Fill Your Generic Direct Deposit Form

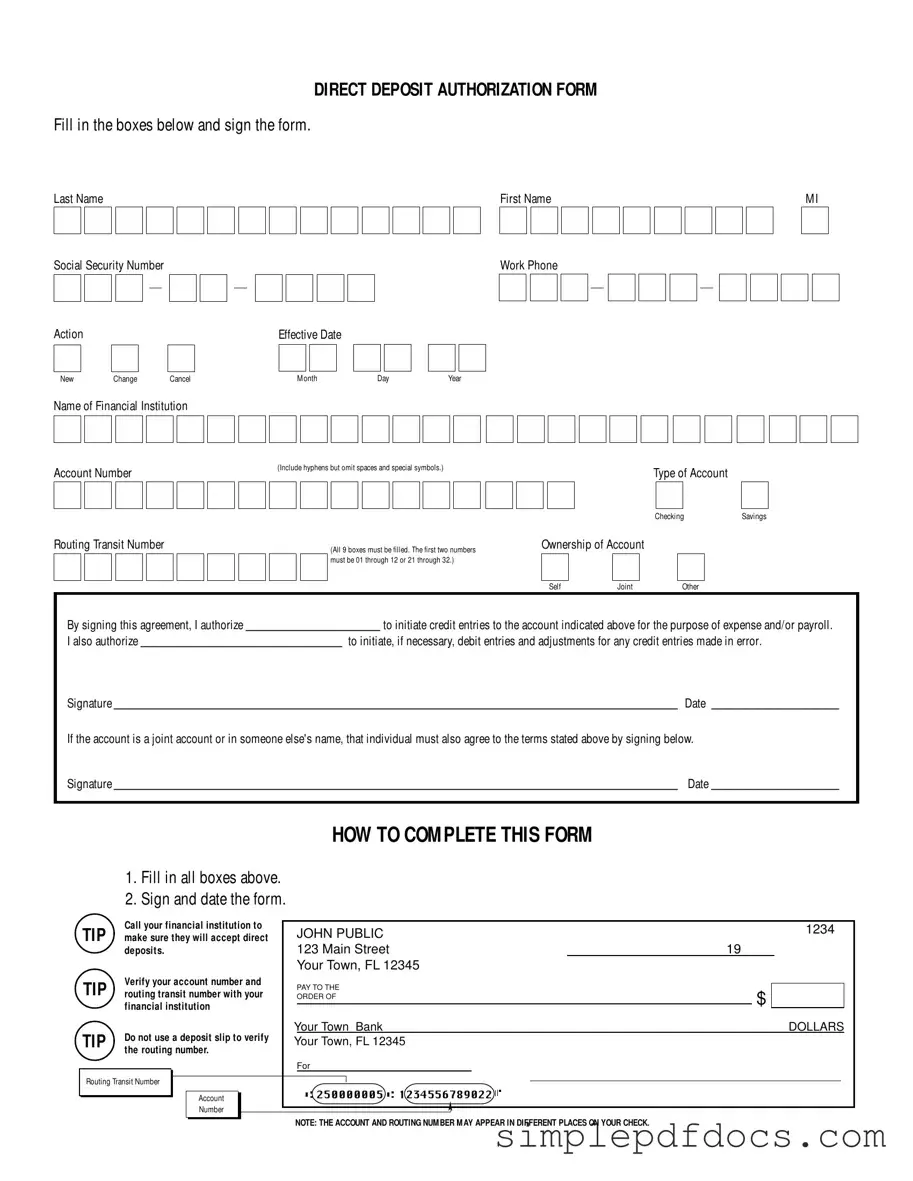

Direct deposit has become an essential feature in the modern financial landscape, providing individuals with a convenient way to receive their funds directly into their bank accounts. The Generic Direct Deposit Authorization Form is a critical tool that facilitates this process. This form requires users to provide personal information, including their name, Social Security number, and contact details, ensuring that the financial institution can accurately identify the individual. Users must also specify the action they wish to take—whether it is a new setup, a change to existing information, or a cancellation of direct deposit. Additionally, the form necessitates the inclusion of banking details such as the name of the financial institution, the account number, and the routing transit number. These details are crucial for directing funds accurately and securely. Furthermore, the form includes sections for the account ownership type, whether self, joint, or other, which helps clarify the relationship to the account. Signing the form signifies the individual's authorization for their employer or another entity to initiate credit entries to their account, as well as the ability to correct any errors through debit adjustments. Completing the form correctly is vital, as it ensures that payments are processed without delay. Clear instructions guide users through the completion process, emphasizing the importance of verifying account information with the financial institution to avoid mistakes. Overall, this form streamlines the direct deposit process, making it easier for individuals to manage their finances efficiently.

More PDF Templates

Ets Ncoer - This evaluation document reflects a commitment to the continuous development of Army leaders.

