Fill Your IRS 2553 Form

Filing taxes can be a daunting task for many small business owners, especially when it comes to choosing the right tax structure. One important step in this process is filling out IRS Form 2553. This form is essential for businesses that want to elect to be taxed as an S corporation, which can provide significant tax benefits. By making this election, a corporation can avoid double taxation on its income, allowing profits to be passed directly to shareholders. However, the process isn't as simple as it may seem. There are specific eligibility requirements that must be met, including limits on the number of shareholders and the types of stock that can be issued. Additionally, the form must be filed in a timely manner, typically within 75 days of the beginning of the tax year. Understanding the ins and outs of Form 2553 can help business owners make informed decisions that align with their financial goals.

More PDF Templates

Odometer Disclosure Statement California - The seller should disclose any known issues or discrepancies before the sale.

In order to ensure a hassle-free transaction when selling or purchasing a boat, it is highly recommended to utilize resources like PDF Documents Hub for accessing the necessary California Boat Bill of Sale form, which formalizes the details of the sale and protects both the seller and buyer.

Texas Driver License Renewal Form - The DL-43 serves as a formal request for motor vehicle information.

Irs Transcript Request - The Sample Tax Return Transcript has certain security protocols due to sensitive information included.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by eligible small businesses to elect S Corporation status for federal tax purposes. |

| Eligibility | To qualify, a corporation must meet specific criteria, including having no more than 100 shareholders and only one class of stock. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year when the election is to take effect. |

| State Requirements | Some states require separate forms for S Corporation election; check state laws for compliance. |

| Shareholder Consent | All shareholders must consent to the S Corporation election by signing the form. |

| Tax Benefits | Electing S Corporation status can provide tax benefits, such as avoiding double taxation on corporate income. |

| Revocation | Once elected, the S Corporation status can be revoked, but this process has specific requirements and consequences. |

| Form Updates | The IRS periodically updates Form 2553; always use the latest version to ensure compliance. |

| Additional Resources | The IRS website offers guidance and resources for completing Form 2553 and understanding S Corporation elections. |

How to Write IRS 2553

Completing the IRS Form 2553 is a necessary step for small businesses that wish to elect S corporation status. After filling out this form, it must be submitted to the IRS to ensure that the election is recognized. Below are the steps to accurately fill out the form.

- Begin by downloading the IRS Form 2553 from the official IRS website.

- At the top of the form, enter the name of your corporation exactly as it appears on your Articles of Incorporation.

- Provide the corporation's Employer Identification Number (EIN) in the designated space.

- Fill in the date of incorporation and the state in which the corporation was formed.

- Indicate the tax year for which you are making the S corporation election.

- List the names, addresses, and social security numbers of all shareholders.

- Ensure that all shareholders sign and date the form, confirming their consent to the S corporation election.

- Review the completed form for accuracy and completeness.

