Fill Your Florida Commercial Contract Form

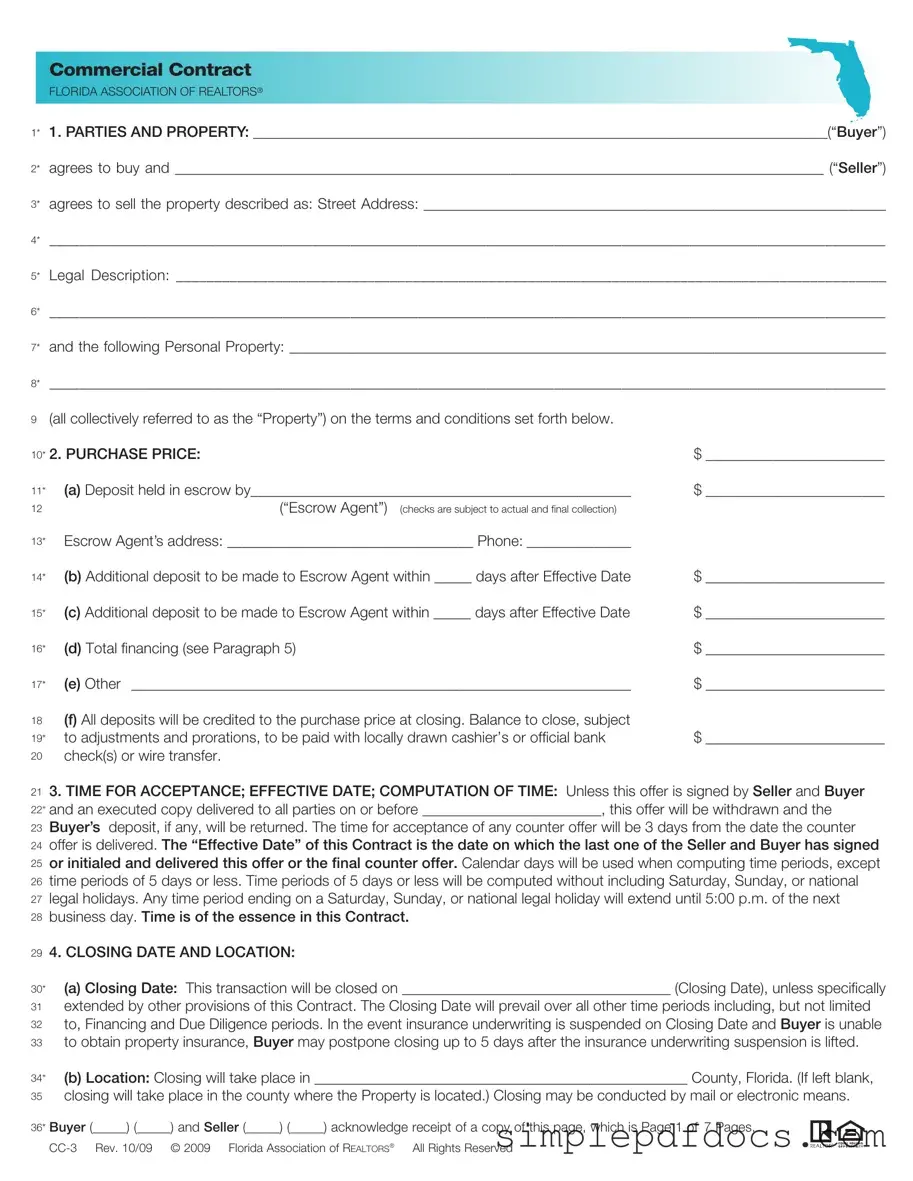

The Florida Commercial Contract form is a crucial document designed to facilitate the sale of commercial real estate in the state. This form outlines the essential terms and conditions of the transaction, ensuring clarity and protection for both buyers and sellers. It begins by identifying the parties involved and the property being sold, including its legal description and any personal property included in the sale. The purchase price is a key component, detailing the total amount, deposits, and the method of payment. Timelines for acceptance of the offer and the closing date are also specified, highlighting the importance of timely execution in real estate transactions. The contract addresses financing obligations, allowing buyers to secure third-party financing while protecting their interests if financing cannot be obtained. Additionally, it covers title issues, ensuring that sellers convey clear title to the property, and details the condition of the property at the time of sale. Other significant aspects include the handling of deposits, responsibilities during the contract period, and procedures for closing the transaction. By comprehensively addressing these elements, the Florida Commercial Contract form serves as a vital tool for anyone involved in commercial real estate transactions in Florida.

More PDF Templates

Prehospital Medical Care Directive - By articulating your wishes, you pave the way for healthcare that aligns with your unique lifestyle and beliefs.

The Texas Motor Vehicle Power of Attorney form is an essential legal document that empowers a vehicle owner to designate another individual to manage specific aspects of their vehicle, such as registration, titling, and sales. This is particularly beneficial for those who are unable to oversee these responsibilities due to absence or health issues. To get started, you can download and fill out the form, ensuring that your vehicle-related matters are handled efficiently and in accordance with the law.

