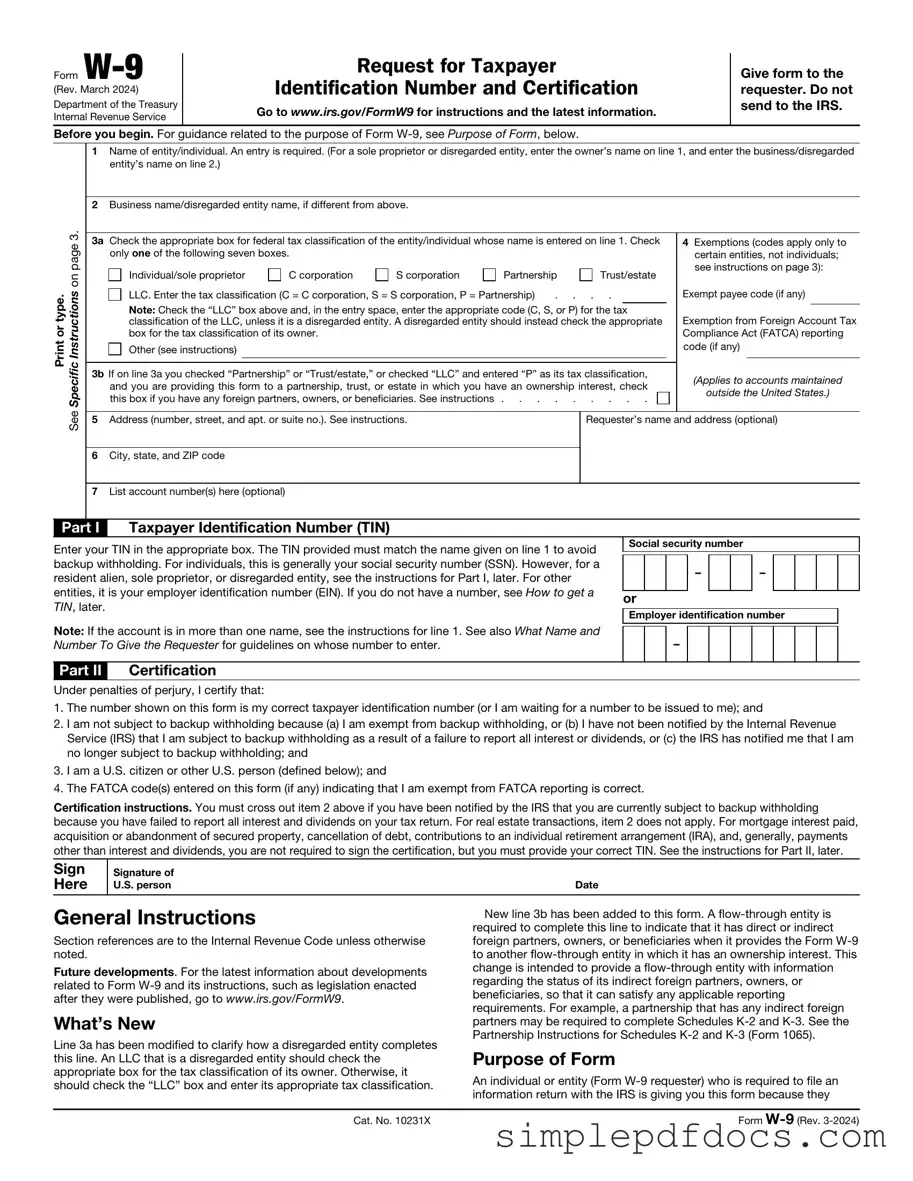

The IRS W-9 form plays a crucial role in the financial landscape for both individuals and businesses. Designed to gather essential information, this form is primarily used to request the taxpayer identification number (TIN) and certification of U.S. persons. When a business or individual hires a contractor or freelancer, they often require the completion of a W-9 to ensure accurate tax reporting. The form includes sections for the name, business name (if applicable), address, and TIN, which can be a Social Security number or an Employer Identification Number. Additionally, it contains a certification section where the signer attests to the accuracy of the information provided. Understanding the purpose and proper completion of the W-9 form is vital for maintaining compliance with tax regulations, avoiding potential penalties, and ensuring that payments are reported correctly to the IRS. As such, both payers and payees benefit from familiarizing themselves with this important document.

