Fill Your Erc Broker Market Analysis Form

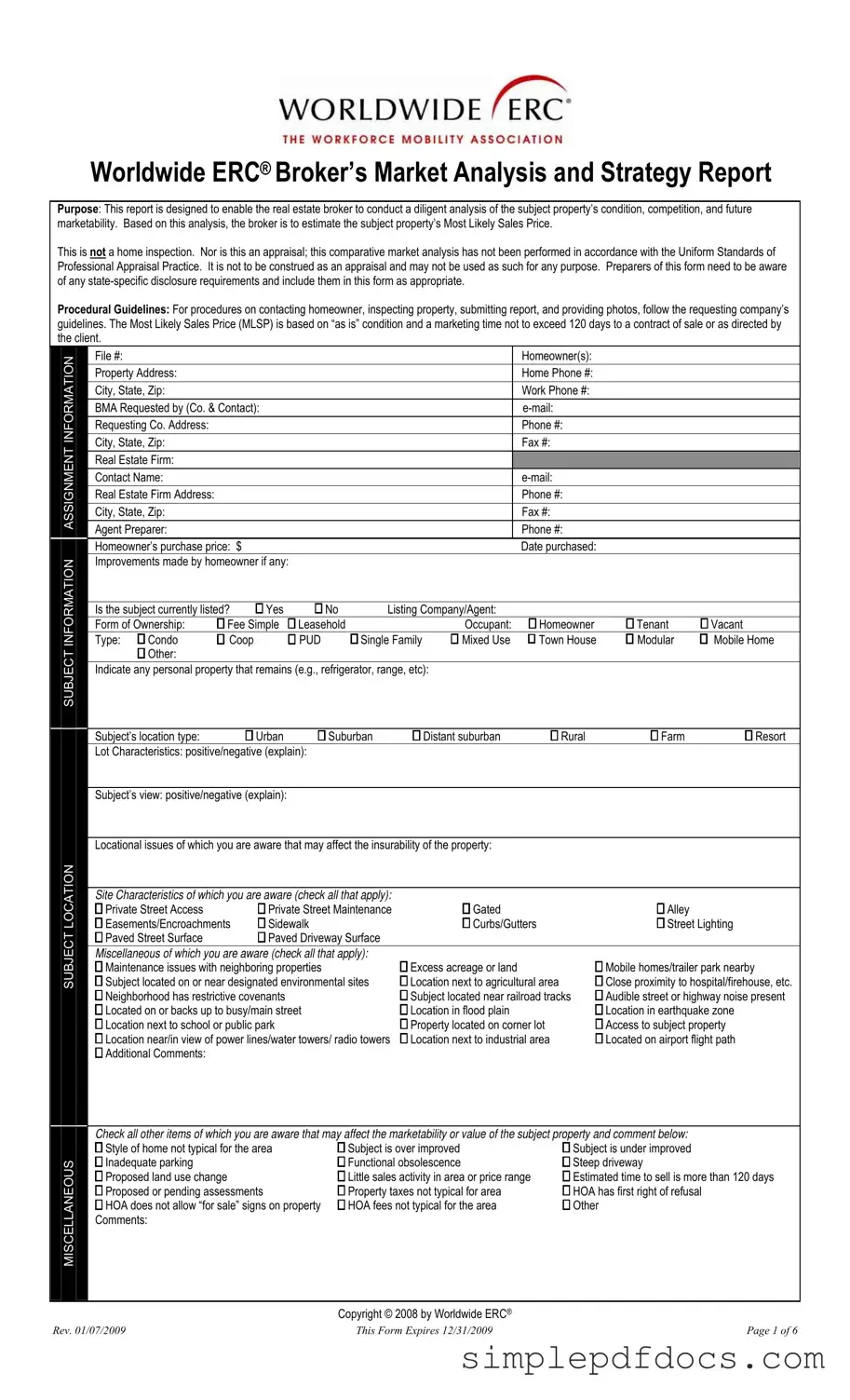

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers, enabling them to thoroughly assess a property's condition, competitive landscape, and potential marketability. The form guides brokers in estimating the Most Likely Sales Price (MLSP) of the property, based on its "as is" condition and a marketing timeframe of no more than 120 days. It is important to note that this report is neither a home inspection nor an appraisal; it does not adhere to the Uniform Standards of Professional Appraisal Practice, and should not be utilized as such. Brokers must also be aware of state-specific disclosure requirements and ensure these are included in their submissions. The form outlines procedural guidelines for contacting homeowners, inspecting properties, and submitting reports, while also gathering essential information such as the homeowner's contact details, property specifics, and any improvements made. Additionally, the report prompts brokers to evaluate various factors affecting the property, including location, neighborhood dynamics, and market conditions. By completing this comprehensive analysis, brokers can make informed recommendations regarding the property’s market strategy.

More PDF Templates

Baseball Batting Order - List the starting players for effective lineup tracking.

By utilizing the services offered by California Templates, you can ensure that your Vehicle Purchase Agreement form is completed accurately, minimizing the risk of any disputes and helping to facilitate a secure and efficient transaction between the buyer and seller.

Imm5707 Canada - Each family member listed contributes to the applicant's immigration eligibility.

