Fill Your Intent To Lien Florida Form

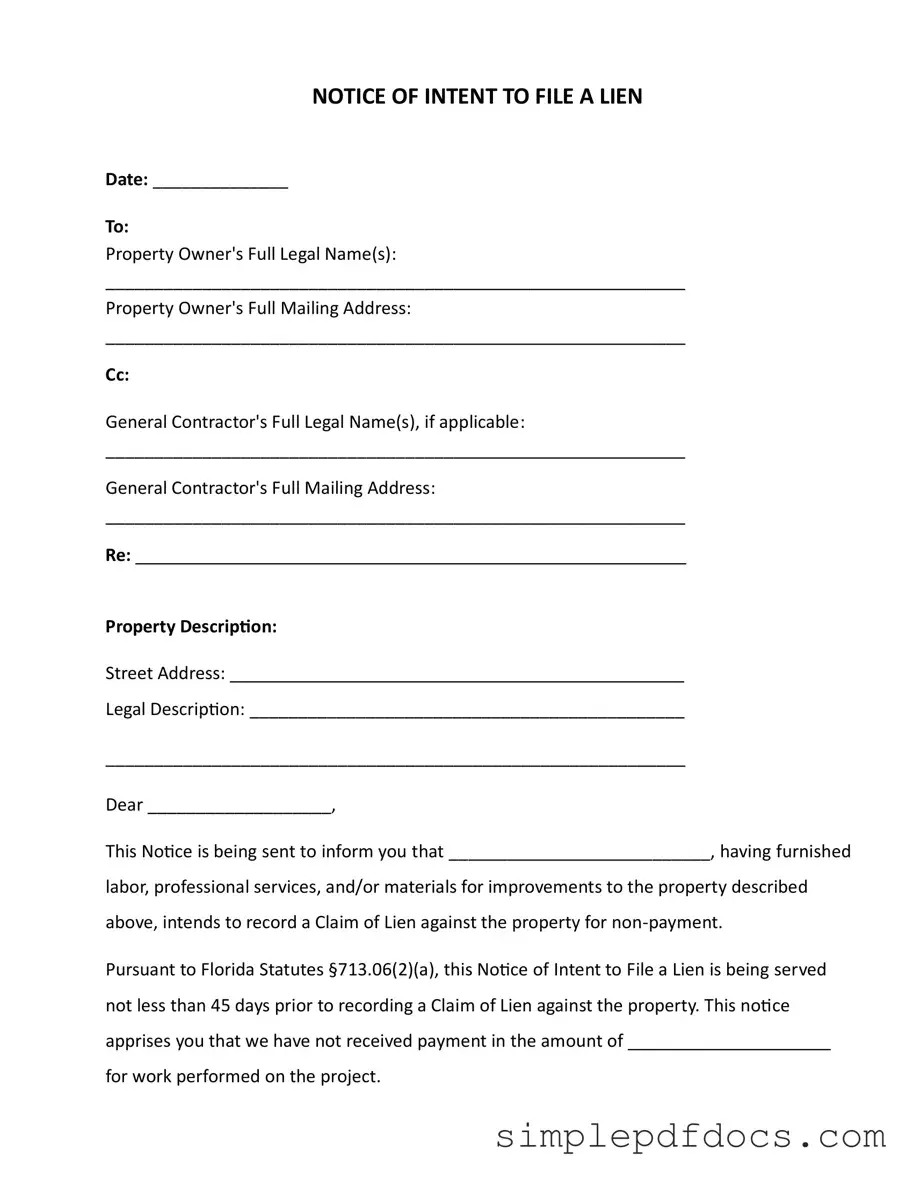

The Intent To Lien Florida form serves as a crucial tool for contractors and suppliers who have not received payment for their services or materials. This form notifies property owners of an impending lien against their property, highlighting the importance of prompt payment. It includes essential details such as the property owner's name, mailing address, and a description of the property in question. Additionally, the form specifies the amount owed and the reason for the lien. According to Florida law, this notice must be sent at least 45 days before filing a Claim of Lien, ensuring that property owners are given adequate warning. The document also emphasizes the potential consequences of non-payment, including the risk of foreclosure and additional legal costs. By sending this notice, the contractor expresses a desire to resolve the issue amicably, urging the property owner to respond within 30 days to avoid further action. This proactive approach not only protects the contractor's interests but also fosters clear communication between all parties involved in the construction process.

More PDF Templates

Verification Forms - A contact phone number is necessary for any follow-up questions.