How to Calculate Load - Establishes a basis for load diversity, which can lead to more efficient electrical designs.

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Commercial Contract form is governed by Florida law, ensuring compliance with state regulations and statutes. |

| Parties Involved | The contract clearly identifies the Buyer and Seller, outlining their respective roles in the transaction. |

| Purchase Price Structure | The form includes detailed sections for the purchase price, deposit amounts, and payment methods, providing clarity on financial obligations. |

| Time for Acceptance | The contract specifies a time frame for acceptance, ensuring that both parties are aware of deadlines and can act accordingly. |

How to Write Florida Commercial Contract

Filling out the Florida Commercial Contract form requires attention to detail and accuracy. This form serves as a crucial document in the process of buying or selling commercial property. To ensure a smooth transaction, it’s important to complete each section thoroughly and correctly. Here’s how to fill out the form step-by-step.

- Identify the Parties: Write the names of the Buyer and Seller in the designated spaces. Ensure that both parties are clearly identified.

- Property Description: Fill in the street address and legal description of the property being sold. This includes any additional personal property being transferred.

- Purchase Price: Specify the total purchase price and detail any deposits held in escrow. Include the Escrow Agent’s name and address.

- Acceptance and Effective Date: Indicate the date by which the offer must be accepted and define the Effective Date of the contract.

- Closing Date and Location: Enter the proposed closing date and the location where the closing will take place.

- Third Party Financing: If applicable, provide details regarding financing, including interest rates and loan terms. Outline the Buyer’s obligations related to obtaining financing.

- Title Information: Specify how the Seller will convey the title and any conditions related to the title. Mention who will pay for the title insurance and the process for title examination.

- Property Condition: Indicate whether the Buyer accepts the property "as is" or if a due diligence period is needed for inspections.

- Closing Procedure: Outline the responsibilities of both parties regarding possession, costs, and documents needed at closing.

- Escrow Agent: Designate the Escrow Agent and clarify their responsibilities regarding the handling of funds.

- Cure Period: Specify the number of days allowed for either party to cure any default before a claim is made.

- Notices: Provide the addresses where all notices will be sent, ensuring they are clear and accurate.

- Signatures: Finally, ensure that both parties sign and date the contract, acknowledging receipt of all pages.

Once the form is filled out, both parties should review it carefully to ensure all information is accurate. Any discrepancies can lead to complications later in the transaction process. After confirming the details, proceed with the next steps in the buying or selling process, which may include further negotiations or disclosures.

Dos and Don'ts

When filling out the Florida Commercial Contract form, it's essential to approach the task with care. Here’s a helpful list of things you should and shouldn't do:

- Do read the entire contract carefully before filling it out.

- Do ensure all parties' names are spelled correctly and match official documents.

- Do provide complete and accurate property descriptions, including the legal description.

- Do specify the purchase price clearly, including any deposits or financing details.

- Do keep track of all deadlines and timeframes mentioned in the contract.

- Don't leave any sections blank; if a section doesn't apply, mark it as "N/A."

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to include any special conditions or contingencies relevant to the sale.

- Don't overlook the need for signatures from all parties involved.

Documents used along the form

When engaging in a commercial real estate transaction in Florida, several important documents accompany the Florida Commercial Contract form. Each of these documents plays a crucial role in ensuring that the transaction proceeds smoothly and that all parties are protected. Below is a list of key forms and documents often used alongside the Florida Commercial Contract.

- Title Insurance Commitment: This document outlines the terms of the title insurance policy that protects the buyer against any defects in the title of the property. It ensures that the buyer receives clear ownership free of any unknown liens or encumbrances.

- Escrow Agreement: This agreement details the terms under which an escrow agent will hold funds and documents until the transaction is completed. It specifies the responsibilities of the escrow agent and the conditions under which the funds will be disbursed.

- Due Diligence Checklist: This checklist helps the buyer assess the property's condition and compliance with local regulations. It includes items such as inspections, zoning regulations, and environmental assessments that need to be completed before closing.

- Lease Agreements: If the property includes tenants, lease agreements will outline the terms under which tenants occupy the space. These documents are essential for understanding existing obligations and rights related to the property.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, deposits, and any adjustments made at closing. It provides a detailed account of how funds will be allocated and who is responsible for various costs.

- Durable Power of Attorney: This legal document grants a trusted individual the authority to make decisions on your behalf, including financial matters. For those looking to fill out this crucial form, visit texasformspdf.com for convenience.

- Disclosure Statements: These statements inform the buyer of any known issues with the property, such as environmental hazards or structural problems. They are essential for transparency and protecting the buyer's interests.

Incorporating these documents into your transaction ensures that all parties are informed and protected throughout the process. Taking the time to understand each form can help facilitate a successful and legally sound commercial real estate transaction in Florida.