Attorney-Approved Closing Date Extension Addendum Form Form

In the dynamic world of real estate transactions, timing is often crucial, and unforeseen delays can create significant challenges for both buyers and sellers. The Closing Date Extension Addendum Form serves as a vital tool in these situations, allowing parties involved in a real estate deal to formally extend the closing date when necessary. This form is particularly useful when issues arise, such as financing complications, appraisal delays, or unexpected repairs that require additional time to address. By utilizing this addendum, both parties can maintain clarity and legal protection, ensuring that their interests are safeguarded while they navigate the complexities of the closing process. The form typically outlines the new closing date, any conditions that must be met before the extension takes effect, and may even include provisions for additional earnest money deposits or other considerations. Understanding the nuances of this addendum can empower both buyers and sellers to manage their transactions more effectively, fostering a smoother path toward a successful closing.

Check out Other Documents

Proprietor Financing Agreement - In an owner financing arrangement, the seller retains the title to the property until paid in full.

When to Renew Australian Passport - The passport being renewed must be in your current name, date of birth, and sex.

For anyone involved in transferring vehicle ownership, understanding the requirements for a specific Vehicle Release of Liability document is vital to ensure a smooth and legally binding process. This form is essential in formalizing the release of any future claims or liabilities once the ownership swap is completed, safeguarding the interests of both the seller and the buyer.

Melaleuca Cancellation Form Pdf - Melaleuca aims to assist customers who choose to suspend their benefits.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Closing Date Extension Addendum is used to extend the closing date of a real estate transaction. |

| Parties Involved | This form typically involves the buyer and seller, both of whom must agree to the extension. |

| Governing Law | The form is governed by state-specific real estate laws, which can vary significantly from one state to another. |

| Mutual Agreement | The extension must be mutually agreed upon; it cannot be unilaterally imposed by one party. |

| Timeframe | The addendum specifies the new closing date, which should be clearly stated to avoid confusion. |

| Signatures Required | Both parties must sign the addendum for it to be valid, indicating their consent to the new terms. |

| Document Storage | Once signed, the addendum should be stored with the original purchase agreement for future reference. |

| Impact on Other Terms | Extending the closing date may affect other contractual obligations, such as financing or inspections. |

| Legal Advice | It is advisable for both parties to seek legal advice before signing the addendum to ensure their interests are protected. |

