Attorney-Approved Gift Deed Form

When considering the transfer of property or assets without any expectation of payment, the Gift Deed form emerges as a crucial legal instrument. This document serves to formalize the voluntary transfer of ownership from one individual to another, often within the context of family or close relationships. Key components of the Gift Deed include the identification of the donor and the recipient, a clear description of the property being gifted, and the explicit declaration of the donor's intention to give the gift without any strings attached. Additionally, the form may require the signatures of witnesses to validate the transaction, ensuring that the gift is legally recognized. Understanding the nuances of this form is essential, as it not only protects the rights of both parties but also clarifies the conditions under which the gift is made. By carefully navigating the requirements and implications of a Gift Deed, individuals can foster goodwill and strengthen relationships while ensuring compliance with legal standards.

State-specific Gift Deed Forms

More Gift Deed Types:

What Is Deed in Lieu of Foreclosure - A Deed in Lieu of Foreclosure transfers property ownership to the lender to avoid foreclosure proceedings.

To ensure comprehensive protection of sensitive information, parties entering into a Florida Non-disclosure Agreement (NDA) form should consider using a reliable template, which can be found at https://floridaforms.net/blank-non-disclosure-agreement-form/. This tool helps clarify the legal responsibilities associated with confidentiality, ultimately fostering trust and safeguarding proprietary information during collaborations.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Consideration | No monetary consideration is required for a Gift Deed, distinguishing it from other types of property transfers. |

| Requirements | Typically, the donor must be of legal age and sound mind, and the deed must be executed voluntarily. |

| State-Specific Forms | Different states may have specific forms or requirements. For example, California requires the use of a specific Gift Deed form under California Civil Code § 1180. |

| Tax Implications | Gift tax may apply if the value of the gift exceeds the annual exclusion limit set by the IRS. |

| Revocation | A Gift Deed can generally be revoked if the donor has not yet transferred the property and retains ownership. |

| Recording | To protect the interests of the recipient, it is advisable to record the Gift Deed with the local property records office. |

