Attorney-Approved Deed in Lieu of Foreclosure Form

The Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing financial difficulties and potential foreclosure. This legal document allows a borrower to voluntarily transfer ownership of their property to the lender, effectively settling the mortgage debt without the lengthy and often stressful foreclosure process. By opting for this route, homeowners can mitigate the negative impact on their credit scores, as it typically results in less severe consequences than a foreclosure. The form outlines key components such as the identification of the parties involved, a clear description of the property, and the terms under which the deed is transferred. Additionally, it addresses any potential liabilities and ensures that the lender releases the borrower from further obligations related to the mortgage. Understanding the implications of this form is essential for homeowners, as it can provide a pathway to financial recovery while minimizing the emotional toll associated with losing a home.

State-specific Deed in Lieu of Foreclosure Forms

More Deed in Lieu of Foreclosure Types:

Free Michigan Lady Bird Deed Pdf - The Lady Bird Deed reduces the need for family discussions about property transfer after death.

The Florida Board Nursing Application form is a crucial document for individuals seeking to obtain a nursing license in Florida. It serves as the official request for licensure by examination, ensuring that applicants meet the necessary educational and professional standards. For more information and to access the necessary documents, you can refer to Florida Forms, which is essential for a smooth application process and successful entry into the nursing profession.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process is often used as a way to resolve mortgage default issues without going through the lengthy foreclosure process. |

| Benefits | Homeowners may benefit from a quicker resolution, less damage to their credit score, and potential forgiveness of remaining debt. |

| State-Specific Forms | Each state may have its own specific form for a Deed in Lieu of Foreclosure. For example, California requires compliance with California Civil Code § 2929.5. |

| Eligibility | Typically, homeowners must demonstrate financial hardship and have an unencumbered title to qualify for this option. |

| Process | The process usually involves negotiations with the lender, signing the deed, and possibly a release of liability for the remaining mortgage balance. |

| Impact on Credit | While a Deed in Lieu of Foreclosure can negatively impact credit, it may be less damaging than a full foreclosure. |

| Legal Advice | Consulting with a legal professional is highly recommended to understand the implications and ensure all paperwork is completed correctly. |

| Alternatives | Alternatives to a Deed in Lieu of Foreclosure include loan modification, short sales, or filing for bankruptcy, depending on individual circumstances. |