The comprehensive ATV Bill of Sale document is an indispensable resource for individuals looking to facilitate the sale and transfer of ATVs legally. This form outlines all necessary information to ensure that the transaction adheres to New York regulations, protecting both the buyer and seller during the process.

Bracket Pdf - Some forms allow for multiple submissions to gauge different outcomes.

I-9 - The I-9 form is a safeguard against identity theft in the workplace.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Generic Direct Deposit form is used to authorize the electronic transfer of funds into a bank account for payroll or expense reimbursement. |

| Personal Information | Applicants must provide their last name, first name, middle initial, and Social Security Number on the form. |

| Account Information | Individuals need to specify their financial institution's name, account number, and routing transit number. All nine digits of the routing number must be filled in correctly. |

| Account Type | Applicants can choose between a savings or checking account for direct deposit. |

| Ownership | The form requires individuals to indicate whether the account is owned solely by them, jointly with another person, or under someone else's name. |

| Signature Requirement | Signing the form authorizes the financial institution to process credit and, if necessary, debit entries related to the account. |

| State-Specific Laws | In Florida, direct deposit practices are governed by the Florida Statutes, specifically Chapter 655 regarding banking and finance. |

How to Write Generic Direct Deposit

After completing the Generic Direct Deposit form, you will be one step closer to having your funds deposited directly into your bank account. Ensure that all information is accurate to avoid any delays in processing. Follow these steps carefully to fill out the form correctly.

- Write your Last Name, First Name, and M I in the designated boxes.

- Enter your Social Security Number in the format XXX-XX-XXXX.

- Select the Action you wish to take: New, Change, or Cancel.

- Fill in the Effective Date using the format Month, Day, Year.

- Provide your Work Phone number.

- Write the Name of Financial Institution where your account is held.

- Enter your Account Number (include hyphens, but omit spaces and special symbols).

- Choose the Type of Account: Savings or Checking.

- Fill in the Routing Transit Number (all 9 boxes must be filled, starting with numbers 01-12 or 21-32).

- Select the Ownership of Account: Self, Joint, or Other.

- Sign the form where indicated to authorize credit entries to your account.

- Date your signature.

- If applicable, have the other account holder sign and date the form as well.

Before submitting the form, consider calling your financial institution to confirm they accept direct deposits. Double-check your account and routing numbers to ensure accuracy. Avoid using a deposit slip for verification, as the account and routing numbers may appear in different places on your check.

Dos and Don'ts

When filling out the Generic Direct Deposit form, it is essential to be thorough and accurate. Here are some important dos and don’ts to keep in mind:

- Do fill in all boxes completely, ensuring that no information is left blank.

- Do sign and date the form to validate your authorization.

- Do verify your account number and routing transit number with your financial institution before submission.

- Do contact your financial institution to confirm they will accept direct deposits.

- Don’t use a deposit slip to verify the routing number; this can lead to errors.

- Don’t omit any required information, as incomplete forms may delay processing.

- Don’t forget to check that the routing transit number consists of all 9 digits.

- Don’t submit the form without ensuring that all signatures are obtained if the account is joint.

Documents used along the form

When setting up direct deposit, several forms and documents may be required in addition to the Generic Direct Deposit Authorization Form. Each of these documents serves a specific purpose in ensuring a smooth and efficient process. Here’s a list of commonly used forms and documents.

- W-4 Form: This form is used to determine the amount of federal income tax withholding from an employee's paycheck. Completing it accurately helps avoid underpayment or overpayment of taxes.

- Employee Information Form: This document collects essential details about the employee, such as contact information, emergency contacts, and tax filing status, which may be needed for payroll processing.

- Bank Account Verification Form: Often required by employers, this form confirms the employee’s bank account details and ensures that the correct account is used for direct deposits.

- Payroll Authorization Form: This document authorizes the employer to process payroll and manage deductions, such as retirement contributions or health insurance premiums.

- Employment Contract: A formal agreement between the employer and employee outlining the terms of employment, including salary, benefits, and work expectations. It may include direct deposit stipulations.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state income tax. Employees must fill it out to ensure the correct state taxes are withheld from their paychecks.

- Last Will and Testament Form: Essential for defining how your assets should be distributed after your passing, this form is crucial for estate planning in Florida. For more details, check out Florida Forms.

- Direct Deposit Change Request Form: If an employee needs to change their bank account information for direct deposit, this form is used to submit the new details securely.

- Time Sheet or Time Card: This document tracks the hours worked by an employee, which is crucial for calculating pay accurately, especially for hourly employees.

- Benefits Enrollment Form: This form allows employees to enroll in various benefit programs, such as health insurance or retirement plans, which may impact payroll deductions.

Each of these documents plays a vital role in the payroll process and ensures that employees receive their earnings accurately and on time. It’s important to complete all required forms thoroughly to avoid any delays in processing your direct deposit.