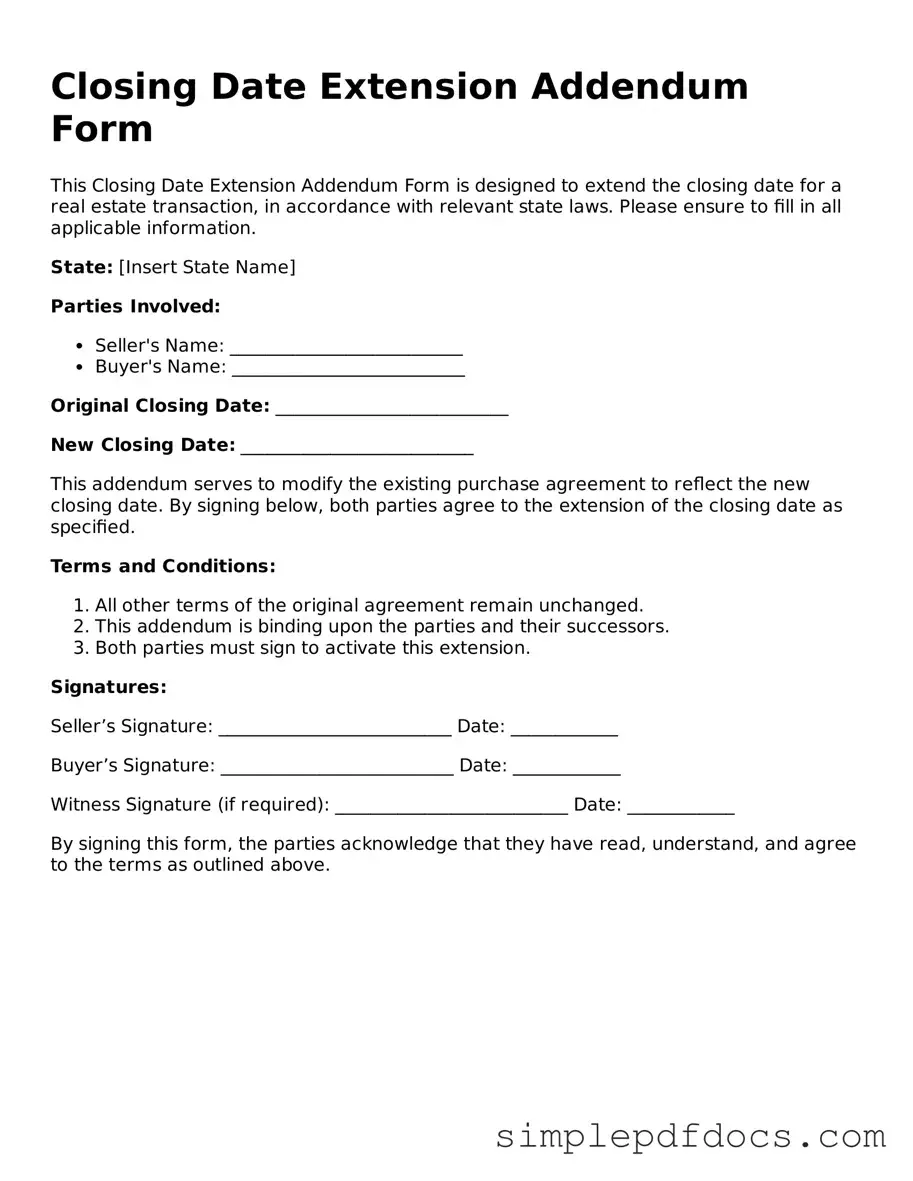

How to Write Closing Date Extension Addendum Form

Completing the Closing Date Extension Addendum Form is a crucial step in ensuring that all parties involved in a real estate transaction are on the same page regarding any changes to the closing date. This process requires attention to detail to avoid any misunderstandings or complications down the line. Follow the steps below to fill out the form accurately.

- Start by entering the names of all parties involved in the transaction at the top of the form.

- Provide the original closing date in the designated space. This is the date that was initially agreed upon.

- Next, indicate the new proposed closing date. Make sure this date works for all parties involved.

- In the section for additional terms, include any specific conditions or agreements that should be noted regarding the extension.

- Review the completed form for accuracy. Ensure that all names and dates are correct and that nothing is left blank.

- Once verified, all parties must sign and date the form to acknowledge their agreement to the new closing date.

- Finally, distribute copies of the signed form to all parties involved to ensure everyone has the updated information.

Dos and Don'ts

When filling out the Closing Date Extension Addendum Form, it's essential to approach the task with care. Here are five important do's and don'ts to keep in mind:

- Do read the form carefully before starting. Understanding each section will help you complete it accurately.

- Do provide clear and precise information. Ambiguities can lead to misunderstandings later.

- Do double-check your dates. Ensure that the new closing date is realistic and agreed upon by all parties.

- Don't leave any sections blank unless instructed. Incomplete forms can be rejected or cause delays.

- Don't rush through the process. Take your time to ensure everything is correct and complete.

Documents used along the form

When navigating the complexities of real estate transactions, several forms and documents often accompany the Closing Date Extension Addendum Form. Understanding these documents can enhance your confidence and ensure a smoother process. Below is a list of commonly used forms that may be relevant during this phase.

- Purchase Agreement: This foundational document outlines the terms and conditions of the sale, including the purchase price, contingencies, and responsibilities of both the buyer and seller.

- Disclosure Statements: Sellers are typically required to provide disclosure statements that reveal any known issues with the property, ensuring buyers are fully informed before closing.

- Financing Addendum: If a buyer's ability to secure financing is a condition for the sale, this addendum details the financing terms and any contingencies related to loan approval.

- Inspection Report: After a home inspection, this report summarizes the property's condition, highlighting any repairs or issues that may need addressing before closing.

- Title Commitment: This document provides evidence of the property’s title status, confirming that the seller has the right to sell the property and that there are no outstanding liens.

- Closing Disclosure: This form outlines the final terms of the loan, including the monthly payments, interest rates, and all closing costs, ensuring transparency for the buyer.

- Vehicle Purchase Agreement: This legal document is essential for outlining the terms of a vehicle sale, including the purchase price and any associated warranties. For a comprehensive template, visit California Templates.

- Escrow Instructions: This document provides detailed instructions for the escrow agent, including how funds should be handled and the conditions for releasing them.

- Power of Attorney: In some cases, a buyer or seller may grant power of attorney to another individual, allowing them to sign documents on their behalf during the closing process.

- Settlement Statement: This statement summarizes all financial transactions related to the closing, including fees, credits, and the final amount due from the buyer.

Being familiar with these documents can empower you as you approach the closing process. Each form plays a crucial role in ensuring that all parties are protected and informed, paving the way for a successful transaction.