Fill Your Goodwill donation receipt Form

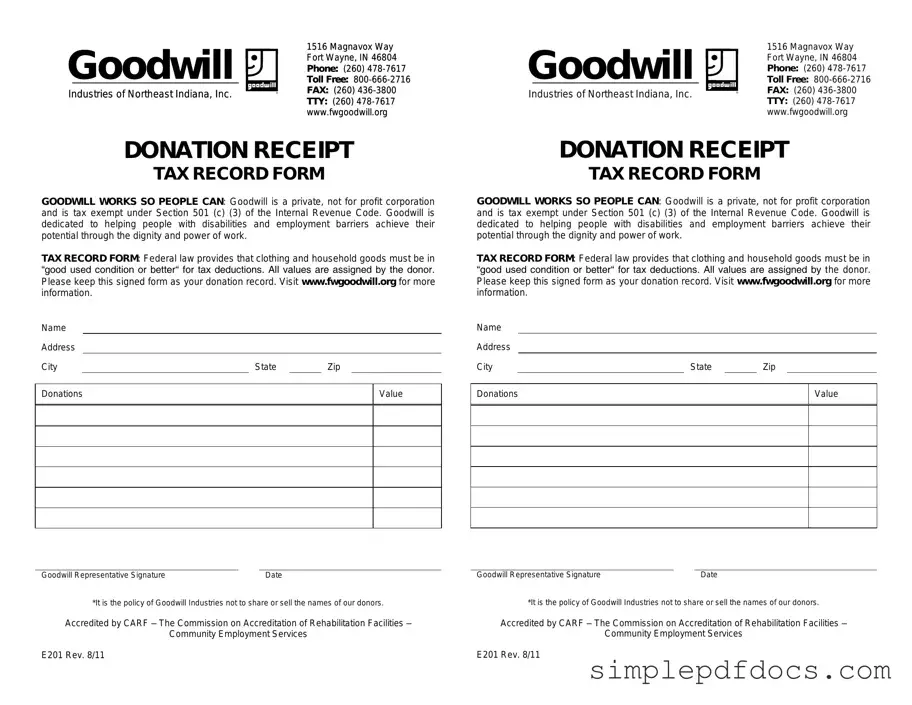

When you donate items to Goodwill, obtaining a donation receipt is an essential step that benefits both you and the organization. This receipt serves as proof of your charitable contribution, which is crucial for tax purposes. It typically includes details such as your name, the date of the donation, and a description of the items donated. Understanding the significance of this form is vital, especially during tax season when you may want to claim deductions for your generosity. The Goodwill donation receipt form also outlines the estimated value of your items, though it’s important to note that you are responsible for determining this value. By keeping a record of your donations, you not only support a worthy cause but also ensure that you maximize your potential tax benefits. Familiarizing yourself with the elements of the receipt can streamline the donation process and help you stay organized throughout the year.

More PDF Templates

Basketball Evaluation Form Pdf - Assess attitude towards coaching and feedback for growth opportunities.

Free Facial Consent Form Template - It clearly defines the relationship between you and your therapist.

In Texas, ensuring a seamless transaction when buying or selling a motorcycle is crucial, which is why the Motorcycle Bill of Sale form is essential. This legal document captures vital details of both the buyer and seller along with information about the motorcycle, serving as a protective measure for all parties involved. For those looking to easily complete this necessary paperwork, you can visit https://texasformspdf.com/ to fill out the form online.

Direction to Pay Form Contractor - When properly used, this form can help smooth over any payment misunderstandings.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of your charitable contribution for tax purposes. |

| Tax Deduction | Donations made to Goodwill are generally tax-deductible, allowing donors to reduce their taxable income. |

| Itemization | Donors should list the items donated on the receipt to substantiate the value claimed on their tax return. |

| Value Assessment | Goodwill recommends that donors assess the fair market value of their items, as this will be necessary for tax records. |

| State-Specific Forms | Some states may have specific requirements for donation receipts, so it’s important to check local laws. |

| Record Keeping | Keep the receipt in a safe place, as the IRS may request it if you are audited. |

How to Write Goodwill donation receipt

After gathering your items for donation, you will need to complete the Goodwill donation receipt form. This form serves as proof of your charitable contribution and can be useful for tax purposes. Follow these steps to fill out the form accurately.

- Start by entering your name in the designated field.

- Provide your address, including city, state, and zip code.

- Write the date of the donation.

- List the items you are donating. Be specific about each item.

- Estimate the value of each item. Consider fair market value for accurate reporting.

- Sign the form to confirm the information is correct.

- Keep a copy of the completed form for your records.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it's important to follow certain guidelines to ensure everything is accurate and clear. Here are some do's and don'ts to keep in mind:

- Do write clearly and legibly to avoid any confusion.

- Do include the date of the donation for your records.

- Do list all items donated, including their condition and estimated value.

- Do keep a copy of the receipt for your tax records.

- Do ask for help if you're unsure about how to fill out any part of the form.

- Don't leave any sections blank; fill out every required field.

- Don't overestimate the value of your items; be honest and realistic.

- Don't forget to sign the receipt if required.

- Don't discard the receipt until you have confirmed it is accurate and complete.

Documents used along the form

When making a donation to Goodwill or similar organizations, several important documents may accompany the Goodwill donation receipt form. Each of these documents serves a specific purpose and can help ensure that the donation process is smooth and well-documented.

- Donation Inventory List: This document details the items being donated, including descriptions and estimated values. It helps both the donor and the charity keep track of what was given.

- Tax Deduction Worksheet: This form assists donors in calculating the potential tax deductions for their charitable contributions. It outlines IRS guidelines and provides a space for recording donation values.

- Charity Confirmation Letter: After a donation is made, a charity confirmation letter may be issued. This letter confirms the receipt of the donation and can serve as additional proof for tax purposes.

- Operating Agreement Form: It's beneficial for LLCs to have an operating agreement that outlines governance and responsibilities among members, ensuring clarity in operations. For more details, you can access the form at https://floridaforms.net/blank-operating-agreement-form.

- Donor Agreement Form: Some organizations require a donor agreement form to outline the terms of the donation. This document clarifies any conditions or restrictions related to the donated items.

- IRS Form 8283: For donations exceeding a certain value, this form is necessary. It is used to report non-cash charitable contributions to the IRS and requires the signature of a qualified appraiser for high-value items.

Having these documents organized and readily available can significantly streamline the donation process and ensure compliance with tax regulations. It is advisable to keep copies of all forms for personal records and future reference.