Fill Your IRS 433-F Form

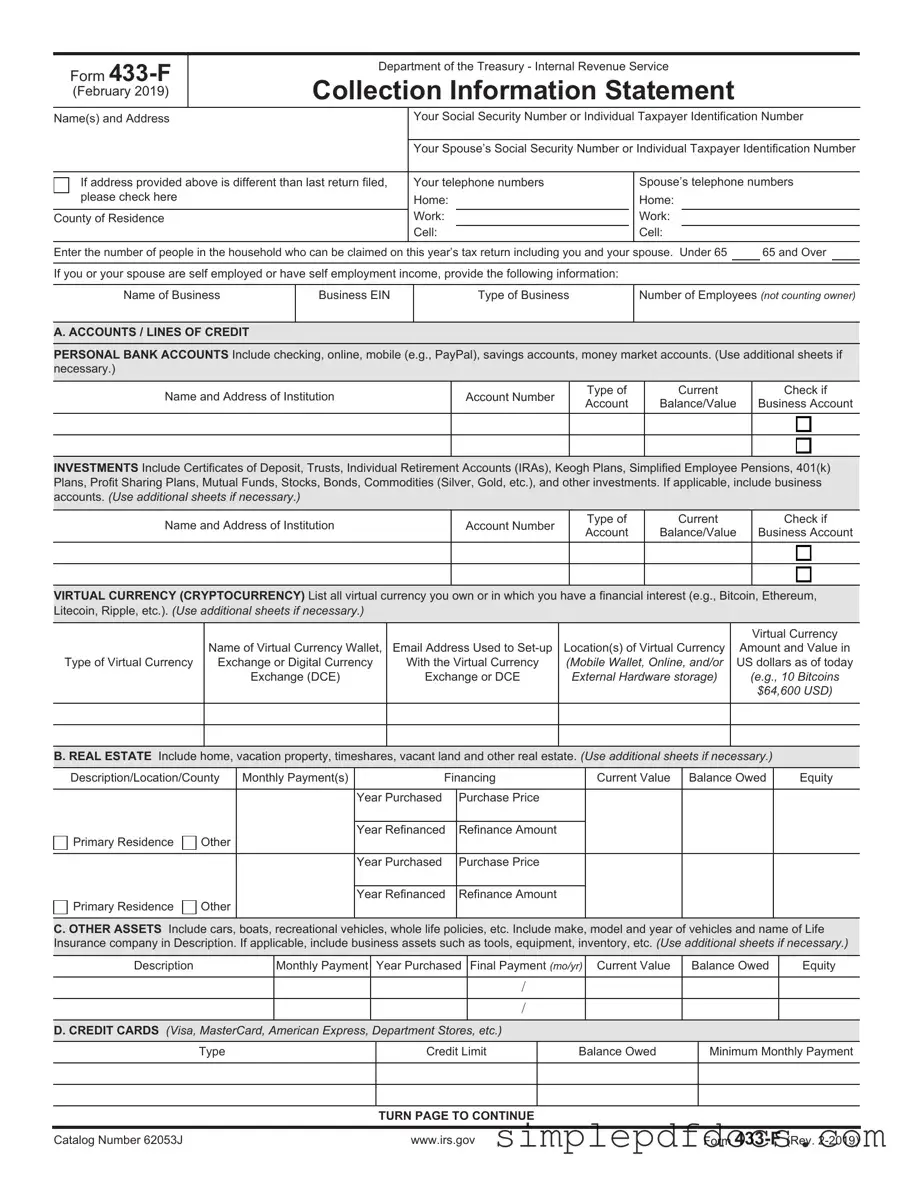

The IRS 433-F form plays a critical role in the process of tax collection and financial assessment for individuals and businesses facing tax liabilities. This form is primarily used by the Internal Revenue Service to gather essential information about a taxpayer's financial situation, including income, expenses, assets, and liabilities. By providing a comprehensive overview of one's financial standing, the 433-F enables the IRS to evaluate the taxpayer's ability to pay their tax debts. This assessment can lead to various outcomes, such as establishing payment plans, negotiating settlements, or determining eligibility for other tax relief options. Understanding the nuances of the 433-F form is vital for taxpayers who find themselves in financial distress, as it can significantly influence the resolution of their tax obligations. Completing the form accurately and thoroughly is essential, as it directly impacts the IRS's decision-making process regarding payment arrangements or potential penalties. As tax situations can be complex and stressful, familiarity with the 433-F form can empower individuals and businesses to navigate their financial responsibilities more effectively.

