Attorney-Approved Codicil to Will Form

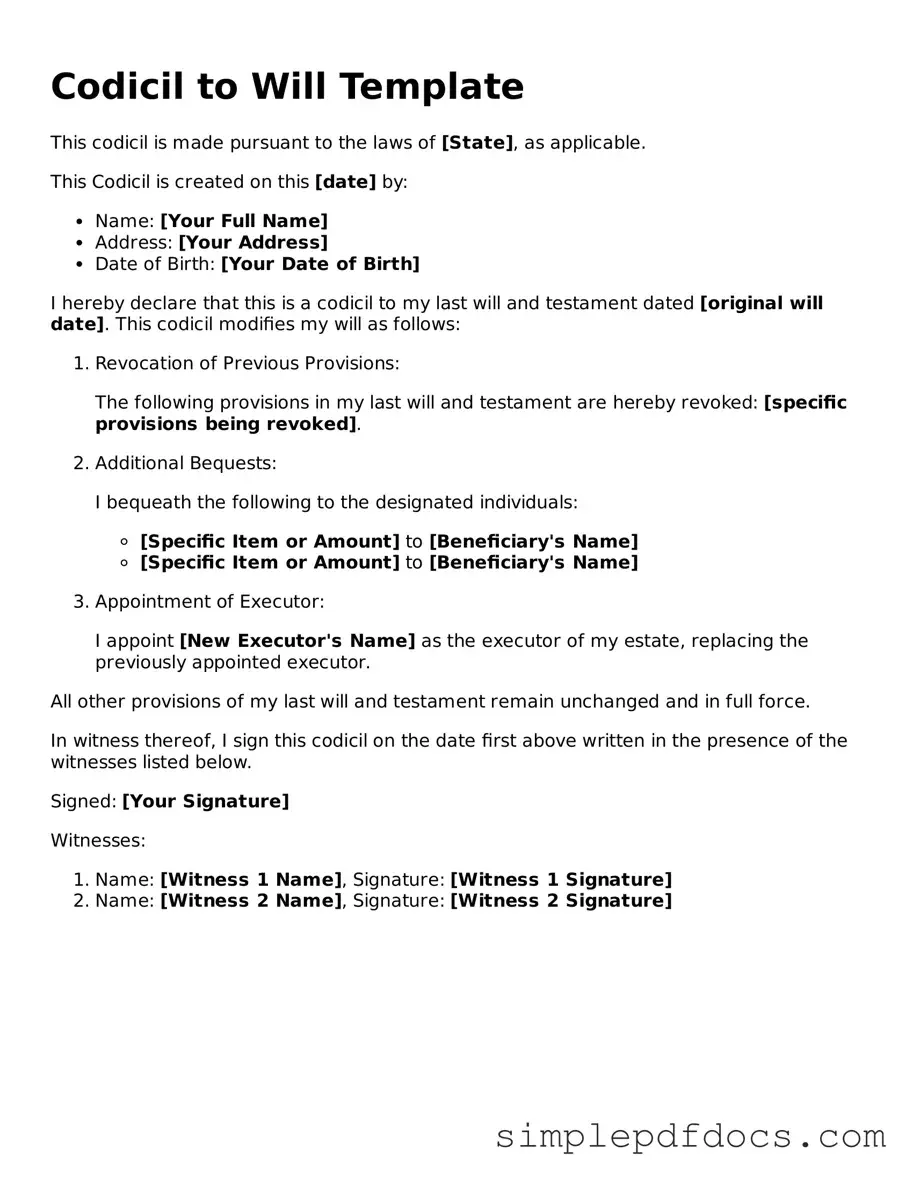

When it comes to estate planning, making changes to your will can be a straightforward process, thanks to the Codicil to Will form. This important document allows you to modify specific provisions of your existing will without the need to create an entirely new one. Whether you wish to add a new beneficiary, change an executor, or adjust the distribution of assets, a codicil provides a flexible solution. It must be executed with the same legal formalities as your original will, ensuring that your intentions are clear and enforceable. Understanding how to properly fill out and execute this form is crucial, as it helps maintain the integrity of your estate plan while reflecting any significant life changes. By utilizing a codicil, you can ensure that your wishes are accurately represented and easily understood by your loved ones and the courts alike.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | A codicil is used to make changes or additions to an existing will without creating a new will. |

| Legal Requirement | In most states, a codicil must be signed and witnessed, similar to a will. |

| Revocation | A codicil can revoke specific parts of the original will while leaving the rest intact. |

| State-Specific Laws | Each state has its own laws governing codicils; for example, in California, it is governed by the California Probate Code. |

