Fill Your IRS 941 Form

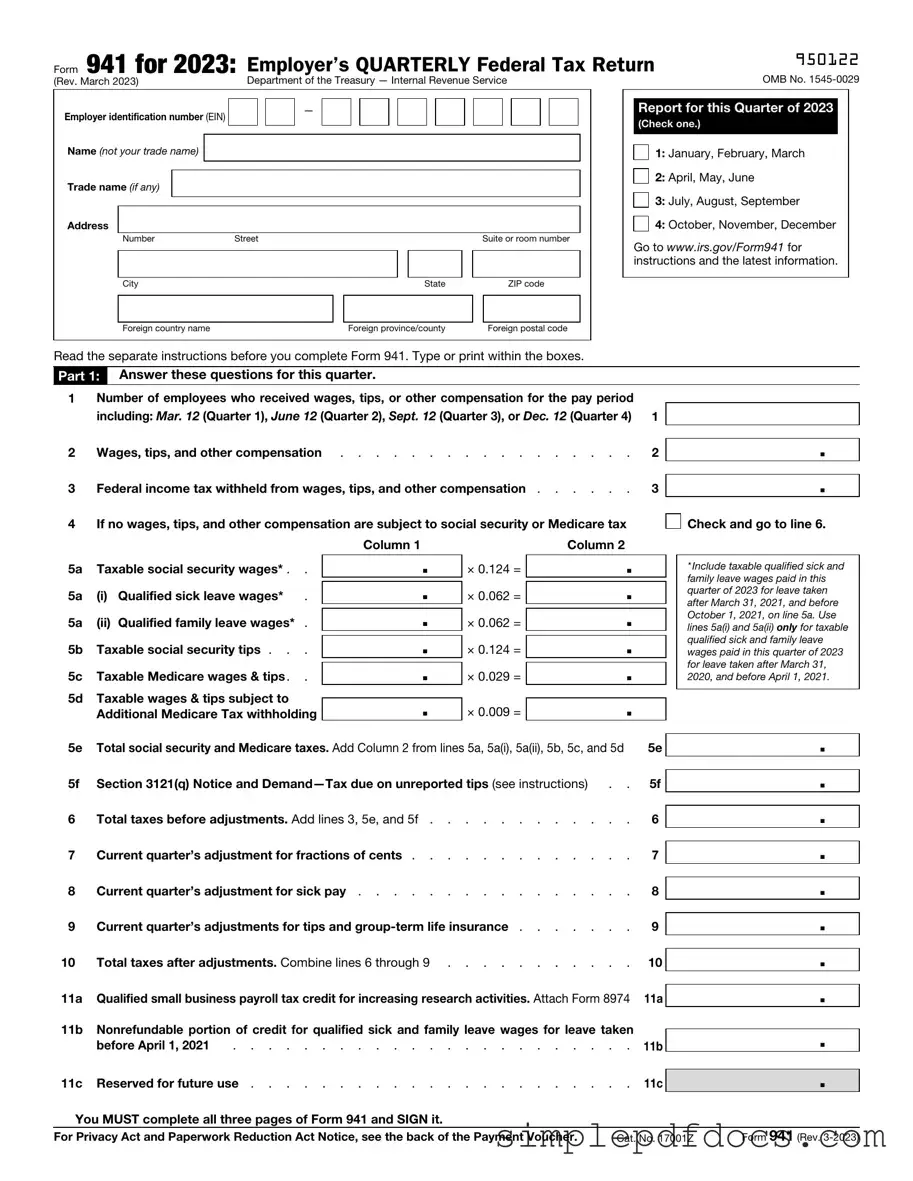

The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, plays a crucial role in the tax responsibilities of employers across the United States. This form is primarily used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Employers must file Form 941 on a quarterly basis, ensuring that the IRS receives accurate information regarding their payroll tax liabilities. The form requires detailed entries, including the number of employees, total wages paid, and the amounts withheld for federal taxes. Additionally, it captures any adjustments or credits that may affect the overall tax liability. Filing Form 941 correctly is essential, as inaccuracies can lead to penalties and interest charges. Understanding the nuances of this form not only helps employers stay compliant but also aids in effective financial planning and management of payroll obligations.

More PDF Templates

Cair2 Login - Keep this document safe as proof of immunizations required for school enrollment.