More PDF Templates

Why Does Fedex Need a Signature - Update your delivery address if necessary before completing the form.

Irs Form 1040 - Taxpayers can adjust their form based on changes in income or family status.

A Florida Commercial Lease Agreement is a legally binding document that outlines the terms and conditions under which a property owner leases commercial space to a tenant. This agreement typically includes details such as rental amount, duration of the lease, and responsibilities of both parties. For more information on how to properly draft this document, you can visit Florida Forms, which provides valuable resources to ensure a clear and mutually beneficial rental relationship.

Pa Inspection Bill - Note the size of your inspection area in the application.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS 433-F form is used to collect financial information from taxpayers to determine their ability to pay tax debts. |

| Who Uses It | IRS agents use this form during the collection process to evaluate a taxpayer's financial situation. |

| Required Information | Taxpayers must provide details about their income, expenses, assets, and liabilities. |

| Submission Method | The form can be submitted by mail or electronically, depending on the IRS's instructions. |

| State-Specific Forms | Some states have their own financial disclosure forms, governed by state tax laws, which may vary. |

| Confidentiality | The information provided is confidential and protected under federal law. |

| Consequences of Non-Submission | Failure to submit the form may result in enforced collection actions by the IRS. |

| Deadline for Submission | Taxpayers are typically given a specific timeframe to submit the form after being requested by the IRS. |

How to Write IRS 433-F

After obtaining the IRS 433-F form, you'll need to provide accurate and complete information to ensure your submission is processed efficiently. Follow the steps outlined below to fill out the form correctly.

- Begin with your personal information. Fill in your name, address, and Social Security number at the top of the form.

- Indicate your marital status by checking the appropriate box.

- List all sources of income. Include wages, self-employment income, rental income, and any other sources.

- Detail your monthly income. Break it down by source and provide the total amount.

- Next, outline your monthly expenses. Include housing costs, utilities, food, transportation, and any other necessary expenses.

- Provide information about your assets. List bank accounts, real estate, vehicles, and any other significant assets you own.

- Complete the section on liabilities. Note any debts, loans, or other financial obligations you have.

- Sign and date the form at the bottom. Make sure to review all entries for accuracy before submission.

Once you have filled out the form, you can submit it to the IRS as directed. Ensure you keep a copy for your records.

Dos and Don'ts

When filling out the IRS 433-F form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do: Provide accurate and complete information about your financial situation.

- Do: Include all sources of income, such as wages, self-employment earnings, and benefits.

- Do: List all assets, including bank accounts, real estate, and vehicles.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Provide misleading or false information, as this can lead to penalties.

- Don't: Forget to sign and date the form before submitting it.

- Don't: Submit the form without reviewing it for accuracy.

Documents used along the form

The IRS 433-F form is often used by individuals and businesses to provide detailed financial information to the IRS, especially when seeking to resolve tax debts. Along with this form, several other documents may be required to support your case. Below is a list of commonly used forms and documents that accompany the IRS 433-F.

- IRS Form 1040: This is the individual income tax return form. It provides a comprehensive overview of your annual income, deductions, and tax liability. Submitting this form helps the IRS assess your overall financial situation.

- Notice to Quit: For landlords, understanding the eviction process is critical, and the essential Notice to Quit guidelines provide important insights into notifying tenants to vacate the property.

- IRS Form 9465: This form is used to request a payment plan for tax debts. It allows taxpayers to propose a monthly payment amount that fits their budget while ensuring the IRS receives payment over time.

- IRS Form 433-A: This is a more detailed financial statement used for individuals who owe more significant amounts. It requires additional information about assets, liabilities, and monthly expenses, providing a clearer picture of your financial status.

- IRS Form 433-B: This form is similar to the 433-A but is specifically for businesses. It collects financial information about the business’s income, expenses, and assets, which is essential for negotiating tax resolutions.

- Supporting Documentation: This includes bank statements, pay stubs, and any other financial records that substantiate the information provided on the IRS forms. These documents help verify income and expenses, making your case stronger.

Gathering these documents along with the IRS 433-F form is crucial for a successful resolution process. Each form plays a role in presenting a complete financial picture to the IRS, aiding in negotiations and payment arrangements.