Fill Your Fl Dr 312 Form

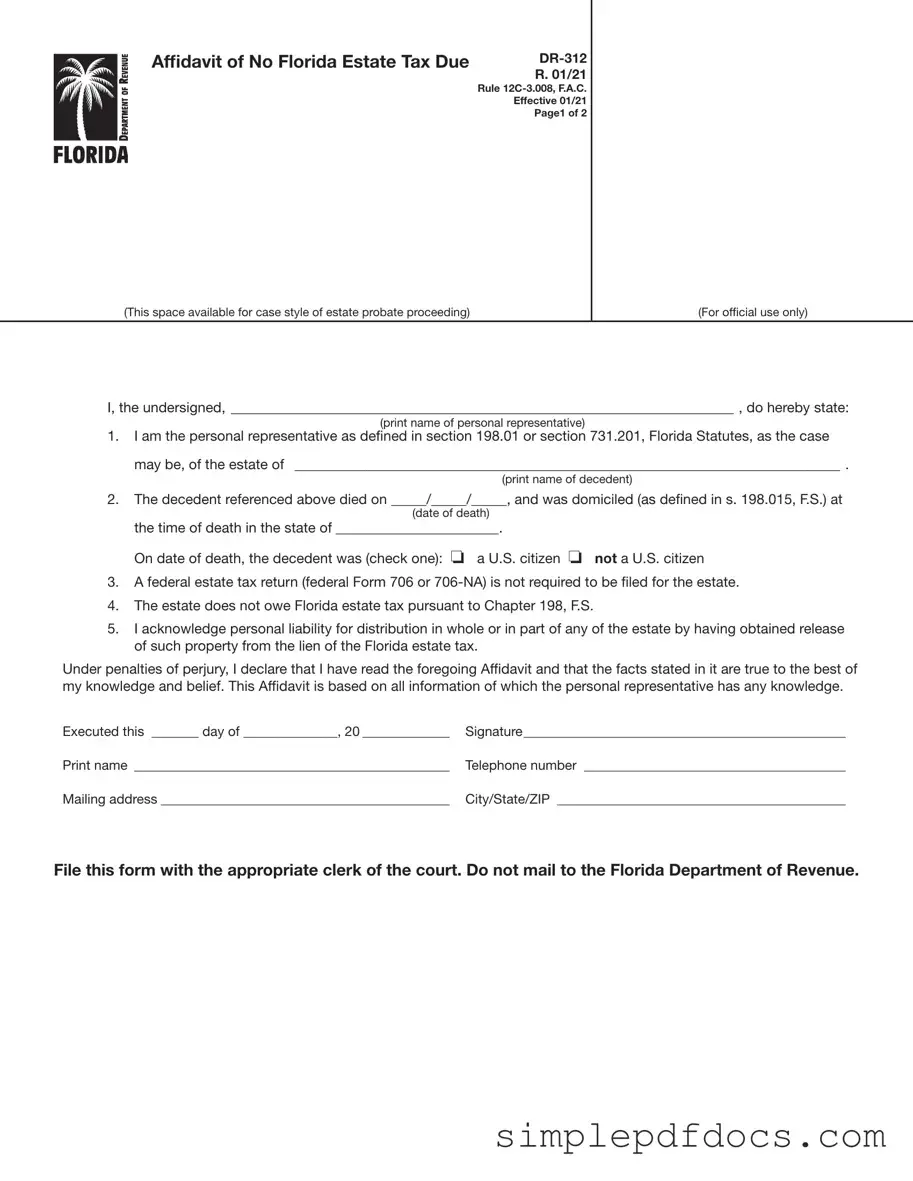

When navigating the complexities of estate management in Florida, the Affidavit of No Florida Estate Tax Due, also known as Form DR-312, plays a crucial role. This form is designed for personal representatives who confirm that no Florida estate tax is owed for the estate of a deceased individual. It serves as a declaration that the estate is not subject to tax under Florida law, specifically Chapter 198. By completing this affidavit, personal representatives can effectively clear any potential liens associated with the estate, streamlining the process of property distribution. The form requires essential information, including the decedent's name, date of death, and their citizenship status, along with a statement affirming that a federal estate tax return is not necessary. Importantly, this affidavit is not just a formality; it holds legal weight and is admissible as evidence of nonliability for estate taxes. Filing this document with the appropriate clerk of the circuit court ensures that the estate is recognized as tax-exempt, allowing for a smoother transition of assets to beneficiaries. Understanding when and how to use Form DR-312 is vital for those involved in estate administration, making it a key tool in the estate planning process.

