Fill Your IRS Schedule C 1040 Form

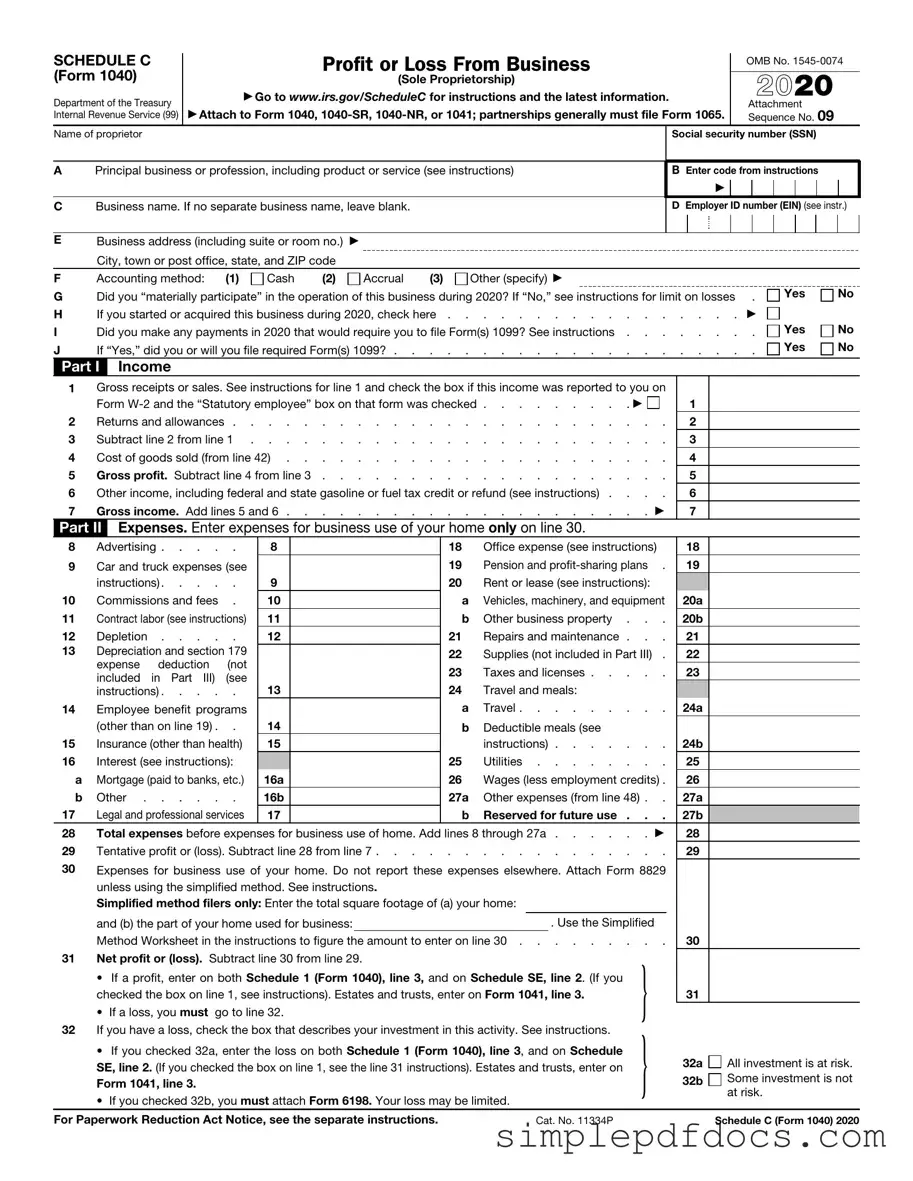

The IRS Schedule C (Form 1040) is an essential document for individuals who are self-employed or operate a sole proprietorship. This form provides a detailed account of income earned and expenses incurred during the tax year, allowing taxpayers to report their business activities accurately. It includes sections for reporting gross receipts, cost of goods sold, and various deductions, such as advertising, supplies, and home office expenses. By using Schedule C, self-employed individuals can calculate their net profit or loss, which ultimately impacts their overall tax liability. Additionally, the form requires information about the business, including its name, principal business activity, and accounting method. Understanding how to complete Schedule C is crucial for ensuring compliance with tax regulations and maximizing potential deductions.

More PDF Templates

High School Transcript - Can be requested by students through their high school administration.

