Attorney-Approved Corrective Deed Form

The Corrective Deed form serves a vital purpose in the realm of real estate transactions, addressing errors or omissions that may have occurred in a previously executed deed. This form is particularly important when there are discrepancies in the property description, the names of the parties involved, or any other critical details that could impact ownership rights or property title. By utilizing a Corrective Deed, property owners can rectify these issues, ensuring that the public record accurately reflects the true intent of the parties at the time of the original deed's execution. This process not only helps to prevent potential legal disputes in the future but also provides peace of mind to all parties involved. It is essential to understand that while the Corrective Deed does not transfer ownership, it clarifies and corrects the existing deed, thereby reinforcing the validity of the property title. Properly executed, this form can safeguard against misunderstandings and protect the interests of current and future property owners.

More Corrective Deed Types:

California Transfer on Death Deed - Possible beneficiaries can include family members, friends, or charities.

The Arizona Transfer-on-Death Deed form is an essential resource for property owners looking to simplify their estate planning. By designating beneficiaries who will automatically inherit real estate upon the owner's death, this form not only expedites the transfer process but also helps avoid the complexities of probate. For those interested in learning more about this straightforward tool, additional details and the necessary form can be found at https://todform.com/blank-arizona-transfer-on-death-deed.

What Does a Quit Claim Deed Look Like - These deeds are frequently used in real estate to clear clouds on titles.

Trust Deed Sample - This instrument establishes a clear hierarchy of claims against the property.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Corrective Deed is a legal document used to correct errors in a previously executed deed. |

| Purpose | The primary purpose is to clarify the intent of the parties involved and ensure the property title is accurate. |

| Common Errors | Errors may include misspelled names, incorrect property descriptions, or mistakes in the legal description. |

| Governing Law | The laws governing Corrective Deeds can vary by state; for example, in California, it falls under Civil Code Section 1092. |

| Execution Requirements | Typically, the Corrective Deed must be signed by the same parties who executed the original deed. |

| Notarization | In many states, notarization is required to validate the Corrective Deed. |

| Recording | To be effective against third parties, the Corrective Deed should be recorded with the appropriate county office. |

| Impact on Title | A Corrective Deed does not transfer ownership; it merely corrects the existing deed. |

| Potential Challenges | Challenges may arise if the original deed was executed under duress or if there are disputes among heirs. |

| Legal Advice | Consulting with a legal professional is advisable to ensure that the Corrective Deed is properly executed and recorded. |

