Attorney-Approved Employee Loan Agreement Form

When employees face unexpected financial challenges, an Employee Loan Agreement can provide a helpful solution. This form outlines the terms under which an employer lends money to an employee, ensuring clarity and mutual understanding. Key aspects include the loan amount, repayment schedule, interest rates (if applicable), and any conditions tied to the loan. Both parties must agree to the terms, which helps protect the employer’s interests while supporting the employee in their time of need. The agreement also typically includes provisions for what happens in case of default or if the employee leaves the company. By having a well-structured Employee Loan Agreement, employers can foster a supportive workplace environment while maintaining clear expectations and responsibilities.

PDF Details

| Fact Name | Description |

|---|---|

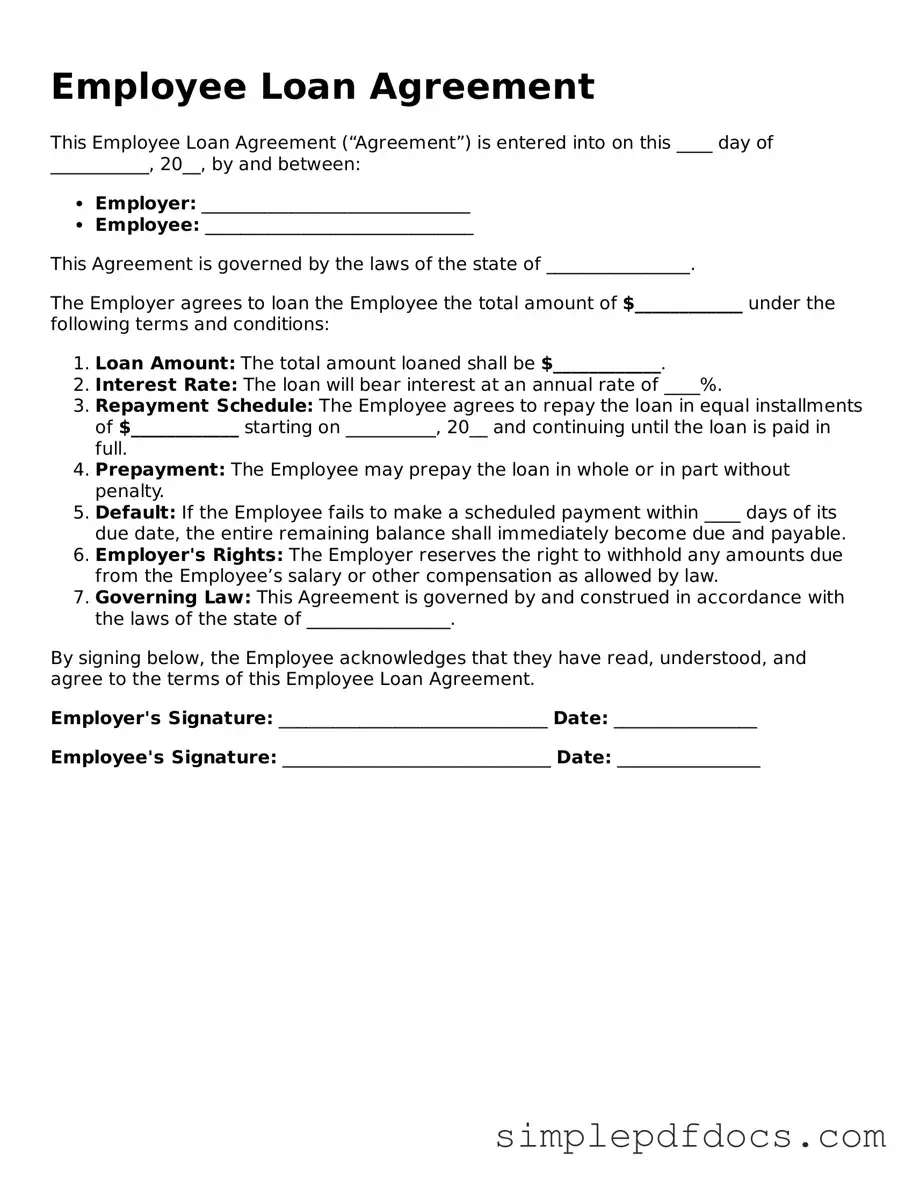

| Definition | An Employee Loan Agreement is a document that outlines the terms under which an employer lends money to an employee. |