Health Insurance Marketplace Statement - A 1095-A is essential for accurately reporting healthcare subsidies received.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form assists real estate brokers in analyzing a property's condition, competition, and marketability to estimate its Most Likely Sales Price (MLSP). |

| Not an Appraisal | The report is a comparative market analysis and should not be considered an appraisal. It does not comply with the Uniform Standards of Professional Appraisal Practice. |

| Disclosure Requirements | Users must be aware of state-specific disclosure requirements and ensure they are included in the form as needed. |

| Marketing Time Frame | The estimated sales price is based on the property being sold "as is" within a marketing time frame of no more than 120 days. |

| Inspection Guidelines | Guidelines for contacting homeowners, inspecting properties, and submitting reports should be followed as per the requesting company's policies. |

| Expiration Date | The form is valid until December 31, 2009, as indicated in the copyright notice. |

How to Write Erc Broker Market Analysis

Completing the ERC Broker Market Analysis form is an essential step in evaluating a property’s market position. By following these steps, you can ensure that all necessary information is accurately captured, allowing for a thorough analysis of the property in question. The information gathered will help inform decisions regarding the property’s potential sales price and marketing strategy.

- Begin by filling in the INFORMATION section. Include the file number, homeowner(s) name, property address, and contact details.

- Provide the details of the requesting company, including the name, address, and contact information.

- In the ASSIGNMENT section, enter the real estate firm’s name, contact person, and their respective details.

- Document the homeowner’s purchase price and the date of purchase in the appropriate fields.

- Note any improvements made by the homeowner and indicate whether the property is currently listed for sale.

- Specify the form of ownership and the occupant status (homeowner, tenant, or vacant).

- Describe the property type and any personal property that remains with the sale.

- Evaluate the subject’s location type and provide details on lot characteristics and views.

- Identify any locational issues that may affect insurability.

- Check all relevant site characteristics and miscellaneous issues that may impact the property.

- In the SUBJECT CONDITION INSPECTIONS/DISCLOSURES section, assess the property’s condition and note any required repairs or improvements.

- List all required and customary inspections, along with any additional recommendations.

- Identify potential financing options and any anticipated issues related to securing financing.

- Define the subject neighborhood and broader market area, including property values and market conditions.

- Gather comparable sales data, ensuring to include all relevant details for each comparable property.

- Finally, provide comments and insights regarding the overall market conditions and any marketing concessions that may be beneficial.

Dos and Don'ts

When filling out the ERC Broker Market Analysis form, keep the following tips in mind:

- Do: Gather accurate information about the property. Ensure that all details, such as the homeowner's name, property address, and contact numbers, are correct.

- Do: Follow procedural guidelines closely. Adhere to the requesting company’s instructions for contacting the homeowner, inspecting the property, and submitting the report.

- Do: Be thorough in your analysis. Evaluate the property's condition, competition, and marketability to provide a well-rounded estimate of the Most Likely Sales Price (MLSP).

- Do: Include any state-specific disclosure requirements. Make sure to incorporate these as necessary to comply with local laws.

- Don't: Skip any sections. Every part of the form is important for a complete analysis, so ensure you fill in all relevant fields.

- Don't: Provide unverified information. Avoid making assumptions or guesses about the property’s condition or market conditions.

- Don't: Forget to note any potential issues. Identifying locational or property-specific concerns can significantly impact marketability.

- Don't: Use the analysis as an appraisal. Remember, this is a comparative market analysis and should not be mistaken for a formal appraisal.

Documents used along the form

When preparing a comprehensive market analysis for a property, various documents are often utilized alongside the ERC Broker Market Analysis form. Each of these forms serves a specific purpose in gathering essential information about the property and its market environment. Here is a list of commonly used documents:

- Property Disclosure Statement: This document outlines known issues with the property, such as structural problems, environmental hazards, or any other factors that could affect its value or insurability.

- Motor Vehicle Power of Attorney: This legal document allows the appointment of another person to manage vehicle-related matters, which is particularly useful when the owner cannot do so themselves. For further details, refer to floridaforms.net/blank-motor-vehicle-power-of-attorney-form.

- Comparative Market Analysis (CMA): This report evaluates similar properties that have recently sold in the area, providing insights into pricing trends and market conditions.

- Inspection Report: A detailed evaluation conducted by a licensed inspector, this report identifies the condition of the property, including any repairs needed or potential issues.

- Appraisal Report: Conducted by a certified appraiser, this document provides an independent assessment of the property's value based on various factors, including location and condition.

- Neighborhood Analysis: This report examines the surrounding area, including demographics, amenities, and economic factors that could influence property values.

- Financing Options Document: This outlines the different financing methods available for potential buyers, including FHA, VA, and conventional loans, along with their specific requirements.

- Marketing Plan: A strategy document detailing how the property will be marketed to potential buyers, including advertising methods and open house schedules.

- Listing Agreement: This contract between the property owner and the real estate broker specifies the terms of the listing, including commission rates and duration of the agreement.

- Sales History Report: This document provides a history of the property’s sales, including past listing prices and any changes in ownership, which can help in understanding market trends.

Each of these documents plays a crucial role in the overall analysis and helps ensure that all relevant factors are considered when determining the marketability and value of a property. By gathering and reviewing this information, brokers can provide informed recommendations to clients.