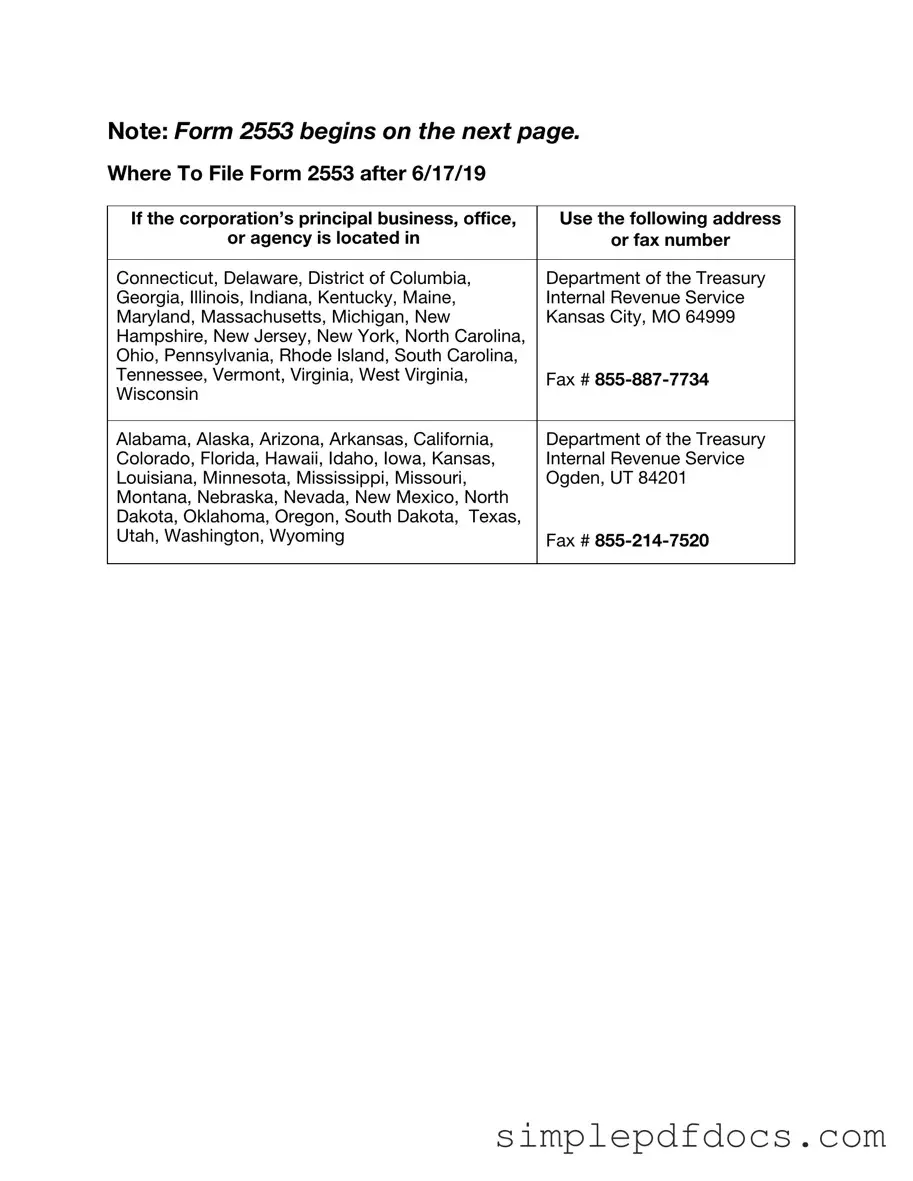

- Mail the form to the appropriate IRS address based on your business location.

Dos and Don'ts

Filling out the IRS 2553 form can be a straightforward process if you keep a few important points in mind. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before you start.

- Don’t rush through the form. Take your time to ensure accuracy.

- Do provide all required information, including your business name and address.

- Don’t leave any sections blank unless instructed to do so.

- Do check the eligibility requirements for S Corporation status.

- Don’t forget to sign and date the form before submission.

- Do file the form on time to avoid penalties.

- Don’t submit the form without a thorough review for errors.

- Do keep a copy of the completed form for your records.

- Don’t hesitate to seek help if you have questions about the process.

Documents used along the form

The IRS Form 2553 is essential for small businesses that wish to elect S Corporation status. However, several other forms and documents are often required or recommended to accompany this form. Understanding these documents can help ensure compliance with tax regulations and streamline the filing process.

- Form 1120S: This is the U.S. Income Tax Return for an S Corporation. It reports the income, deductions, and credits of the corporation, and is filed annually.

- Form 941: This form is used to report payroll taxes withheld from employees. It must be filed quarterly and includes information about wages and taxes paid.

- Form W-2: Employers must provide this form to employees to report annual wages and the taxes withheld. It is essential for employees to file their personal tax returns.

- Form W-3: This is a summary form that accompanies Form W-2 when filed with the Social Security Administration. It provides a summary of all W-2 forms issued by the employer.

- Form 1065: If the business has partners, this form is used to report income, deductions, and other information from partnerships. It is filed annually and provides details about the partnership's financial status.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It is particularly relevant for contractors and freelancers who receive payments from the business.

- Operating Agreement: While not a tax form, this document outlines the management structure and operating procedures of the business. It is crucial for clarifying roles and responsibilities among owners.

- Motorcycle Bill of Sale: For those engaging in the sale of motorcycles, it's essential to have a proper document like the Bill of Sale for a Motorcycle to facilitate the transfer of ownership and ensure all parties are protected.

- Bylaws: These are the rules governing the internal management of the corporation. Bylaws are important for ensuring compliance with state laws and maintaining organizational structure.

Filing the IRS Form 2553 is a critical step for businesses seeking S Corporation status. Accompanying documents play a vital role in maintaining compliance and ensuring accurate reporting. Familiarity with these forms can help business owners navigate the complexities of tax obligations more effectively.