| Purpose | This agreement serves to protect both the employer and the employee by clearly stating the loan amount, repayment terms, and any interest rates. |

| Repayment Terms | Repayment terms typically include the duration of the loan, payment schedule, and method of payment. |

| Interest Rates | Interest may be charged on the loan amount, depending on the agreement. Some employers may offer interest-free loans. |

| Governing Law | The agreement is subject to state laws. For example, in California, the governing law is the California Civil Code. |

| Employee Rights | Employees have the right to understand the terms of the loan before signing the agreement. |

| Default Consequences | If an employee fails to repay the loan, the employer may have the right to deduct the owed amount from future paychecks. |

| Modification | Any changes to the agreement must be documented and signed by both parties to be enforceable. |

How to Write Employee Loan Agreement

Completing the Employee Loan Agreement form is a straightforward process that requires careful attention to detail. By following the steps outlined below, you can ensure that all necessary information is accurately provided, facilitating a smooth agreement between the employer and employee.

- Obtain the Form: Start by downloading or printing the Employee Loan Agreement form from your company’s designated source.

- Fill in Employee Information: Enter the employee's full name, address, and contact information at the top of the form.

- Specify Loan Amount: Clearly indicate the total amount of the loan being requested by the employee.

- State Purpose of Loan: Provide a brief description of the purpose for which the loan is being requested.

- Outline Repayment Terms: Specify the repayment schedule, including the amount of each payment and the frequency (e.g., weekly, bi-weekly, monthly).

- Include Interest Rate: If applicable, state the interest rate that will be charged on the loan.

- Signatures: Ensure both the employee and an authorized representative of the company sign and date the agreement at the bottom of the form.

- Review for Accuracy: Before finalizing, double-check all entries for accuracy and completeness.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Read the entire agreement carefully before filling it out.

- Do: Provide accurate and truthful information in all sections.

- Do: Sign and date the form where indicated.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Use abbreviations or shorthand that may cause confusion.

- Don't: Sign the form without fully understanding the terms.

- Don't: Submit the form without verifying that all information is correct.

Documents used along the form

When an employee seeks a loan from their employer, several forms and documents often accompany the Employee Loan Agreement. Each of these documents serves a specific purpose, ensuring clarity and understanding between the employer and employee. Below is a list of commonly used documents in conjunction with the Employee Loan Agreement.

- Loan Application Form: This document allows the employee to formally request a loan. It typically requires details about the amount needed, the purpose of the loan, and personal financial information.

- Loan Agreement Form: To clarify the terms and conditions, refer to our informative Loan Agreement guidelines to ensure all details are properly outlined.

- Promissory Note: A promissory note is a written promise from the employee to repay the loan. It outlines the repayment terms, including the interest rate and payment schedule.

- Repayment Schedule: This document details when payments are due and how much will be paid at each interval. It helps both parties track the repayment process.

- Loan Disclosure Statement: This statement provides essential information about the loan, including fees, interest rates, and any other terms. It ensures that the employee fully understands the financial implications.

- Employment Verification Letter: This letter confirms the employee’s current job status and salary. It may be required by the employer to assess the employee’s ability to repay the loan.

- Consent to Deduct from Payroll: This form allows the employer to deduct loan repayments directly from the employee’s paycheck. It ensures that the repayment process is seamless and automatic.

- Termination of Loan Agreement: In the event the employee leaves the company, this document outlines the terms for repaying the remaining loan balance. It protects both parties in case of employment termination.

Understanding these documents can facilitate a smoother loan process and foster a positive employer-employee relationship. Clear communication and proper documentation are key to ensuring that both parties are protected and informed throughout the loan agreement journey.