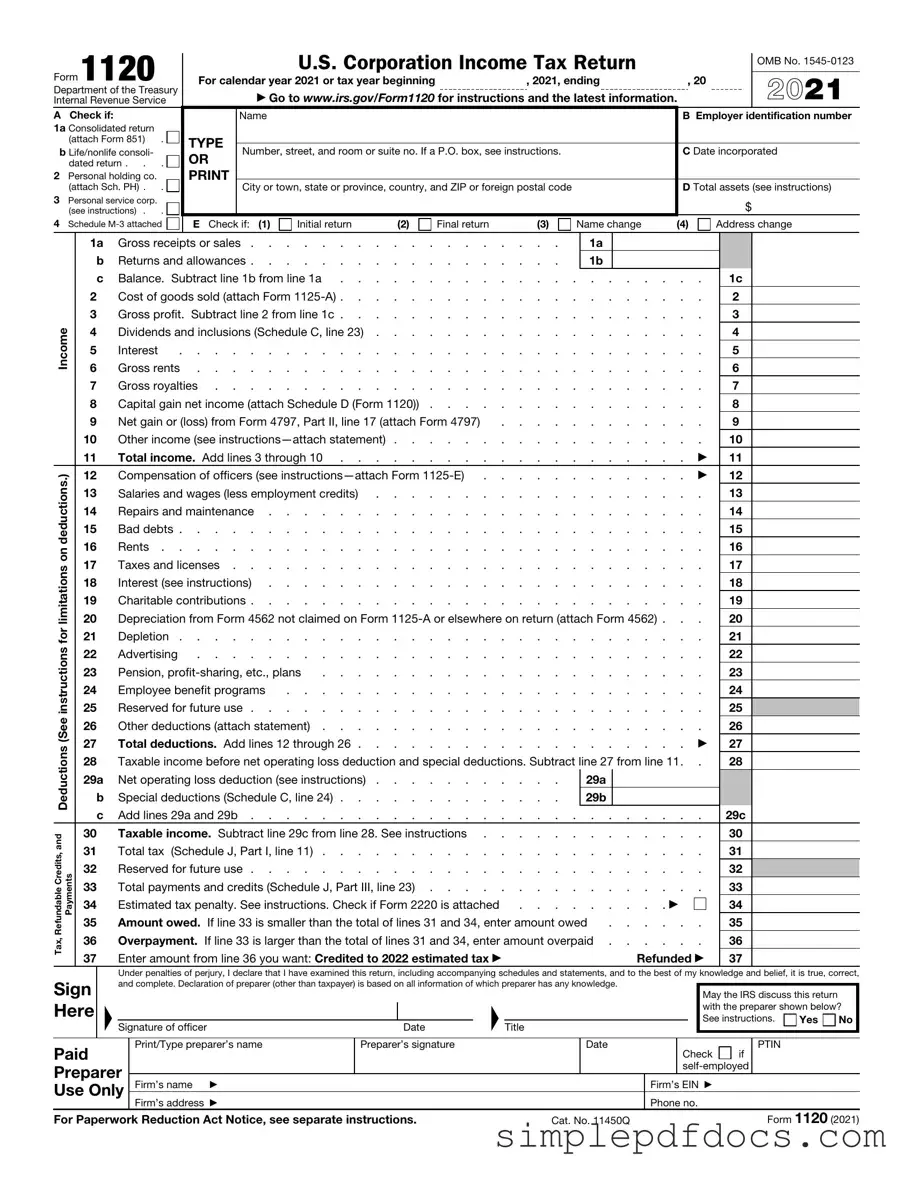

Fill Your IRS 1120 Form

The IRS 1120 form is a crucial document for corporations operating in the United States, serving as their official tax return. It plays a significant role in reporting income, gains, losses, deductions, and credits to the Internal Revenue Service. Corporations, including C corporations, must file this form annually, detailing their financial activities for the year. The form requires information about the company’s revenue, expenses, and the taxes owed, ensuring compliance with federal tax laws. Additionally, the IRS 1120 form includes sections for calculating taxable income, reporting dividends, and addressing any applicable tax credits. Understanding the nuances of this form is essential for corporate tax planning, as it can impact a corporation's overall tax liability and financial health. By accurately completing the IRS 1120, corporations can not only meet their legal obligations but also take advantage of potential tax benefits, making it a vital component of their fiscal strategy.

More PDF Templates

Legal Guardianship Forms - Should be kept updated as circumstances around custody change.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. It's an essential tool for anyone who needs someone else to manage their vehicle affairs, especially when they're unable to do so themselves. For more information, you can visit floridaforms.net/blank-motor-vehicle-power-of-attorney-form.

