Attorney-Approved Deed of Trust Form

When navigating the world of real estate transactions, understanding the Deed of Trust form is essential for both borrowers and lenders. This important document serves as a security instrument that protects the lender's investment while providing the borrower with the necessary funds to purchase a home or property. In essence, it outlines the terms of the loan agreement, including the amount borrowed, the interest rate, and the repayment schedule. Additionally, the Deed of Trust designates a third party, known as the trustee, who holds the legal title to the property until the loan is fully repaid. Should the borrower default on the loan, the trustee has the authority to initiate foreclosure proceedings, allowing the lender to recover their investment. This form also includes critical information about the property itself, such as its legal description, ensuring clarity and transparency in the transaction. Understanding these key components can empower individuals to make informed decisions, whether they are buying their first home or refinancing an existing mortgage.

More Deed of Trust Types:

Free Michigan Lady Bird Deed Pdf - This deed allows property owners to pass on real estate without the complexities of a living trust.

Gift Deed Form - This form allows the donor to give property to the recipient freely.

In estate planning, it is important to consider tools like the Transfer-on-Death Deed, which can facilitate the seamless transfer of property to your chosen beneficiaries without the complications of probate, providing peace of mind and clarity during the succession process.

California Transfer on Death Deed - To ensure the deed is valid, complete all required formalities for your state.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a trustee until the loan is paid off. |

| Parties Involved | The Deed of Trust involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee who holds the title. |

| Governing Law | The laws governing Deeds of Trust vary by state. For example, in California, it is governed by the California Civil Code. |

| Foreclosure Process | In the event of default, the trustee can initiate a non-judicial foreclosure process, which is generally quicker than judicial foreclosure. |