In order to effectively communicate the need for tenants to vacate or remedy any lease violations, landlords may utilize the Texas Notice to Quit form. This legal document plays a vital role in the eviction process, ensuring clarity regarding the rights and responsibilities of both parties. For a seamless process in handling this legal requirement, it's recommended to accurately fill out the form by visiting https://texasformspdf.com.

Subcontractor Pay Stub - A document showcasing the financial relationship between contractor and client.

Document Specifics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Intent to Lien form is used to notify property owners that a lien may be filed against their property due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien in Florida. |

| Notice Period | The form must be served at least 45 days before a lien is recorded, ensuring the property owner has time to respond. |

| Response Time | Property owners have 30 days to respond to the notice. Failure to respond may lead to the recording of a lien. |

| Consequences of Non-Payment | If payment is not made, the property could be subject to foreclosure proceedings, which may incur additional costs for the owner. |

| Certificate of Service | The form includes a section for certifying that the notice was properly delivered to the property owner, ensuring legal compliance. |

| Contact Information | It is essential to provide accurate contact details in the form to facilitate communication regarding the outstanding payment. |

| Importance of Timeliness | Filing the Intent to Lien in a timely manner is crucial to protect the right to claim a lien on the property for unpaid work. |

How to Write Intent To Lien Florida

Filling out the Intent to Lien form in Florida is an important step if you are seeking to secure payment for services rendered or materials supplied. After completing the form, it must be served to the property owner and, if applicable, the general contractor. Follow the steps below to ensure accurate and complete submission of the form.

- Date: Fill in the date on which you are completing the form.

- Property Owner's Full Legal Name(s): Enter the full legal name of the property owner(s).

- Property Owner's Full Mailing Address: Provide the complete mailing address of the property owner(s).

- General Contractor's Full Legal Name(s): If applicable, include the full legal name of the general contractor.

- General Contractor's Full Mailing Address: Enter the mailing address for the general contractor, if applicable.

- Re: Specify the subject or reference related to the lien.

- Property Description: Include the street address of the property.

- Legal Description: Write the legal description of the property.

- Dear: Address the property owner by name.

- Labor/Services/Materials: State who is providing the labor, services, or materials and indicate the intent to file a lien.

- Payment Amount: Fill in the amount owed for the work performed.

- Signature: Sign the form with your name, title, phone number, and email address.

- Certificate of Service: Complete this section by indicating the method of service used to deliver the notice.

Once the form is filled out, it should be delivered to the property owner and any applicable parties. Ensure that you keep a copy for your records. This will help maintain a clear line of communication and may assist in resolving the payment issue before further action is necessary.

Dos and Don'ts

Things You Should Do:

- Fill out the form completely and accurately.

- Include all required details, such as property owner's name and address.

- Clearly state the amount owed for services or materials provided.

- Send the notice at least 45 days before filing a lien.

- Keep a copy of the notice for your records.

Things You Shouldn't Do:

- Do not leave out any important information.

- Avoid sending the notice without verifying the recipient's details.

- Do not wait until the last minute to send the notice.

- Never assume the property owner knows about the debt.

- Do not ignore any responses from the property owner.

Documents used along the form

The Intent to Lien Florida form is an important document for those involved in construction and property improvements. However, it is often accompanied by other forms and documents that help clarify and support the lien process. Here are a few key documents that are commonly used alongside the Intent to Lien form.

- Claim of Lien: This document is filed after the Notice of Intent to File a Lien. It officially records the lien against the property, detailing the amount owed and the nature of the work performed. Filing this document is essential for enforcing the lien rights.

- Employment Verification Form: This form is essential for confirming the employment status of an individual and can be particularly useful in various scenarios, including background checks and loan applications. For more information on this document, you can refer to Florida Forms.

- Notice of Non-Payment: This notice serves to inform the property owner that payment has not been received for services rendered. It can be sent prior to the Intent to Lien form and acts as a formal reminder of the outstanding debt.

- Waiver of Lien: This document is used when a contractor or subcontractor agrees to waive their right to file a lien against the property in exchange for payment. It provides protection for property owners by ensuring that they are not subject to future claims for the same work.

- Release of Lien: Once payment is made, this document is issued to formally release the lien. It confirms that the debt has been satisfied and that the property is free from any claims related to the work performed.

Using these documents correctly can help ensure a smoother process when dealing with payments and liens in Florida. Understanding each form's role is crucial for both property owners and contractors to protect their rights and interests.