Divorce Forms Michigan - Completing the form accurately can prevent delays in processing.

For those looking to secure their transaction, obtaining a reliable essential RV Bill of Sale agreement ensures that all necessary details regarding the vehicle are properly documented. This form acts as both a legal receipt and a record of the sale, helping to prevent disputes or misunderstandings in the future.

How Do You File a Mechanics Lien - Complying with California law is essential when filing a mechanics lien.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income or loss from their business. |

| Filing Requirement | Individuals must file Schedule C if they have net earnings of $400 or more from self-employment. |

| Income Reporting | All business income must be reported, including cash, checks, and credit card payments. |

| Deductible Expenses | Common deductible expenses include rent, utilities, and supplies necessary for business operations. |

| Net Profit or Loss | The net profit or loss from Schedule C is transferred to Form 1040, impacting overall tax liability. |

| Self-Employment Tax | Net earnings from Schedule C are subject to self-employment tax, which funds Social Security and Medicare. |

| Record Keeping | Maintaining accurate records of income and expenses is crucial for completing Schedule C accurately. |

| State-Specific Forms | Some states require additional forms for reporting business income; laws vary by state. |

| Due Date | Schedule C must be filed by the tax return deadline, usually April 15, unless an extension is requested. |

| Amendments | If errors are found after filing, individuals can amend their tax return using Form 1040-X. |

How to Write IRS Schedule C 1040

Completing the IRS Schedule C (Form 1040) is essential for reporting income and expenses from self-employment. This process requires attention to detail, as accurate information is crucial for tax compliance. Follow these steps to ensure you fill out the form correctly.

- Gather necessary documents, including your income records, expense receipts, and any other relevant financial information.

- Obtain the IRS Schedule C form from the IRS website or through tax preparation software.

- Fill in your name, Social Security number, and business name at the top of the form.

- Indicate your principal business activity by selecting the appropriate code from the provided list.

- Report your gross receipts or sales in Part I. Include all income earned from your business activities.

- List your business expenses in Part II. Categorize them into sections such as advertising, car and truck expenses, and utilities.

- Calculate your net profit or loss by subtracting total expenses from gross income. This number goes on Line 31.

- Complete any additional sections as required, such as the Cost of Goods Sold if applicable.

- Review the entire form for accuracy. Make sure all entries are clear and correct.

- Sign and date the form before submitting it with your tax return.

Once you have completed these steps, you can proceed with your tax filing. Ensure you keep a copy of the form and all supporting documents for your records.

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during the process.

- Do: Gather all necessary documentation, including income records and expense receipts.

- Do: Use clear and accurate descriptions for each item listed on the form.

- Do: Report all sources of income from your business activities.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank; if a question does not apply, indicate that with “N/A.”

- Don't: Overstate expenses; only include legitimate business costs.

- Don't: Forget to sign and date the form before submission.

Adhering to these guidelines will help ensure a smooth filing process and reduce the likelihood of errors or audits.

Documents used along the form

The IRS Schedule C (Form 1040) is a crucial document for individuals operating a sole proprietorship. This form is used to report income or loss from a business operated as a sole proprietorship. However, several other forms and documents are often utilized in conjunction with Schedule C to provide a comprehensive view of an individual's financial situation. Below is a list of these related forms and documents.

- Form 1040: This is the standard individual income tax return form. Taxpayers use it to report their annual income, calculate taxes owed, and claim refunds. Schedule C is attached to this form to report business income and expenses.

- Florida Traffic Crash Report: This form is essential for drivers involved in traffic incidents, allowing them to document the crash details. For more information, visit Florida Forms.

- Schedule SE: This form is used to calculate self-employment tax. Individuals who report income on Schedule C must also complete Schedule SE to determine the amount of self-employment tax owed, which funds Social Security and Medicare.

- Form 4562: This form is utilized to claim depreciation and amortization for business assets. Taxpayers use it to report the cost of assets and the amount that can be deducted for depreciation in the current tax year.

- Form 8829: This form is for claiming expenses for business use of a home. Taxpayers who operate their business from home can use this form to calculate and deduct eligible home office expenses.

Understanding these forms and their purposes is essential for accurately reporting business income and expenses. Proper documentation not only ensures compliance with tax regulations but also helps maximize potential deductions and credits available to business owners.