Attorney-Approved Investment Letter of Intent Form

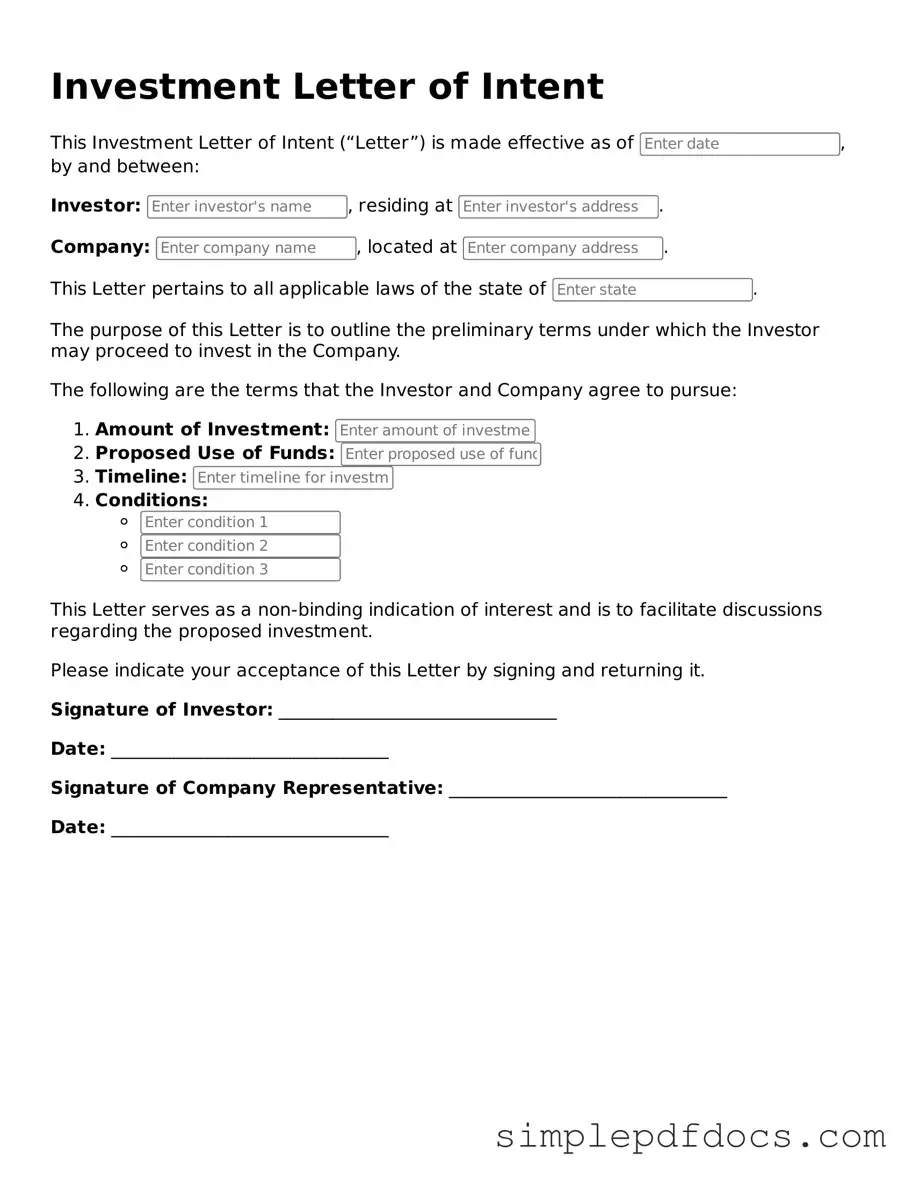

When embarking on an investment journey, clarity and mutual understanding between parties are paramount. The Investment Letter of Intent (LOI) serves as a critical tool in this process, outlining the preliminary terms and intentions of the investment before any formal agreements are drawn up. This document typically includes essential details such as the amount of investment, the type of security being offered, and the timeline for closing the deal. Additionally, it often highlights any conditions that must be met before the transaction can proceed, ensuring that both parties are aligned in their expectations. By capturing the essence of the investment relationship, the LOI not only sets the stage for future negotiations but also helps to establish trust and transparency. Whether you are an investor looking to secure a stake in a promising venture or a business seeking funding, understanding the components of the Investment Letter of Intent is crucial for navigating the complexities of financial partnerships.