The California Trailer Bill of Sale form is a legal document that records the sale and transfer of ownership of a trailer in California. This essential form protects both the buyer and seller by providing proof of the transaction and ensuring that all necessary details are documented. For more information and resources, you can visit California Templates to facilitate a smooth transfer, fill out the form by clicking the button below.

Prescription Paper for Controlled Substances - Provides a structured format for prescribing medications.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. |

| Filing Frequency | Employers must file Form 941 quarterly, with specific deadlines for each quarter. |

| Penalties | Failure to file Form 941 on time can result in penalties and interest on unpaid taxes. |

| State-Specific Forms | Some states require additional forms for state income tax withholding. Check local laws for specific requirements. |

How to Write IRS 941

Completing the IRS Form 941 is an important task for employers. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. After filling out the form, you will need to submit it to the IRS, along with any payment due, to ensure compliance with tax regulations.

- Obtain a copy of IRS Form 941. You can download it from the IRS website or request a physical copy.

- Fill in your business information at the top of the form. This includes your name, address, and Employer Identification Number (EIN).

- Report the number of employees you paid during the quarter. This information is crucial for calculating tax liabilities.

- Enter the total wages, tips, and other compensation you paid to employees during the quarter in the appropriate box.

- Calculate the total taxes withheld. This includes federal income tax, Social Security tax, and Medicare tax.

- Complete the sections for any adjustments. If you had any adjustments for sick pay or tips, make sure to include them here.

- Fill in the total tax liability for the quarter. This is the sum of all taxes calculated in the previous steps.

- Determine if you owe any taxes or if you are due a refund. This will depend on your total tax liability compared to what you have already paid.

- Sign and date the form. This confirms that the information provided is accurate to the best of your knowledge.

- Submit the completed form by the due date. You can file electronically or send a paper copy to the IRS.

Dos and Don'ts

When filling out the IRS Form 941, it's important to be careful and thorough. This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Here are some key dos and don'ts to keep in mind:

- Do double-check your business information, including your Employer Identification Number (EIN).

- Do ensure that all employee wages and tax amounts are accurately reported.

- Do file the form on time to avoid penalties.

- Do keep a copy of the completed form for your records.

- Do use the correct tax period for the form you are submitting.

- Don't forget to sign and date the form before submission.

- Don't leave any fields blank; if something doesn’t apply, write “0” or “N/A.”

- Don't use outdated forms; always download the most current version from the IRS website.

- Don't ignore instructions provided by the IRS; they are there to help you.

By following these guidelines, you can ensure that your Form 941 is filled out correctly and submitted without issues. Remember, attention to detail is key when dealing with tax forms!

Documents used along the form

The IRS Form 941 is an essential document for employers, as it reports employment taxes withheld from employee wages. However, several other forms and documents often accompany it to ensure compliance with tax regulations and provide a complete picture of an employer's tax obligations. Below is a list of these important documents, each serving a unique purpose.

- Form W-2: This form reports annual wages and the amount of taxes withheld from employees' paychecks. Employers must provide a W-2 to each employee by January 31 of the following year.

- Form W-3: This is a summary form that accompanies Form W-2 when submitting to the IRS. It provides totals for all W-2 forms issued by the employer.

- Form 940: This form is used to report and pay federal unemployment taxes (FUTA). Employers file it annually, and it helps determine their unemployment tax liability.

- Form 1099-MISC: This form is used to report payments made to independent contractors and other non-employees. It’s essential for tracking non-wage payments and ensuring accurate tax reporting.

- Form 944: Smaller employers may use this form to report annual payroll taxes instead of quarterly. It simplifies the filing process for those with lower tax liabilities.

- Form 1095-C: This form provides information about health insurance coverage offered to employees. It is part of the Affordable Care Act requirements for large employers.

- Form 8508: If an employer needs an extension for filing Forms 1099 or W-2, this form requests that extension from the IRS.

- Form 8822: This form is used to notify the IRS of a change of address. It’s important for ensuring that all tax-related correspondence is sent to the correct location.

- Non-disclosure Agreement: For protecting confidential information, consider utilizing the comprehensive Non-disclosure Agreement form to secure your interests.

- Form 941-X: This form is used to amend a previously filed Form 941. If mistakes are discovered, this form helps correct those errors.

Understanding these forms and documents is crucial for maintaining compliance with tax laws. By keeping accurate records and filing the necessary paperwork, employers can avoid penalties and ensure their tax obligations are met efficiently.