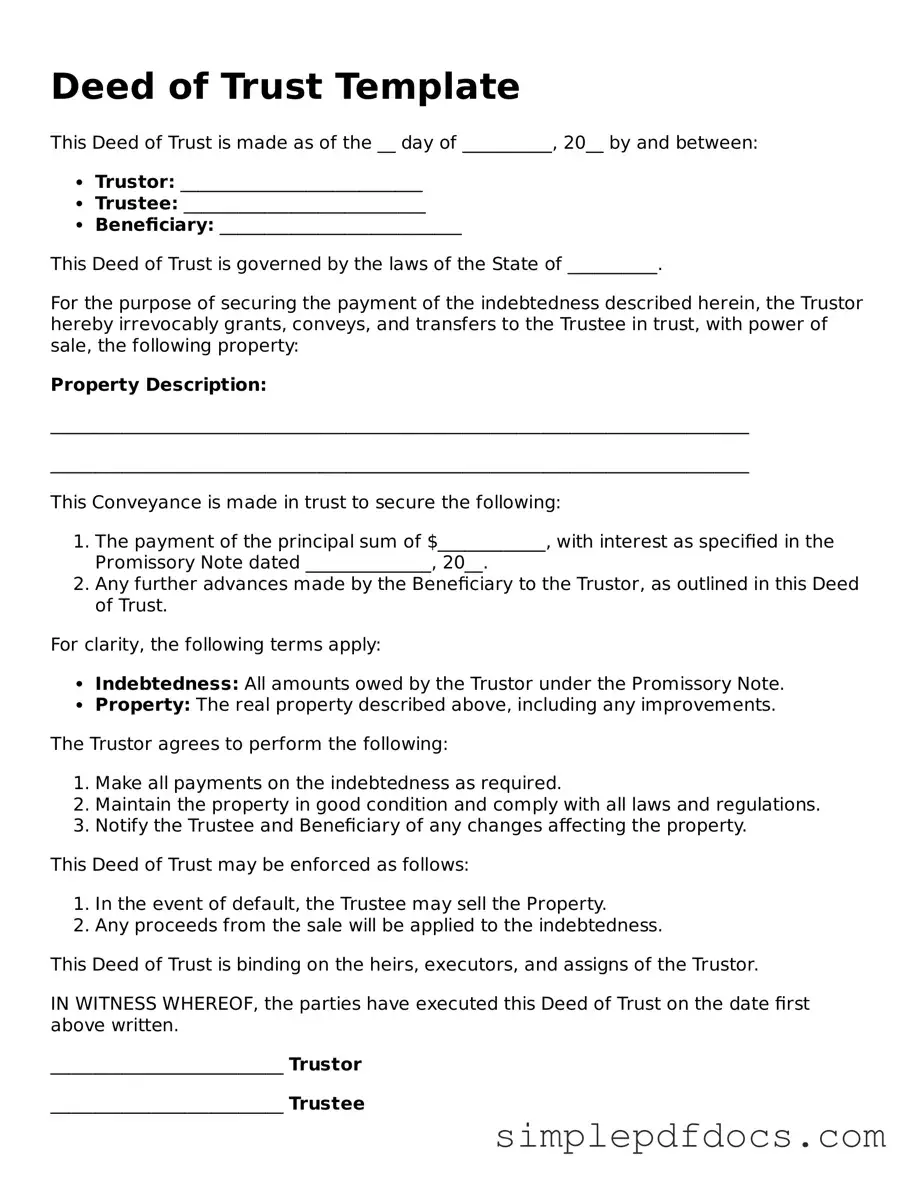

How to Write Deed of Trust

After gathering the necessary information, you are ready to fill out the Deed of Trust form. This document is essential for securing a loan against property. Make sure you have all relevant details at hand to ensure a smooth process.

- Start with the title of the form at the top. Clearly write “Deed of Trust.”

- Fill in the date on which the deed is being executed.

- Provide the names and addresses of the borrower(s). Ensure the names are spelled correctly.

- Next, enter the lender's name and address. This should also be accurate.

- Describe the property being secured. Include the full address and legal description if available.

- State the amount of the loan. This should match the agreement between the borrower and lender.

- Include any additional terms or conditions that apply to the trust. Be clear and concise.

- Leave space for the signatures of the borrower(s) and the lender. Signatures must be dated.

- Have the document notarized. This adds an extra layer of legitimacy to the deed.

Once the form is completed, review it for accuracy. Ensure all signatures are present and the notarization is properly done. After that, you can proceed to record the Deed of Trust with the appropriate local government office.

Dos and Don'ts

When filling out a Deed of Trust form, it's crucial to approach the task with care. Here are five essential dos and don'ts to keep in mind:

- Do ensure all parties involved are correctly identified. Include full names and addresses.

- Do read the form thoroughly before signing. Understanding the terms is vital.

- Do consult with a legal expert if you have questions. Their guidance can prevent mistakes.

- Don't leave any blanks. Every section should be completed to avoid confusion.

- Don't rush through the process. Take your time to ensure accuracy.

Documents used along the form

A Deed of Trust is a crucial document in real estate transactions, especially when securing a loan. However, it often goes hand in hand with several other forms and documents that help clarify the terms and conditions of the agreement. Below is a list of commonly associated documents that you may encounter alongside a Deed of Trust.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It details the loan amount, interest rate, repayment schedule, and consequences of default. Essentially, it serves as a written contract between the borrower and lender.

- Georgia Deed Form: This document is essential for transferring ownership of real property in Georgia. For more information and to access the form, visit https://georgiapdf.com/deed.

- Loan Application: The loan application is submitted by the borrower to request financing. It includes personal information, financial details, and the purpose of the loan. Lenders use this information to assess the borrower's creditworthiness.

- Title Insurance Policy: This document protects the lender and borrower from potential disputes over property ownership. It ensures that the title to the property is clear and free of liens or other claims that could affect ownership.

- Closing Disclosure: Provided to the borrower before closing, this document outlines the final terms of the loan, including all costs and fees associated with the transaction. It ensures that the borrower understands their financial obligations before finalizing the deal.

Understanding these documents can help you navigate the complexities of real estate transactions more effectively. Each plays a vital role in protecting the interests of both borrowers and lenders, ensuring a smoother process for everyone involved.