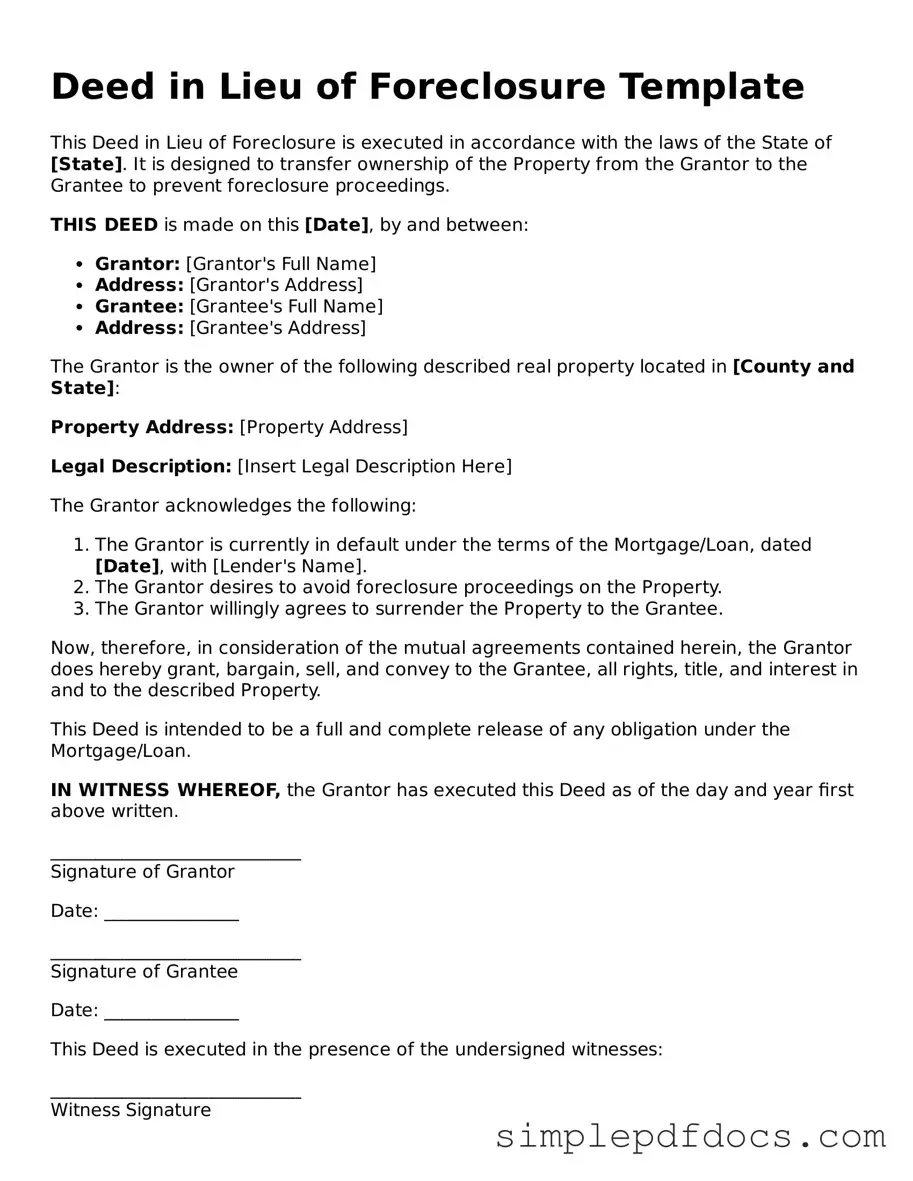

How to Write Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender for review. They will assess the document and decide whether to accept it. Make sure to keep a copy for your records.

- Begin by entering the date at the top of the form.

- Fill in your full name and address in the designated sections.

- Provide the name and address of the lender.

- Enter the property address that is subject to the deed.

- Include the legal description of the property, which can typically be found on your mortgage documents.

- State the reason for the deed in lieu of foreclosure.

- Sign the document in the space provided. Ensure that your signature matches the name listed on the form.

- Have the document notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed form for your records.

- Submit the original form to your lender, along with any required supporting documents.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it is essential to approach the process carefully. Here are some important dos and don'ts to consider:

- Do read the entire form thoroughly before filling it out.

- Do provide accurate and complete information.

- Do consult with a legal professional if you have any questions.

- Do ensure that all signatures are included where required.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't sign the form until you fully understand its implications.

Following these guidelines can help ensure that the process goes smoothly and that your rights are protected.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the ownership of their property to the lender to avoid the foreclosure process. This agreement can simplify the transition for both parties, but it often requires the completion of several other forms and documents. Below is a list of commonly associated documents that may be necessary in conjunction with the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes made to the original loan terms, which may include adjustments to the interest rate or payment schedule. It is often considered before a deed in lieu is executed.

- Release of Liability: This form releases the borrower from any further obligation on the mortgage after the deed is executed. It ensures that the borrower is no longer held accountable for the remaining loan balance.

- Property Condition Disclosure: This document provides the lender with information about the condition of the property. It may include details about any repairs needed or existing issues that could affect the property's value.

- Affidavit of Title: This sworn statement confirms that the borrower holds clear title to the property, free from any liens or claims that could complicate the transfer of ownership.

- Notice of Default: This document notifies the borrower that they are in default on their mortgage payments. It is often issued by the lender prior to initiating foreclosure proceedings.

- Power of Attorney for a Child: This legal document enables parents to authorize another adult to care for their child(ren) in their absence. For more details, visit floridaforms.net/blank-power-of-attorney-for-a-child-form/.

- Settlement Statement: This form outlines the financial aspects of the transaction, including any costs associated with the deed in lieu process, such as closing costs or fees that may need to be paid to finalize the transfer.

- Quitclaim Deed: This document is used to transfer any interest the borrower has in the property to the lender. It is often executed alongside the deed in lieu to formalize the transfer of ownership.

Understanding these associated documents can help homeowners navigate the deed in lieu process more effectively. Each form plays a vital role in ensuring a smooth transition and protecting the interests of all parties involved.