Fill Your Gift Letter Form

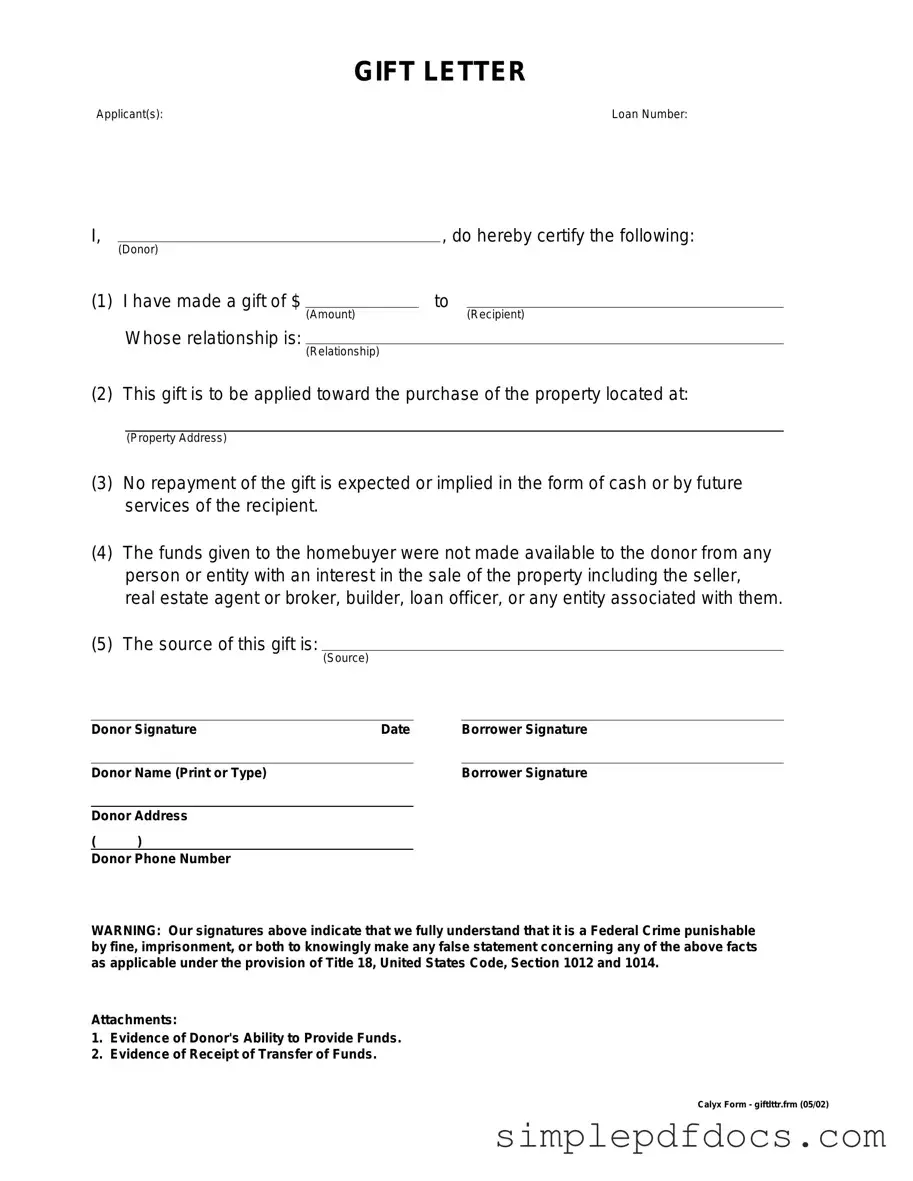

The Gift Letter form plays a crucial role in various financial transactions, particularly in the realm of real estate. When someone receives a monetary gift, often from a family member or close friend, this form serves as a formal declaration that the funds are indeed a gift and not a loan. This distinction is essential for both the recipient and the lender, as it can significantly impact mortgage applications and approval processes. Typically, the form includes important details such as the donor's name, the recipient's name, the amount of the gift, and a statement affirming that repayment is not expected. Additionally, it may require the donor's signature to validate the information provided. By clarifying the nature of the funds, the Gift Letter helps to ensure that the recipient can secure financing without complications, making it a vital document in many financial dealings.

More PDF Templates

Affidavit Death of Joint Tenant California - It provides clarity and ensures that property transfers are handled correctly following a death.

How to Obtain a Background Check on Myself - All job applicants must consent to background checks before employment.