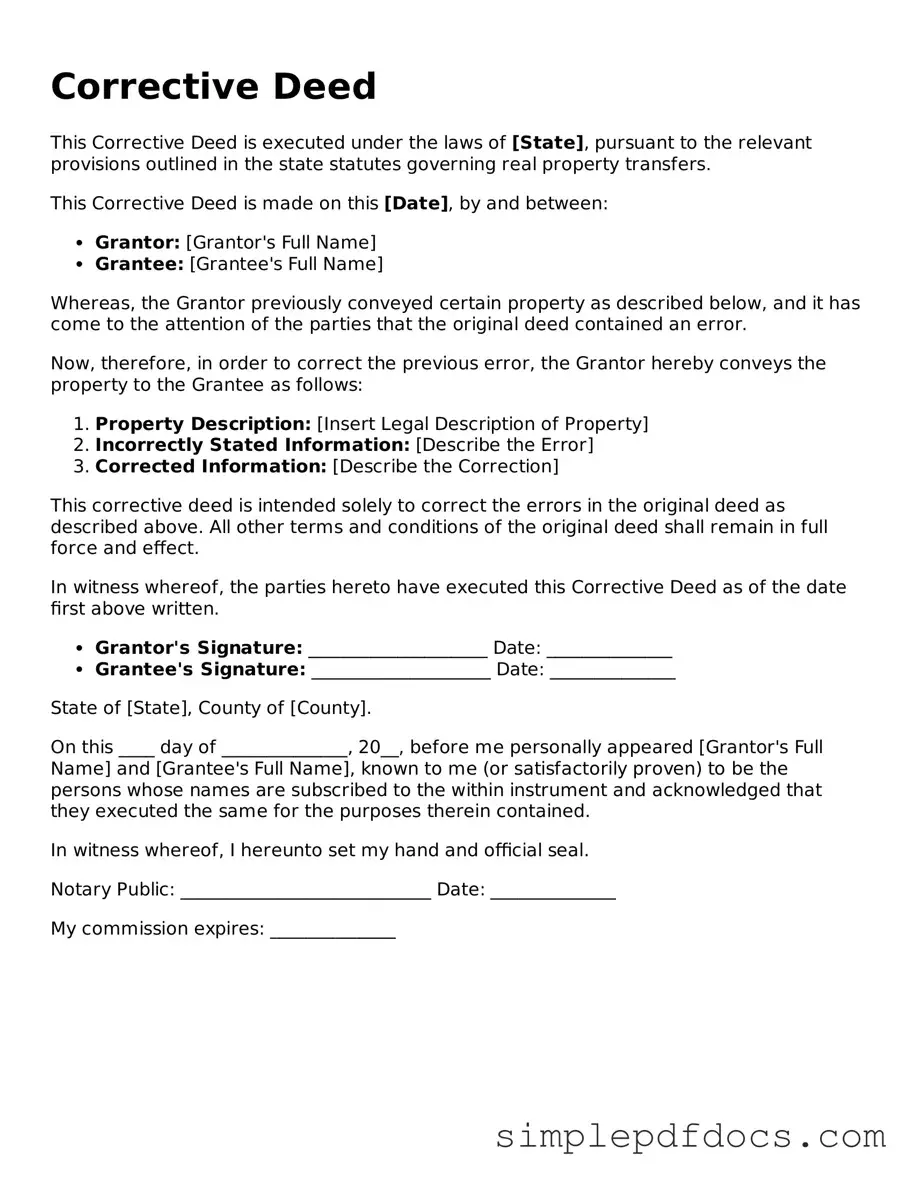

How to Write Corrective Deed

After you have gathered the necessary information, you are ready to fill out the Corrective Deed form. This process involves providing specific details about the property and the parties involved. Follow these steps carefully to ensure the form is completed accurately.

- Begin by entering the date at the top of the form. Make sure to use the correct format.

- Provide the names of the parties involved. List the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Next, include the property description. This should be as detailed as possible, including the address and any relevant legal descriptions.

- Indicate the reason for the corrective deed. Clearly state what error or omission the deed is correcting.

- Sign the form. The grantor must sign, and if required, have the signature notarized.

- Include any additional information requested on the form, such as the date of the original deed and the recording information.

- Review the completed form for accuracy. Check all names, descriptions, and dates.

- Finally, submit the form to the appropriate local government office for recording.

Dos and Don'ts

When filling out the Corrective Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are some key things to do and avoid.

- Do: Review the original deed carefully to understand the corrections needed.

- Do: Provide accurate and complete information in all required fields.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Do: Submit the form to the appropriate local government office.

- Don't: Rush through the process; take your time to ensure everything is correct.

- Don't: Leave any fields blank; all required information must be filled out.

- Don't: Use white-out or other correction methods on the form.

- Don't: Forget to check for any additional requirements specific to your state.

- Don't: Ignore deadlines for submission; timely filing is essential.

Documents used along the form

When dealing with property transactions, the Corrective Deed form is often accompanied by several other important documents. Each of these forms plays a crucial role in ensuring that all aspects of the property transfer or correction are handled appropriately. Below is a list of common documents that you might encounter alongside a Corrective Deed.

- Original Deed: This is the initial document that outlines the transfer of property ownership. It serves as the foundation for any corrections made later.

- Title Search Report: A title search report provides a detailed history of the property, including previous owners and any liens or encumbrances. This report helps verify the legitimacy of the property title.

- Affidavit of Heirship: In cases where property is inherited, this affidavit confirms the heirs’ identities and their rights to the property, helping to clarify ownership.

- Property Survey: A property survey outlines the exact boundaries and dimensions of the property. This document can help resolve disputes regarding property lines.

- Release of Lien: If there are any outstanding liens on the property, a release of lien document indicates that the debt has been satisfied, allowing for a clear title transfer.

- Transfer-on-Death Deed: This document allows property owners to transfer their real estate to designated beneficiaries upon death, avoiding probate and simplifying the estate planning process. For more information, visit the Transfer-on-Death Deed page.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can be essential if the property owner cannot be present.

- Settlement Statement: Also known as a HUD-1, this statement itemizes all the costs and fees associated with the property transaction, ensuring transparency for all parties involved.

- Transfer Tax Declaration: This form is often required by local governments to assess any transfer taxes owed on the property sale or transfer.

Understanding these accompanying documents can help streamline the property correction process and ensure that everything is in order. Each form serves a unique purpose, contributing to the clarity and legality of the property transaction.