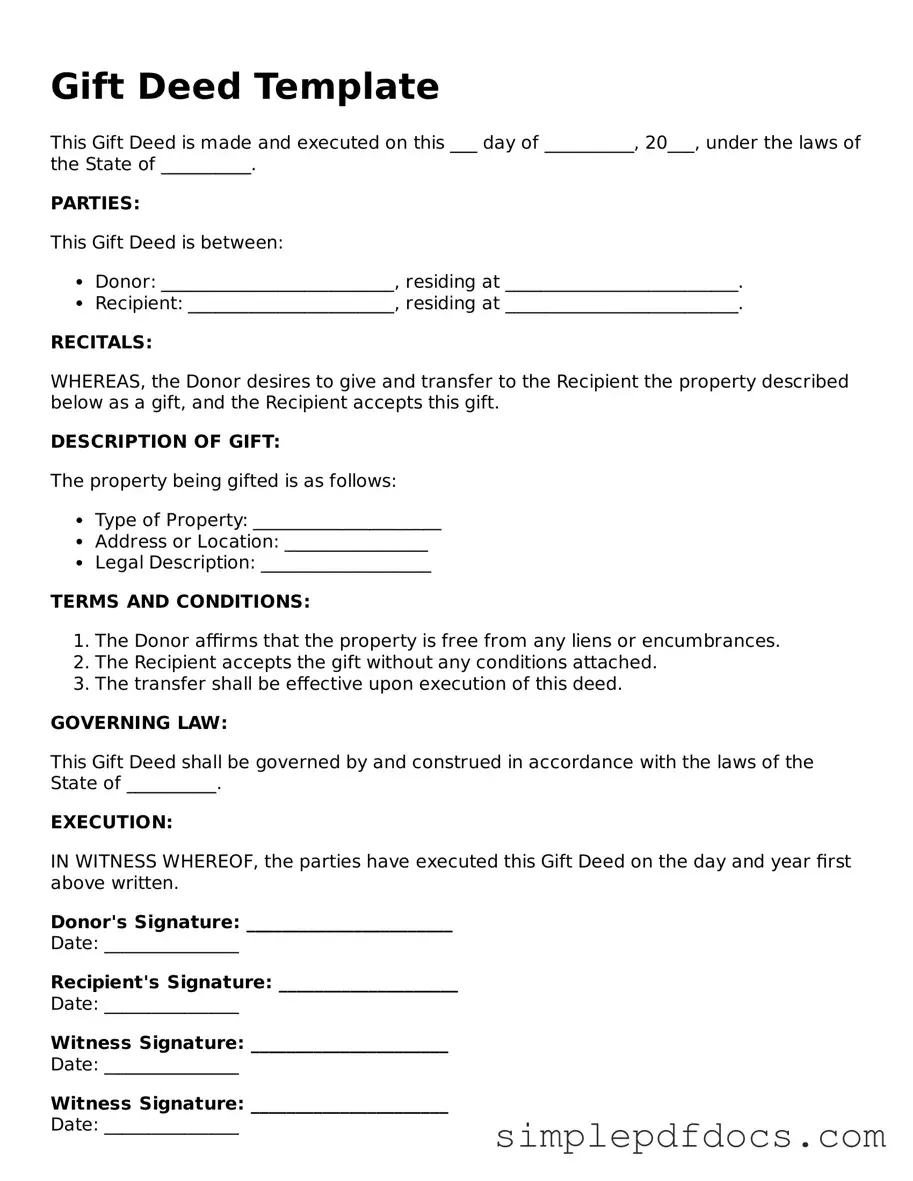

How to Write Gift Deed

Filling out a Gift Deed form is an important step in transferring ownership of property or assets from one person to another without any exchange of money. After completing the form, you will need to have it signed and notarized to ensure its validity. Below are the steps to help you fill out the Gift Deed form correctly.

- Title the Document: At the top of the form, write "Gift Deed" to clearly indicate the purpose of the document.

- Identify the Parties: Enter the full names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift).

- Describe the Gift: Provide a detailed description of the property or asset being gifted. Include any relevant information such as location, value, and any identifying numbers.

- State the Intent: Clearly state that the donor intends to give the property as a gift and that the recipient accepts it.

- Include Consideration: Although this is a gift, it’s often helpful to state that the gift is made without consideration (payment) to avoid any confusion.

- Signatures: Both the donor and the recipient should sign the document. Ensure that all signatures are dated.

- Notarization: Take the completed form to a notary public for notarization. This step is crucial for the document's legal validity.

Dos and Don'ts

When filling out a Gift Deed form, it is important to follow certain guidelines to ensure the document is valid and effective. Here are eight things you should and shouldn't do:

- Do ensure that the gift is clearly defined, including a detailed description of the property being transferred.

- Don't leave any sections of the form blank. Each part should be completed to avoid confusion.

- Do include the names and addresses of both the donor and the recipient to establish clear identification.

- Don't forget to sign the document in the presence of a notary public, if required by your state.

- Do check local laws to ensure compliance with any specific requirements for gift deeds.

- Don't use vague language. Be specific about the terms of the gift to prevent disputes later.

- Do keep a copy of the signed Gift Deed for your records and for the recipient.

- Don't rush through the process. Take your time to review all information for accuracy.

Documents used along the form

When preparing a Gift Deed, several other forms and documents may be necessary to ensure a smooth transfer of property or assets. Each of these documents plays a crucial role in the process, providing legal clarity and protecting the interests of both the giver and the recipient.

- Property Title Deed: This document serves as proof of ownership. It outlines the legal description of the property and is essential for transferring ownership from the giver to the recipient.

- Affidavit of Gift: This sworn statement confirms the intent of the giver to gift the property. It can help clarify the circumstances surrounding the gift and may be required by some jurisdictions.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain threshold, the giver may need to file this form with the IRS. It documents the gift for tax purposes and helps avoid future tax complications.

- Notice of Gift: This document informs relevant parties, such as financial institutions or other stakeholders, about the gift. It can help prevent disputes or misunderstandings regarding ownership.

- Power of Attorney: In some cases, the giver may wish to appoint someone to handle the transfer process on their behalf. A Power of Attorney grants legal authority to another person to act in the giver’s stead.

- Certificate of Trust: If the property is held in a trust, this document verifies the existence of the trust and the authority of the trustee to make the gift. It is important for ensuring that the gift complies with the trust's terms.

- Bill of Sale: If personal property is being gifted, a Bill of Sale may be needed. This document provides a record of the transaction and details the items being transferred.

- Bill of Sale: A Florida Bill of Sale is a vital document for recording the transfer of ownership of personal property. For more details, refer to Florida Forms.

- Release of Liability: This document protects the giver from future claims related to the property after the gift is made. It can be especially important in cases involving real estate or valuable assets.

By gathering these documents, both the giver and recipient can navigate the gifting process with confidence. Ensuring that all necessary paperwork is in order helps to safeguard against potential disputes and legal issues in the future.