Attorney-Approved Deed Form

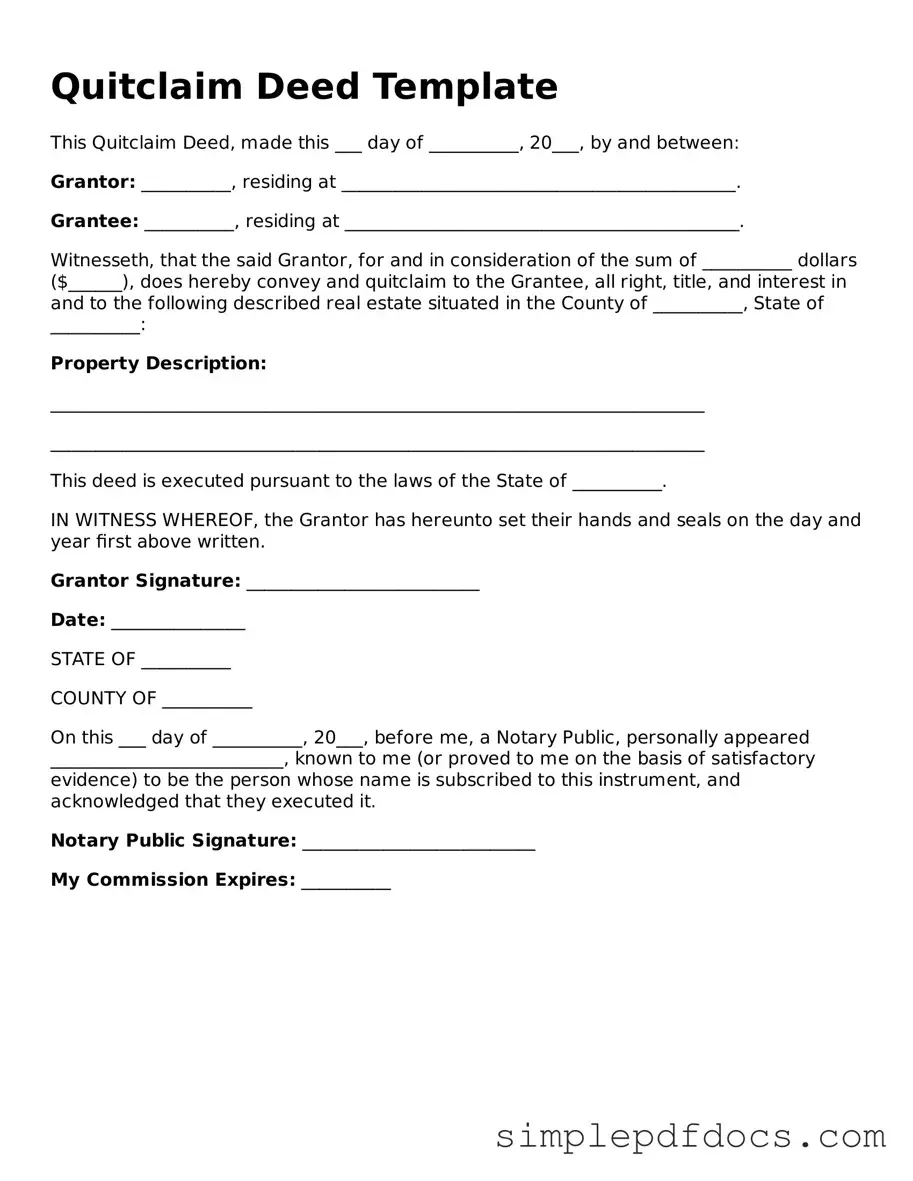

When it comes to transferring property ownership, a deed form plays a crucial role in ensuring that the process is clear and legally binding. This essential document outlines the specifics of the property being transferred, including its legal description and the names of the parties involved. It serves as a written record of the transaction, providing proof of ownership and protecting the rights of both the seller and the buyer. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving unique purposes and offering varying levels of protection. Understanding the key components of a deed form, such as the grantor, grantee, and any necessary signatures, is vital for anyone looking to buy or sell real estate. Additionally, knowing how to properly execute and record a deed can help prevent disputes and ensure a smooth transfer of ownership. Whether you are a first-time homebuyer or an experienced investor, familiarity with the deed form is essential for navigating the complexities of property transactions.