More PDF Templates

1040 Schedule C Form - Includes both direct and indirect expenses.

When selling a vehicle in Washington, it is important to have a proper documentation in place, which is where the Vehicle Sale Receipt comes into play; this form helps to formalize the transaction and provides both parties with a record of the sale. By detailing key information such as the buyer's and seller's names, vehicle identification number, and price, the Bill of Sale acts as a safeguard against any potential disputes in the future.

Wifey Application - A fun-loving adventure seeker who enjoys spontaneous road trips.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-9 form is used to provide taxpayer information to businesses or individuals who need to report income paid to you. |

| Who Uses It | Independent contractors, freelancers, and vendors typically fill out the W-9 form when they are hired by a business. |

| Tax Identification Number | The form requires you to provide your Social Security Number (SSN) or Employer Identification Number (EIN). |

| Filing Requirements | The W-9 form is not submitted to the IRS but is kept on file by the requester for their records. |

| State-Specific Forms | Some states may have their own versions of the W-9, governed by state tax laws. For example, California has specific requirements under the California Revenue and Taxation Code. |

| Privacy Considerations | Since the W-9 contains sensitive information, it should be shared securely to protect against identity theft. |

How to Write IRS W-9

After completing the IRS W-9 form, you will typically submit it to the requester, who may be a business or individual needing your taxpayer information for various purposes, such as reporting income. Make sure to keep a copy for your records.

- Begin by downloading the IRS W-9 form from the official IRS website or obtaining a hard copy from the requester.

- At the top of the form, enter your name as it appears on your tax return in the first box.

- If applicable, fill in your business name or disregarded entity name in the second box.

- In the next section, check the appropriate box that corresponds to your tax classification. Options include individual, corporation, partnership, and others.

- Provide your address in the designated fields, including street address, city, state, and ZIP code.

- If you have a different mailing address, fill it in the next section.

- Enter your Taxpayer Identification Number (TIN) in the space provided. This is usually your Social Security Number (SSN) or Employer Identification Number (EIN).

- Review the certification section. By signing, you confirm that the information provided is accurate.

- Sign and date the form at the bottom. Ensure the date is current.

Dos and Don'ts

When filling out the IRS W-9 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do: Provide your legal name as it appears on your tax return.

- Do: Use the correct taxpayer identification number (TIN), such as your Social Security Number or Employer Identification Number.

- Do: Sign and date the form to validate the information provided.

- Do: Check the appropriate box for your tax classification, such as individual or corporation.

- Do: Review the form for accuracy before submission.

- Don't: Use a nickname or any name other than your legal name.

- Don't: Leave any required fields blank; this may delay processing.

- Don't: Submit the form without a signature, as it will be considered incomplete.

- Don't: Provide false information, as this could lead to penalties.

- Don't: Forget to keep a copy for your records.

Documents used along the form

The IRS W-9 form is a vital document for individuals and businesses that need to provide their taxpayer identification information. It serves as a request for taxpayer identification number and certification. However, there are several other forms and documents that often accompany the W-9, each serving a specific purpose. Below is a list of these forms, along with a brief description of each.

- IRS Form 1099-MISC: This form is used to report payments made to independent contractors or freelancers. If you receive payments of $600 or more in a year, the payer must issue this form to you, summarizing the total amount paid.

- IRS Form 1040: This is the standard individual income tax return form. Taxpayers use it to report their annual income, calculate taxes owed, and claim any deductions or credits.

- IRS Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. It is filed quarterly and is essential for maintaining compliance with payroll tax obligations.

- California Lease Agreement: This document outlines the terms and conditions between a landlord and tenant for property rental in California, ensuring a transparent leasing process. For more details, you can find the Lease Agreement form.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). Businesses need an EIN for tax purposes, and it is often required when filling out a W-9 form.

- IRS Form 1099-NEC: This form specifically reports non-employee compensation, which is relevant for freelancers and contractors. Since 2020, it has been used to report payments made to non-employees instead of the 1099-MISC.

- IRS Form W-8BEN: Foreign individuals or entities use this form to certify their foreign status and claim any applicable tax treaty benefits. It is crucial for U.S. payers to determine the appropriate withholding tax rates for foreign payees.

- State Tax Forms: Depending on your state, you may need to complete additional tax forms. Each state has its own requirements for reporting income and withholding taxes, which may be necessary alongside the W-9.

- Contract or Agreement: When working with independent contractors or freelancers, a written contract outlines the terms of the working relationship. This document often references the W-9 to ensure proper tax reporting.

Understanding these forms and their purposes can streamline your tax reporting and compliance processes. Each document plays a role in ensuring that all parties involved have the necessary information for accurate reporting and tax obligations.