More PDF Templates

Lyft Help Center - Understanding the inspection requirements can improve your driving experience with Lyft.

The process of obtaining a nursing license in Florida often begins with the Florida Board Nursing Application form, which is a crucial document for aspiring nurses. This form not only serves as the official request for licensure by examination but also ensures that applicants adhere to the required educational and professional standards. For more detailed guidance on completing this form, you can refer to Florida Forms, which provides valuable resources to facilitate a smooth application process and successful entry into the nursing profession.

W9 Form 2022 - Individuals submit a W-9 to provide their social security number or taxpayer ID.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The DR-312 form is an Affidavit of No Florida Estate Tax Due, used to declare that an estate does not owe Florida estate tax. |

| Governing Law | This form is governed by Chapter 198 of the Florida Statutes and Rule 12C-3.008 of the Florida Administrative Code. |

| Filing Requirement | Personal representatives must file this form with the clerk of the circuit court in the county where the decedent owned property. |

| Federal Tax Return | A federal estate tax return (Form 706 or 706-NA) is not required to be filed for estates using this form. |

How to Write Fl Dr 312

After gathering the necessary information, you can begin filling out the Fl Dr 312 form. This form is essential for confirming that no Florida estate tax is due for the estate in question. Ensure that all information is accurate and complete to avoid any issues.

- Print your name in the space provided for the personal representative at the top of the form.

- In the next line, write the name of the decedent whose estate you are representing.

- Enter the date of death in the format of month/day/year.

- Specify the state where the decedent was domiciled at the time of death.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return is not required by checking the relevant box.

- Affirm that the estate does not owe Florida estate tax as per Chapter 198 by checking the corresponding box.

- Acknowledge your personal liability for any distribution of the estate by signing your name.

- Print your name again beneath your signature.

- Provide your telephone number, mailing address, city, state, and ZIP code in the designated spaces.

- Finally, submit the completed form to the appropriate clerk of the court. Do not mail it to the Florida Department of Revenue.

Dos and Don'ts

When filling out the Fl Dr 312 form, there are some important dos and don’ts to keep in mind. Here’s a helpful list:

- Do ensure you are the personal representative of the estate.

- Do provide accurate information about the decedent, including their name and date of death.

- Do check the box indicating whether the decedent was a U.S. citizen.

- Do file the form with the appropriate clerk of the court.

- Don't mail the form to the Florida Department of Revenue.

- Don't write or mark in the designated space for the clerk of the court.

- Don't use this form if a federal estate tax return is required.

- Don't forget to include your signature and contact information.

Documents used along the form

When navigating the complexities of estate management in Florida, several forms and documents often accompany the Florida Form DR-312, the Affidavit of No Florida Estate Tax Due. Each of these documents serves a unique purpose in ensuring compliance with state regulations and facilitating the probate process. Below is a list of commonly used forms that may be relevant.

- Form DR-1: This is the initial application for a Florida estate tax waiver. It must be filed by the personal representative to initiate the process of determining whether any estate tax is owed.

- Notice to Quit Form: For landlords in Texas, utilizing the https://texasformspdf.com/ is essential to communicate the need for tenants to vacate or remedy lease violations promptly.

- Form DR-706: This federal estate tax return is required for estates exceeding certain thresholds. It details the decedent's gross estate and calculates any federal estate tax due.

- Form DR-706-NA: Similar to Form DR-706, this form is specifically for nonresident aliens. It outlines the estate's value and any applicable tax obligations for non-U.S. citizens.

- Notice of Administration: This document formally notifies interested parties of the probate proceedings. It is essential for ensuring that all potential heirs are informed of their rights and obligations.

- Inventory of Assets: This form lists all assets owned by the decedent at the time of death. It provides a comprehensive overview necessary for both tax calculations and the distribution of the estate.

- Final Accounting: This document summarizes all financial transactions related to the estate, including income, expenses, and distributions to beneficiaries. It is crucial for transparency and accountability in estate management.

- Order of Discharge: Once all debts and taxes have been settled, this court order officially releases the personal representative from further liability and concludes the probate process.

Understanding these forms and their purposes can significantly ease the probate process. Each document plays a critical role in ensuring that the estate is managed effectively, taxes are handled appropriately, and beneficiaries receive their rightful shares. By familiarizing oneself with these requirements, personal representatives can navigate the complexities of estate management with confidence.