Fill Your Independent Contractor Pay Stub Form

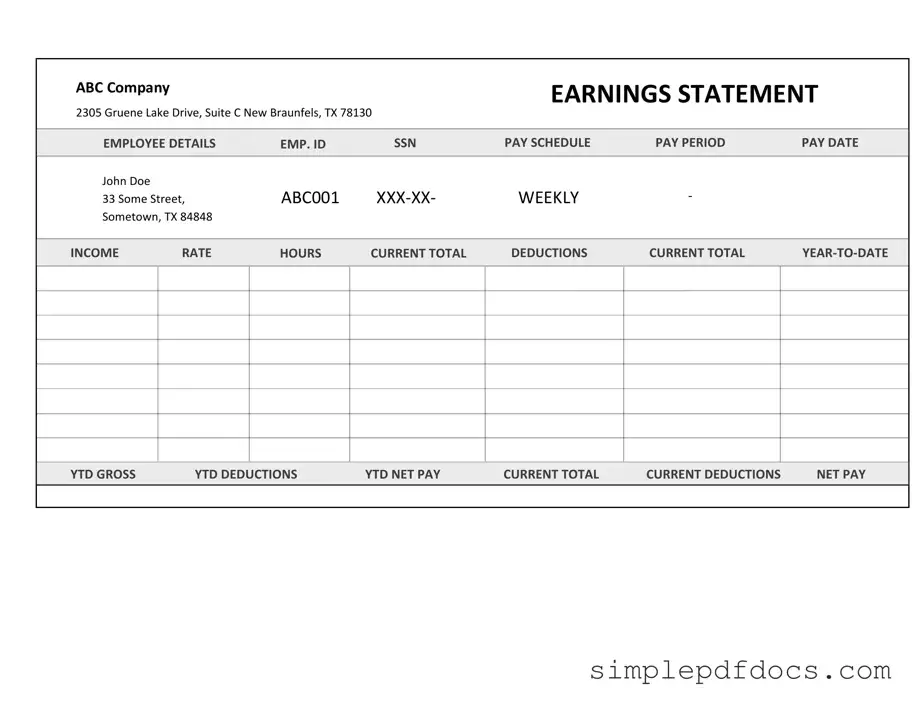

The Independent Contractor Pay Stub form serves as a crucial document for both contractors and businesses, ensuring clarity and transparency in financial transactions. This form outlines essential details such as the contractor's name, the services provided, and the payment amount, helping to establish a clear record of earnings. It typically includes information about the payment period, any deductions made, and the net amount received, allowing contractors to track their income effectively. Additionally, the form may specify the method of payment, whether by check, direct deposit, or another means. By providing a comprehensive overview of earnings and deductions, the Independent Contractor Pay Stub form not only aids in personal financial management but also serves as a vital tool for tax reporting and compliance. Understanding the components of this form is essential for independent contractors to ensure they receive fair compensation for their work while maintaining accurate records for their financial needs.

More PDF Templates

Aia A305 Form 2020 Free Download - This form helps owners assess potential contractors before awarding contracts.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. This form simplifies the process, making it faster and more straightforward to shift ownership. For those looking to obtain the form, you can find it at https://floridaforms.net/blank-quitclaim-deed-form.

Annual Physical Examination Form Pdf - List all current medications you are taking to ensure safe and effective care.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors. |

| Purpose | It serves as a record of payment, helping contractors track their income and taxes. |

| Components | The pay stub typically includes the contractor's name, address, payment period, and total earnings. |

| Deductions | It may list deductions for taxes, insurance, and other withholdings, though independent contractors often handle their own taxes. |

| State-Specific Forms | Some states may have specific requirements for pay stubs, including California and New York, governed by labor laws. |

| Legal Requirement | While not always legally required, providing a pay stub is considered a best practice for transparency. |

| Frequency of Issuance | Pay stubs are usually issued on a regular schedule, such as bi-weekly or monthly, depending on the contractor's agreement. |

| Record Keeping | Contractors should keep pay stubs for their records, especially for tax filing purposes. |

| Format | Pay stubs can be provided in paper or electronic formats, with electronic versions becoming increasingly common. |

| Verification | Contractors can use pay stubs to verify income when applying for loans or other financial services. |

How to Write Independent Contractor Pay Stub

Completing the Independent Contractor Pay Stub form is an important step in ensuring accurate payment records. Follow the steps below to fill out the form correctly.

- Begin by entering your name in the designated field. Ensure it matches the name on your tax documents.

- Next, provide your address. Include your street address, city, state, and ZIP code.

- Fill in the date of payment. This should reflect the date you are being paid.

- Indicate the pay period. Specify the start and end dates for the work you are being compensated for.

- Enter the total amount earned during the pay period. This should be the gross amount before any deductions.

- List any deductions if applicable. This may include taxes or other withholdings.

- Calculate the net pay by subtracting any deductions from the total amount earned. Write this figure clearly.

- Finally, sign and date the form at the bottom to certify the information provided is accurate.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do provide accurate personal information, including your name and address.

- Do include the correct date of payment.

- Do specify the services rendered clearly.

- Do calculate the total amount due carefully, including any deductions.

- Do keep a copy of the completed pay stub for your records.

- Don't use vague descriptions for the services provided.

- Don't forget to include your tax identification number if required.

- Don't alter any pre-printed information on the form.

- Don't submit the form without double-checking for errors.

Documents used along the form

When working with independent contractors, several forms and documents are commonly used alongside the Independent Contractor Pay Stub. Each of these documents serves a specific purpose and helps ensure clarity and compliance in the working relationship.

- Independent Contractor Agreement: This document outlines the terms and conditions of the working relationship. It specifies the scope of work, payment terms, and responsibilities of both parties.

- Florida Traffic Crash Report: In the event of a traffic incident, this report is vital to document necessary details and comply with state law. For more information, visit Florida Forms.

- W-9 Form: This form is used to collect the contractor's taxpayer identification number. It is essential for reporting income to the IRS and ensuring tax compliance.

- Invoice: An invoice is submitted by the contractor to request payment for services rendered. It typically includes details like the services provided, payment due date, and the total amount owed.

- Payment Receipt: After payment is made, a receipt is issued to confirm the transaction. This document serves as proof of payment for both the contractor and the hiring entity.

- 1099 Form: At the end of the tax year, this form is issued to report payments made to independent contractors. It is crucial for tax filing and compliance purposes.

- Scope of Work Document: This outlines specific tasks and deliverables expected from the contractor. It helps prevent misunderstandings and ensures that both parties are on the same page regarding project expectations.

Understanding these documents can help streamline the process of working with independent contractors. Each form plays a vital role in maintaining a professional and transparent relationship, ultimately benefiting both parties involved.