More Investment Letter of Intent Types:

Letter of Intent for Lease - The LOI can include proposed timelines for completing the lease agreement.

How to Create a Letter of Intent - This letter can help establish your credibility with potential funders.

Letter of Intent to Homeschool - Can be pivotal for obtaining funding or support specific to homeschoolers.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent serves as a preliminary agreement outlining the terms and conditions under which an investor intends to invest in a company. |

| Non-Binding Nature | This document is typically non-binding, meaning it expresses intent rather than creating a legally enforceable obligation. |

| Key Components | It usually includes details such as the amount of investment, valuation, and proposed terms for the investment. |

| Confidentiality Clause | Many Investment Letters of Intent include a confidentiality clause to protect sensitive information shared during negotiations. |

| Governing Law | The governing law varies by state; for instance, in California, the laws of California will apply, while in New York, New York laws govern. |

| Expiration Date | These letters often have an expiration date, after which the terms may no longer be valid or negotiable. |

| Due Diligence | Investors typically conduct due diligence after signing the letter, assessing the company’s financial health and business model. |

| Negotiation Tool | The letter serves as a negotiation tool, allowing both parties to clarify expectations before finalizing a formal agreement. |

| Legal Review | Although generally non-binding, it is advisable for parties to seek legal review to ensure all terms are clear and understood. |

How to Write Investment Letter of Intent

Filling out the Investment Letter of Intent form is an important step in the investment process. Once you complete this form, you can move forward with the next stages of your investment journey. Here’s how to fill it out correctly.

- Begin by entering your personal information at the top of the form. This includes your full name, address, phone number, and email address.

- Next, provide details about the investment opportunity. Include the name of the investment, the amount you intend to invest, and any relevant dates.

- In the designated section, outline your investment goals. Be clear about what you hope to achieve through this investment.

- Review any terms and conditions associated with the investment. Make sure you understand them before proceeding.

- Sign and date the form at the bottom. This confirms your intention to invest and acknowledges that you understand the information provided.

- Finally, submit the completed form as instructed. This may involve sending it via email or mailing a physical copy.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is essential to follow certain guidelines to ensure clarity and accuracy. Below is a list of recommended actions and common pitfalls to avoid.

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and truthful information regarding your financial status.

- Do: Clearly outline your investment goals and expectations.

- Do: Use clear and concise language to avoid misunderstandings.

- Don't: Rush through the form; take your time to ensure all information is complete.

- Don't: Leave any required fields blank; incomplete forms may be rejected.

- Don't: Use jargon or overly technical language that may confuse the reader.

- Don't: Submit the form without reviewing it for errors or inconsistencies.

Documents used along the form

The Investment Letter of Intent (LOI) is an important document that outlines the preliminary understanding between parties involved in an investment. Alongside this form, several other documents may be necessary to ensure a smooth investment process. Here are five common forms and documents that are often used in conjunction with the Investment Letter of Intent.

- Confidentiality Agreement: This document protects sensitive information shared between parties during negotiations. It ensures that both sides keep proprietary information private and secure.

- Term Sheet: A term sheet summarizes the key terms and conditions of the investment. It serves as a roadmap for the final agreement, outlining the structure and expectations of the deal.

- Due Diligence Checklist: This checklist helps investors gather and assess information about the investment opportunity. It typically includes financial statements, legal documents, and operational details to evaluate the viability of the investment.

- Homeschool Intent Letter: Parents looking to homeschool their children in Alabama must complete a formal document, known as the Homeschool Intent Letter, to notify the state of their educational choice.

- Subscription Agreement: This agreement formalizes the investor's commitment to purchase shares or interests in a company. It outlines the terms of the investment and the rights of the investor.

- Operating Agreement: For limited liability companies (LLCs), this document details the management structure and operational procedures. It defines the roles and responsibilities of members and managers involved in the business.

These documents play a crucial role in the investment process. They help clarify expectations and protect the interests of all parties involved. Understanding each of these forms can lead to a more successful and transparent investment experience.