State-specific Deed Forms

Deed Document Categories

Check out Other Documents

How Many Cells in 96 Well Plate - The state-of-the-art design reduces the likelihood of sample evaporation.

The Florida Employment Verification form is a document used by employers to confirm the employment status of an individual. This form serves as a crucial tool for various purposes, including background checks and loan applications. For additional resources and templates, you can visit Florida Forms, which provide valuable assistance in navigating the verification process effectively.

Roof Inspection Report Template - The roofing contractor’s information is crucial for warranty claims and service requests.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A deed is a legal document that signifies the transfer of property ownership from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Governing Law | Deeds are governed by state law, which varies by jurisdiction. |

| Signing Requirements | Most states require the deed to be signed by the grantor, often in the presence of a notary. |

| Recording | Recording the deed with the county clerk or recorder's office is essential for public notice. |

| Consideration | Deeds typically require consideration, which is something of value exchanged for the property. |

| Transfer of Title | Once executed and delivered, the deed transfers the title to the grantee. |

| State-Specific Forms | Each state has its own specific deed forms, which must comply with local laws. |

| Legal Effect | A properly executed deed creates a legally binding obligation to transfer property. |

| Importance of Accuracy | Accuracy in the deed is crucial, as errors can lead to disputes or title issues. |

How to Write Deed

After obtaining the Deed form, you will need to fill it out accurately to ensure proper recording. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the names of the parties involved in the transaction. Include the full legal names of the grantor (seller) and grantee (buyer).

- Provide the property address. This should include the street address, city, state, and zip code.

- Describe the property. Include details such as the lot number, block number, and any other relevant information that identifies the property.

- State the consideration. This is the amount paid for the property or a statement indicating it is a gift.

- Sign the form. The grantor must sign the deed in the presence of a notary public.

- Have the deed notarized. The notary will verify the identity of the grantor and witness the signing.

- Make copies of the completed deed for your records.

- Submit the original deed to the appropriate county office for recording.

Dos and Don'ts

When filling out a Deed form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly and match official documents.

- Do include the correct legal description of the property.

- Do sign the form in the presence of a notary public if required.

- Do keep a copy of the completed Deed for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use correction fluid or erasers; if a mistake is made, cross it out and initial it.

Documents used along the form

A Deed is a crucial legal document that signifies the transfer of ownership of property from one party to another. However, it is often accompanied by other forms and documents that help facilitate the transaction and ensure all legal requirements are met. Below is a list of some commonly used documents that are typically associated with a Deed.

- Title Search Report: This document provides a comprehensive review of the property’s title history. It confirms the current owner and identifies any liens, encumbrances, or other claims against the property.

- Power of Attorney for a Child: This important document allows parents to grant authority to another adult for decision-making and care for their child(ren) in their absence. For more information, visit https://floridaforms.net/blank-power-of-attorney-for-a-child-form.

- Bill of Sale: This document outlines the sale of personal property that may be included in the transaction, such as appliances or furniture. It serves as proof of the transfer of ownership for these items.

- Property Disclosure Statement: Sellers often provide this document to disclose any known issues or defects with the property. It helps protect both parties by ensuring transparency in the sale process.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document itemizes all the costs associated with the transaction. It details the financial aspects, including the purchase price, closing costs, and any adjustments.

Understanding these documents can help ensure a smoother transaction when dealing with property transfers. Each plays a vital role in safeguarding the interests of both buyers and sellers, making it essential to review them carefully.