Melaleuca Cancellation Form Pdf - The process is structured to ensure clarity and ease for customers.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Deadline | Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year. For calendar year corporations, this is typically April 15. |

| State-Specific Forms | Many states require their own corporate tax forms, which may be governed by specific state laws. For example, California requires Form 100, governed by the California Revenue and Taxation Code. |

| Electronic Filing | Form 1120 can be filed electronically through the IRS e-file system, which can help speed up processing and reduce errors. |

How to Write IRS 1120

Completing the IRS Form 1120 is an essential task for corporations in the United States. This form serves as the annual income tax return for corporations, and it requires careful attention to detail. Below are the steps to guide you through the process of filling out this form.

- Begin by downloading the IRS Form 1120 from the official IRS website or obtaining a physical copy.

- At the top of the form, fill in the corporation's name, address, and Employer Identification Number (EIN).

- Indicate the date of incorporation and the total assets of the corporation at the end of the tax year.

- In Part I, report the corporation's income. This includes gross receipts or sales, cost of goods sold, and other income.

- Calculate the corporation's taxable income by subtracting the cost of goods sold and other deductions from the total income.

- In Part II, detail the corporation’s deductions. This section includes salaries, wages, rent, and other business expenses.

- Complete Part III, where you will calculate the tax liability based on the taxable income reported in Part I.

- Fill out Part IV, which requires information on the corporation's tax credits and payments made during the year.

- Sign and date the form. Ensure that the signature is from an authorized officer of the corporation.

- Finally, submit the completed form to the IRS by the due date, which is typically the 15th day of the fourth month after the end of the corporation’s tax year.

By following these steps, you can accurately complete the IRS Form 1120, ensuring compliance with federal tax regulations. Remember to keep a copy for your records, as it may be needed for future reference or audits.

Dos and Don'ts

Filling out the IRS Form 1120, which is used by corporations to report their income, can be a complex task. To help you navigate this process, here are some important dos and don'ts to consider.

- Do gather all necessary financial documents before starting. This includes income statements, balance sheets, and any other relevant records.

- Do ensure that you are using the correct version of the form for the tax year you are filing. Tax laws can change, and using an outdated form may lead to complications.

- Do double-check all calculations. Simple math errors can lead to significant issues, including penalties or audits.

- Do keep a copy of your completed form for your records. This can be helpful for future reference or in case of an audit.

- Don't rush through the form. Take your time to ensure that all information is accurate and complete.

- Don't ignore the instructions provided by the IRS. They offer valuable guidance on how to correctly fill out the form.

- Don't forget to sign and date the form before submitting it. An unsigned form can be considered incomplete and may delay processing.

By following these guidelines, you can help ensure that your filing process goes smoothly and that you meet your tax obligations accurately and on time.

Documents used along the form

The IRS Form 1120 is the U.S. Corporation Income Tax Return, primarily used by corporations to report their income, gains, losses, deductions, and credits. While this form is crucial for corporate tax reporting, several other forms and documents often accompany it to provide a comprehensive financial picture. Below is a list of these additional forms, each serving a unique purpose in the tax reporting process.

- Schedule C: This form is used to report income or loss from a sole proprietorship. It provides details on business income and expenses, helping to determine the net profit or loss.

- Schedule D: This document reports capital gains and losses from the sale of assets. Corporations must disclose transactions involving stocks, bonds, and other capital assets to calculate their tax obligations accurately.

- Form 941: This is the Employer's Quarterly Federal Tax Return, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is essential for corporations with employees to ensure compliance with payroll tax requirements.

- Form 1125-A: This form details the cost of goods sold. Corporations that manufacture or sell products must complete this form to calculate their gross income accurately.

- Form 1125-E: This document is used to report compensation of officers. It provides transparency regarding the salaries and bonuses paid to corporate officers, which can impact the overall tax liability.

- Form 4562: This form is used to report depreciation and amortization. Corporations must detail their depreciable assets and the corresponding deductions they are claiming for tax purposes.

- Residential Lease Agreement: This essential document outlines the terms between a landlord and tenant, ensuring clarity on rental conditions. For more details, you can refer to the comprehensive resource available at https://nyforms.com/.

- Form 5471: This is the Information Return of U.S. Persons With Respect to Certain Foreign Corporations. It is required for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, ensuring compliance with international tax laws.

- Form 8865: This form is used for reporting information on U.S. persons with respect to foreign partnerships. Similar to Form 5471, it helps maintain transparency in international business dealings and tax obligations.

Understanding these forms and their purposes is essential for corporations to navigate the complexities of tax compliance effectively. Each document plays a critical role in ensuring that all financial activities are reported accurately, thus minimizing the risk of penalties or audits from the IRS.