The Florida Vehicle POA form 82053 is essential for individuals who need to delegate responsibilities related to their vehicles. This legal document streamlines the process of vehicle transactions, ensuring that tasks such as buying, selling, or registering a vehicle are handled smoothly. For more information about this form and its uses, visit Florida Forms.

Warranty on Roof - Homeowners must pay for repairs not related to MCS Roofing's workmanship.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | A gift letter form is used to document a monetary gift, typically for a home purchase, ensuring clarity in financial transactions. |

| Donor's Intent | The form explicitly states that the funds are a gift and not a loan, which is crucial for mortgage lenders. |

| State-Specific Requirements | Different states may have specific requirements for gift letters; for instance, California requires a signed statement from the donor. |

| Tax Implications | Gift amounts exceeding $15,000 (as of 2021) may require the donor to file a gift tax return under federal law. |

| Documentation | Along with the gift letter, donors may need to provide bank statements to verify the source of the funds. |

How to Write Gift Letter

Completing the Gift Letter form is an important step in the process of documenting financial support. This letter typically serves to confirm that a monetary gift has been given without any expectation of repayment. Follow these steps to ensure the form is filled out correctly.

- Begin by entering the date at the top of the form. Make sure to use the current date.

- Fill in the name of the donor, the person giving the gift. Include their full legal name as it appears on official documents.

- Provide the donor's address. This should be the complete address, including street, city, state, and zip code.

- Next, include the recipient's name, the person receiving the gift. Again, use their full legal name.

- Fill in the recipient's address, ensuring it is accurate and complete.

- Specify the amount of the gift. Clearly write the dollar amount in both numerical and written form to avoid any confusion.

- Indicate the purpose of the gift, if applicable. This could be for a home purchase, education, or another specific reason.

- Both the donor and the recipient should sign the form. Signatures should be dated as well.

- Make copies of the completed form for both the donor and recipient's records.

Once the Gift Letter form is completed, it should be submitted as part of the necessary documentation for the intended transaction. Ensure all information is accurate to avoid delays in processing.

Dos and Don'ts

When filling out a Gift Letter form, it is important to follow certain guidelines to ensure the process goes smoothly. Below are nine key dos and don'ts to consider.

- Do clearly state the relationship between the donor and the recipient.

- Do specify the amount of the gift being given.

- Do include the date the gift was made.

- Do provide a signature from the donor to validate the letter.

- Do ensure the letter is free from errors and clearly written.

- Don't use vague language that could lead to misunderstandings.

- Don't omit important details, such as the purpose of the gift.

- Don't forget to keep a copy of the letter for your records.

- Don't rush through the form; take your time to fill it out accurately.

By adhering to these guidelines, you can help ensure that your Gift Letter form is properly completed and accepted without complications.

Documents used along the form

When individuals receive financial assistance in the form of gifts, especially in the context of purchasing a home, several forms and documents accompany the Gift Letter to ensure clarity and compliance with regulations. Each of these documents serves a specific purpose, providing necessary information to lenders and helping to establish the legitimacy of the gift. Below is a list of common forms and documents often used alongside a Gift Letter.

- Bank Statement: This document shows the donor's account balance and transaction history, confirming that the funds are available and have been transferred to the recipient.

- Gift Tax Return (Form 709): This form is filed with the IRS if the gift exceeds a certain amount, documenting any tax implications for the donor.

- Tractor Bill of Sale: To ensure a smooth transaction when transferring tractor ownership, utilize the comprehensive tractor bill of sale form guide for all necessary details.

- Loan Application: The borrower submits this form to the lender, detailing their financial situation, including income, debts, and assets, to assess eligibility for a mortgage.

- Proof of Relationship: Documentation such as birth certificates or marriage licenses may be required to establish the relationship between the donor and the recipient, confirming that the gift is legitimate.

- Settlement Statement (HUD-1): This document outlines all costs associated with the real estate transaction, including how the gift funds are applied toward the purchase.

- Income Verification Documents: These may include pay stubs or tax returns, providing the lender with insight into the borrower’s income and financial stability.

- Credit Report: Lenders often request this report to assess the borrower’s creditworthiness, which plays a crucial role in the loan approval process.

- Gift Declaration Form: This form may be used to formally declare the intent of the gift, clarifying that it is not a loan and does not require repayment.

Understanding these documents is essential for anyone involved in the home-buying process. Each form plays a critical role in ensuring that the transaction is transparent and compliant with legal and financial standards. By gathering and preparing these documents, both donors and recipients can facilitate a smoother transaction, ultimately contributing to a successful home purchase.