How to Write Codicil to Will

After completing the Codicil to Will form, it is important to ensure that the document is properly executed and stored. This will help to avoid any potential disputes or confusion regarding your wishes. Follow these steps carefully to fill out the form accurately.

- Begin by writing the date at the top of the form. This is important as it establishes when the codicil was created.

- Clearly state your full name and address. This information identifies you as the testator.

- Reference your original will by including the date it was executed. This ensures that the codicil is linked to the correct will.

- Specify the changes you wish to make. Be clear and concise about what you want to add, modify, or revoke in your will.

- Review the changes carefully. Ensure that all information is accurate and reflects your intentions.

- Sign the codicil in the presence of at least two witnesses. They must also sign the document to validate it.

- Store the codicil with your original will. Keeping them together helps maintain clarity regarding your estate planning.

Dos and Don'ts

When filling out the Codicil to Will form, it’s important to approach the task with care and attention. Here are ten things to keep in mind, both what to do and what to avoid.

- Do ensure that you are using the correct form for your state.

- Do clearly identify the original will that you are modifying.

- Do write in clear and legible handwriting or type the information.

- Do include the date on which you are completing the codicil.

- Do sign the codicil in the presence of witnesses, if required by your state.

- Don't make any changes to the original will without properly documenting them.

- Don't forget to have the codicil witnessed, if necessary.

- Don't use vague language; be specific about what you are changing.

- Don't assume that a codicil can replace a will; it only modifies it.

- Don't store the codicil in an unsafe place; keep it with the original will.

By following these guidelines, you can help ensure that your wishes are accurately reflected in your estate planning documents.

Documents used along the form

A Codicil to a Will is a legal document that allows an individual to make amendments or additions to an existing will without having to rewrite the entire document. When creating or updating a will, several other forms and documents may be necessary to ensure that the estate planning process is thorough and legally sound. Below is a list of commonly used forms that complement the Codicil to Will.

- Last Will and Testament: This foundational document outlines how an individual's assets will be distributed upon their death. It typically includes provisions for guardianship of minor children and can be amended with a codicil.

- Durable Power of Attorney: This document designates someone to make financial decisions on behalf of an individual if they become incapacitated. It is crucial for managing finances and assets when the individual is unable to do so themselves.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this form allows an individual to appoint someone to make medical decisions on their behalf if they are unable to communicate their wishes due to illness or injury.

- Living Will: This document specifies an individual's preferences regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and loved ones about the individual's wishes when they cannot express them.

- Revocation of Will: If an individual decides to completely revoke their existing will, this document formally cancels it. This is important when a new will is created, ensuring that the previous will is no longer valid.

- Trust Agreement: This document establishes a trust, which can hold and manage assets for beneficiaries. Trusts can provide benefits such as avoiding probate and offering tax advantages.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for specific accounts or assets, such as life insurance policies or retirement accounts. They can supersede instructions in a will.

- Affidavit of Heirship: In cases where a person dies without a will, this document helps establish the rightful heirs of the deceased's estate. It is often used to clarify ownership of property.

- Last Will and Testament Form: To secure your estate distribution, refer to our essential guide for the Last Will and Testament to ensure all legal requirements are met.

- Estate Inventory: This form lists all assets and liabilities of an estate. It is often required for probate proceedings and helps ensure that all assets are accounted for during the distribution process.

- Notice to Creditors: This document informs creditors of a deceased person's estate that they have a limited time to make claims against the estate for debts owed. It is an important step in the probate process.

Understanding these forms and how they relate to the Codicil to Will can help individuals navigate the complexities of estate planning. Each document serves a specific purpose, contributing to a comprehensive strategy for managing one’s assets and ensuring that personal wishes are honored after death.